Nothing is more frustrating to us at Demand Side than the continued trust in and respect for the economics that got us into this mess. True it has wealthy sponsors and a host of people in power married to its error. But this is the intellectual architecture of the misery of billions of people and the continuing demise of the economies of virtually all nations.

So today we issue another broadside. Beginning with Steve Keen from his book "Debunking Economics," and on Friday we'll continue with Idiot of the Week, for which we picked from the host of eligible candidates at the Federal Reserve, choosing Randall Crossner, on the Fed's board until January 2009 and now at, of course, the University of Chicago.

First, and briefly, a look at the data. And following the excerpt from Keen, a continuation of our look at the Sarkozy report.

Last week.

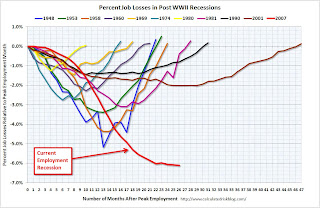

Nonfarm payrolls decreased by 36,000 in February. The economy has lost almost 3.3 million jobs over the last year, and 8.43 million jobs since the beginning of the current employment recession.

The unemployment rate is at 9.7 percent.

Employment growth is still negative three percent when we need about a positive percent and a half to deal with people new to the labor force. But the unemployment rate is flat at 9.7 percent. I don't understand. Particularly as the employment to population ratio, like the unemployment rate is relatively stable.

For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Looking at the charts reminds us of the most successful employment related program in American history. We reminded you of the most successful foreign aid program a couple of weeks ago -- the Marshall Plan that rebuilt Europe economically and politically and as a major market for American goods. The most successful jobs program was from the same era, when government was explicitly committed to full employment.

Setting the scene. The Great Depression was interrupted and reversed by the massive effort of the Second World War. As the War drew to a close those who looked forward, including some of the more prominent Keynesians, predicted a return to the Depression with the baggage of two hundred percent of GDP in government debt. The prospect of 8 million men and women being cashiered out of the military and falling on the unrebuilt domestic economy raised the fear of Depression level unemployment rates.

Enter the GI Bill. A grateful nation welcomed it. Old Guard Republicans could not resist it. The door to higher education was opened for millions, keeping them out of the workforce while employing millions in their tutelage and producing a nation of educated workers, teachers, and so on. Good in the short term. Good in the long term. Underappreciated in the long term was this treating education as a public good allowed the quality of mind to determine the achievement. Today, pay to play education allows achievement and position to those who can afford or whose families can afford the Ivy League. Not only does it reduce the general competence, but it raises to authority not those with the chops but those with the funding.

One more note before we get to our critique of the economic profession and the Monetarist monopeds at the Fed.

This month begins the next burgeoning of resets and recasts in the mortgage market. Between now and March 2012, the subprime wave gives way to waves of unsecuritized ARMS (adjustable rate mortgages) option ARMS and Alt-As.

An Alt-A mortgage, short for Alternative A-paper, is a type of U.S. mortgage that, for various reasons, is considered riskier than A-paper, or "prime", and less risky than "subprime," the riskiest category. Alt-A interest rates, which are determined by credit risk, therefore tend to be between those of prime and subprime home loans. Typically Alt-A mortgages are characterized by borrowers with less than full documentation, lower credit scores, higher loan-to-values, and more investment properties.

Calculated Risk suggests that resets are not a huge worry right now - because interest rates are so low - but if interest rates rise, this could lead to more defaults in the future.

Calculated Risk suggests that resets are not a huge worry right now - because interest rates are so low - but if interest rates rise, this could lead to more defaults in the future.As we've noted the exit by the Fed from buying mortgage securities takes by far the major buyer out of the market. Our sense is that mortgage rates will go up, continuing stress on credit markets will widen spreads and house prices will decline further, creating problems for everybody.

Anecdotal evidence of delays in foreclosure continue to indicate banks keeping troubled mortages on their books at inflated prices.

This is the scenario for recovery?

Leaving that question hanging, lets get on to our features on today's podcast. The smackdown of the economics profession. Beginning here from Steve Keen.

Steve Keen, p. 14 ff

The belief that economic theory is sound, and that it alone considers ’the big picture’, is the major reason why economics has gained such an ascendancy over public policy. Economists, we are told, know what is best for society because economic theory knows how a market economy works, and how it can be made to work better, to everyone’s ultimate benefit. Its critics are simply special interest groups, at best misunderstanding the mechanisms of a market economy, at worst pleading their own special case to the detriment of the larger good. If we simply ignore the criticisms, and follow the guidelines of economic policy, ultimately everybody will be better off. The occasional failures of economies to respond as economic theory predicts occur because the relevant policy-makers either applied the theory badly, or were using out-of-date economics.

Bunkum.

If this proposition were true, then economic theory would be clear, unequivocal, unsullied, and empirically verified. It is nothing of the sort.

Though economists have long believed that their theory constitutes “a body of generalisations whose substantial accuracy and importance are open to question only by the ignorant or the perverse” (Robbins 1932), for over a century economists have shown that economic theory is replete with logical inconsistencies, specious assumptions, errant notions, and predictions contrary to empirical data.

... critical economists are neither ’ignorant’ of economic theory, nor ’perverse’ in their motives. As [Keen's book] shows, they have a far more profound understanding of economic theory than those economists who refuse to peer too deeply into the foundations of their dogma. ...

When their critiques are collated, little if anything of conventional economic theory remains standing.

Virtually every aspect of conventional economic theory is intellectually unsound; virtually every economic policy recommendation is just as likely to do general harm as it is to lead to the general good. Far from holding the intellectual high ground, economics rests on foundations of quicksand. If economics were truly a science, then the dominant school of thought in economics would long ago have disappeared from view.

Instead it has been preserved, not via greater knowledge, as its advocates might believe, but by ignorance. Many economists are simply unaware that the foundations of economics have even been disputed, let alone that these critiques have motivated prominent economists to profoundly change their views, and to consequently themselves become, to some extent, critics of economic orthodoxy.

Names such as Irving Fisher, John Hicks, Paul Samuelson, Robert Solow, Alan Kirman and Joseph Stiglitz are famous within economics because they made major contributions to modern economic theory. Yet to varying degrees, these and other prominent economists have distanced themselves from conventional economics, after coming to believe, for a range of reasons, that the theory harboured fundamental flaws.

Unfortunately, in a classic illustration of the cliche that ’a little knowledge is a dangerous thing’, lesser intellects continue to build the economic edifice atop foundations which many of its architects long ago declared suspect. There are many reasons for this failure of economics to accept fundamental criticism, and to evolve into a different but richer theory. ... these include the undeniable complexity of economic phenomena, and the impossibility of conducting crucial experiments to decide between competing theories. But a key reason – the one which motivated me to write this book – is the manner in which economics is taught.

Educated into ignorance

Most introductory economics textbooks present a sanitised, uncritical rendition of conventional economic theory, and the courses in which these textbooks are used do little to counter this mendacious presentation. Students might learn, for example, that ’externalities’ reduce the efficiency of the market mechanism. However, they will not learn that the ’proof’ that markets are efficient is itself flawed.

Since this textbook rendition of economics is also profoundly boring, many students do no more than an introductory course in economics, and instead go on to careers in accountancy, finance or management – in which, nonetheless, many continue to harbour the simplistic notions they were taught many years earlier.

The minority which continues on to further academic training is taught the complicated techniques of economic analysis, with little to no discussion of whether these techniques are actually intellectually valid. The enormous critical literature is simply left out of advanced courses, while glaring logical shortcomings are glossed over with specious assumptions. However, most students accept these assumptions because their training leaves them both insufficiently literate and insufficiently numerate.

Modern-day economics students are insufficiently literate because economic education eschews the study of the history of economic thought. Even a passing acquaintance with this literature exposes the reader to critical perspectives on conventional economic theory – but students today receive no such exposure.

They are insufficiently numerate because the material which establishes the intellectual weaknesses of economics is complex. Understanding this literature in its raw form requires an appreciation of some quite difficult areas of mathematics– concepts which require up to two years of undergraduate mathematical training to understand.

Curiously, though economists like to intimidate other social scientists with the mathematical rigour of their discipline, most economists do not have this level of mathematical education.

Instead, most economists learn their mathematics by attending courses in mathematics given by other economists. The argument for this approach – the partially sighted leading the partially sighted – is that generalist mathematics courses don’t teach the concepts needed to understand mathematical economics (or the economic version of statistics, known as econometrics). This is quite often true. However, this has the side-effect that economics has produced its own peculiar versions of mathematics and statistics, and has persevered with mathematical methods which professional mathematicians have long ago transcended. This dated version of mathematics shields students from new developments in mathematics that,incidentally, undermine much of economic theory. One example of this is the way economists have reacted to ’chaos theory’ (discussed in Chapter 8). Most economists think that chaos theory has had little or no impact – which is generally true in economics, but not at all true in most other sciences. This is partially because, to understand chaos theory, you have to understand an area of mathematics known ....

Economics students therefore graduate from Masters and PhD programs with an effectively vacuous understanding of economics, no appreciation of the intellectual history of their discipline, and an approach to mathematics which hobbles both their critical understanding of economics, and their ability to appreciate the latest advances in mathematics and other sciences.

A minority of these ill-informed students themselves go on to be academic economists, and then repeat the process. Ignorance is perpetuated.

The attempt to conduct a critical dialogue within the profession of academic economics has therefore failed, not because economics has no flaws, but because – figuratively speaking – conventional economists have no ears.

Now to our series on the Sarkozy Report. Also known as the Report by the Commission on the Measurement of Economic Performance and Social Progress. It is a look at the economic metrics we use to describe our world, led by Joseph Stiglitz and Amartya Sen.

We cannibalize liberally from the text of the report in our account of its contents.

Between the time that the Commission began working on this report and its completion, the economic context radically changed. We are now living one of the worst financial, economic and social crises in post-war history. The reforms in measurement recommended by the Commission would be highly desirable, even if we had not had the crisis, but now there is a heightened urgency.

The crisis took many by surprise exactly because the measurement system failed us or participants and government officials were not focusing on the right set of statistical indicators. Neither the private nor the public accounting systems were ableto deliver an early warning. The seemingly bright growth of the world economy between 2004 and 2007 was achieved at the expense of future growth. More than this, at least some of the prosperity was a mirage, profits based on a bubble.

Perhaps a better measurement system would not have led to early measures to avoid or at least mitigate the profound decline, but with more awareness of the limitations of standard metrics, like GDP, there might have been less euphoria. Metrics which took account of sustainability, that is, for example, admitted increased indebtedness could have chastened the cheerleaders.

Unfortunately, many countries lack a comprehensive set of wealth accounts – the ‘balance sheets’ of the economy – the assets, debts and liabilities of the main actors in

the economy.

We'll get back to more reasons for overhauling economic metrics, but let's go back and remember that one basic reason was because the world's citizens don't trust them. Among the explanations for the gap between metrics and perceptions of the same phenomena may be, according to the report:

- The statistical concepts may be correct, but the measurement process may be imperfect.

- There are debates about what are the right concepts, and the appropriate use of different concepts.

- When there are large changes in inequality (more generally a change in income distribution) gross domestic product (GDP) or any other aggregate computed per capita may not provide an accurate assessment of the situation in which most people find themselves. If inequality increases enough relative to the increase in average per capital GDP, most people can be worse off even though average income is increasing.

- The commonly used statistics may not be capturing some phenomena, which have an increasing impact on the well-being of citizens. For example, traffic jams may increase GDP as a result of the increased use of gasoline, but obviously not the quality of life.

- Moreover, if citizens are concerned about the quality of air, and air pollution is increasing, then statistical measures which ignore air pollution will provide an inaccurate estimate of what is happening to citizens’ well-being. Or a tendency to measure gradual change may be inadequate to capture risks of abrupt alterations in the environment such as climate change.

- The way in which statistical figures are reported or used may provide a distorted view of the trends of economic phenomena. For example, much emphasis is usually put on GDP although net national product (which takes into account the effect of depreciation), or real household income (which focuses on the real income of households within the economy) may be more relevant. These numbers may differ markedly. Then, GDP is not wrong as such, but wrongly used. What is needed is a better understanding of the appropriate use of each measure.

- To focus specifically on the enhancement of inanimate objects of convenience (for example in the GNP or GDP which have been the focus of a myriad of economic studies of progress), could be ultimately justified only through what these objects do to the human lives they can directly or indirectly influence.

- And it has long been clear that GDP is an inadequate metric to gauge well-being over time particularly in its economic, environmental, and social dimensions, some aspects of which are often referred to as sustainability.

Of course, the looming environmental crisis we are facing, water, air, soil, and especially that associated with global warming is completely outside the measures that describe our economic well-being. The depletion of resources and the destruction of the Commons is an economic event of the first order, but is completely outside the metrics.

The Commission notes only that market prices are distorted by the fact that there is no charge imposed on carbon emissions; and no account is made of the cost of these emissions in standard national income accounts. Clearly, measures of economic performance that reflected these environmental costs might look markedly different from standard measures.

Before we sign off today, a footnote. Some listeners may be looking for the Saturday Relay and not finding it. This week it was Lance Taylor at Google talks presenting the views of an orthodox Keynesian. You are not finding it because it is for bandwidth limitation reasons podcast on only one of our channels. demandside lowercase one word.

See you there.

On Friday, we'll have idiot of the week, featuring the latest in a string of representatives from the Fed. On one hand, we are happy for the Fed's forecasts because they set such a low bar for us. On the other, these guys are responsible for a direction that is one hundred eighty degrees from accurate and one hundred percent in favor of the banking industry that brought the economy down.

Look for it Friday

No comments:

Post a Comment