Today, forecast, inflation, and the failure of monetary policy featuring Chris Whalen and Nouriel Roubini

LEADING OFF WITH A SUMMARY OF THE DEMAND SIDE FORECAST:

A summary of the demand side forecast is and has been that we are in recession and are now bouncing along the bottom. Because of inadequate policy response, in particular failure to help states and localities with open-ended support, the bottom is sloped downward. The only resolution to the current depression will come from a reorientation of the economy from a consumer base to one based on the development and maintenance of public goods. Absent this public investment, there is no recovery.

Significant new dangers have appeared in the form of public policy favoring austerity. Some have said we are threatened with a repeat of 1937. Our view is we are still in 1932, having failed to correct the causes of the financial collapse or mitigate the impact of crushing debt on the household sector. We have not had our New Deal of 1933. The recent financial regulation notwithstanding. That means the opportunity for a repeat of the crisis. The only life in the economy over the past year has been the ARRA stimulus. It is waning.

A quick summary of the week from Calculated Risk

- NFIB Survey showed small businesses were more pessimistic in June

- Ceridian Diesel Fuel index showed a sharp decline in June

- The Census Bureau reported the trade deficit increased in May.

- The BLS reported low labor turnover in May.

- The Association of American Railroads reported softer rail traffic in June.

- The MBA reported the mortgage purchase index was at the lowest level since December 1996.

- The Census Bureau reported retail sales fell 0.5% in June.

- The minutes of the FOMC meeting showed the Fed revised down their forecast for GDP growth, and revised up their forecast for unemployment.

- The Empire State Manufacturing Survey showed the pace of growth "slowed substantially" in July.

- The Fed reported that Industrial production and Capacity Utilization were mostly flat in June.

- The Philly Fed index showed slowing growth in July.

- The Consumer Price Index declined 0.1% in June.

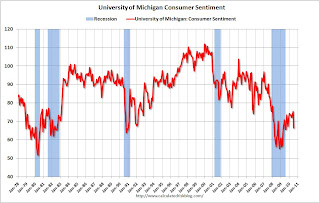

- The Reuters / University of Michigan's Consumer Sentiment index declined sharply in July.

There are many who see continued recovery in these numbers. Some who see the threat of a double dip. In fact, we've put up double dip week on the blog, with Krugman, Galbraith, Stiglitz and others -- David Levy, Stephanie Kelton, Calculated Risk, Steven Roach, so far.

Perhaps most instructive are the consumer confidence numbers. Coming down now at the University of Michigan. The survey's preliminary July reading on the overall index on consumer sentiment plummeted to 66.5 from 76.0 in June. The figure was below the median forecast of 74.5 among economists polled by Reuters.

Click on graph for larger image in new window.

Calculated risk calls consumer confidence a coincident indicator. Demand Side sees it as also a leading indicator.

We are holding on to our continued recession, continued depression, call.

FORECAST: INFLATION

Some economists we respect have taken the view that low interest rates for sovereign debt, particularly in the developed economies, is a sign of the market's confidence in those economies and a reason not to rein in government deficits. this is only partly correct, in our view. While we agree with the conclusion, low rates on Treasuries are the result of relative strength, not absolute strength.

We also, along with Minsky and, we believe, Keynes, differentiate between asset prices and consumer prices. Asset prices have been in full-scale deflation since the crisis, as exemplified by housing and commercial real estate. China's overbuilding of manufacturing capacity as stimulus has further depressed productive asset prices to levels below their cost. Result. Nothing is being built in the private sector.

Consumer prices are low and falling. Here, from the BLS report on the Consumer Price Index:

The CPI for All Urban Consumers declined 0.1 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the index increased 1.1 percent before seasonal adjustment. The index for all items less food and energy rose slightly in June after increasing slightly in May. ... The 12-month change in the index for all items less food and energy remained at 0.9 percent for the third month in a row. The index for owners' equivalent rent also rose very slightly, its first increase since August 2009. Even with the slight monthly increase, Owners' equivalent rent is down year-over-year.

The general disinflationary trend continues - CPI is unchanged over the last 8 months - and with all the slack in the system (especially the 9.5% unemployment rate), CPI will probably stay low or even fall further.

That is, with one-sixth to one-quarter of the economy idle, we are still producing all the consumer goods we can buy.

It is part of the Demand Side forecast that if idle productive capacity were put to work in public investment, both the inflation rate and growth would pick up immediately. If it is put to work in producing consumer goods, and subsidized by the government, as with the proposed programs to help small business or private employment, it will only depress prices further. Theoretically, if it were put to use in producing private investment goods, inflation and growth would resume, as with public investment. But there is no reason to do what China has done. The market for these goods is ample evidence that they are not needed.

On inflation, Paul Krugman takes the OECD to task for its incompetence in forecasting.

SEE KRUGMAN

http://krugman.blogs.nytimes.com/2010/07/17/conventional-madness-revisited/

Conventional Madness, Revisited

In late May I had a, um, negative reaction to the latest OECD Economic Outlook. Not only did the report call for immediate fiscal austerity; it called for a sharp rise in US interest rates over the next year and a half, even though its own forecasts projected very high unemployment and below-target inflation at the end of 2011. The only justification given for this monetary tightening was the fact that “some long-term measures of inflation expectations have increased.” This was a reference to the TIPS spread, the difference between the interest rate on ordinary government bonds and bonds indexed to inflation.

So how’s the TIPS spread doing? The chart provided by Krugman and reproduced in today's transcript shows a cliff dive.

Treasury Department

So yes, the spread widened for a while; then it plunged.

I eagerly await the OECD’s retraction of its previous policy advice, he concludes.

MONETARY POLICY

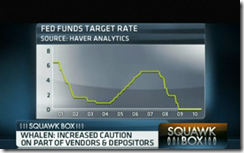

Monetary Policy has not worked. Here we differ from Paul Krugman, who is worried by the so-called zero bound. More later.

But monetary policy, zero interest rates and aggressive purchases of financial assets by the Fed, has not worked. This is an empirical fact -- there is no credit growth, there is no investment -- and it is not going to work. This is no longer such a fringist, outsider view, as we'll hear in a moment with Chris Whalen, perhaps the preeminent banking analyst. Odd, to be fringist, that is, because the vast majority of analysts and forecasters rely on extrapolating the trend, jumping up and down on their spreadsheets to look over the horizon, we've said. The trend for monetary policy efficacy is not up.

And more odd because the failure of monetary policy follows directly from the neoclassical vew of the economy. Self-interested economic actors are now hoarding cash. Self interest is supposed to activate the invisible hand for the benefit of all. Doesn't work too good in debt deflation.

What does monetary policy do?

Back up. What is monetary pollicy supposed to do? It is supposed to make capital cheaper and encourage investment.

But what does it actually do?

It introduces easy leverage for big players. Cheap interest rates that are not available to everybody. It inflates or attempts to inflate the value of assets, but succeeds predominantly -- nearly exclusively -- in doing this only for financial assets. Thus it divorces the financial from the real.

Here is Chris Whalen, the voice of Institutional Risk Analytics, the preeminant banking analyist. Recognize that all our auido on Demand Side is heavily edited. And the other voice you hear is Nouriel Roubini.

WHALEN

Chris Whalen, who has been right about banks for so long, it's a wonder people contradict him. Whalen is saying the Fed's zero interest policy has not worked. Again, that conclusion is nakedly apparent , insofar as no investment has been produced. Banks and corporations are hoarding cash, while the rest of us are paying down our debt.

A chart of Fed rates that accompanied Whalen's comments is available in the transcript.

Demand Side is a great fan of Steve Keen, the Australian economist and disciple of Hyman Minsky, whose computer simulations have replicated real world instabilities, such as we have experienced over the past three years. Keen produce one run which tested the economic impact of giving money to banks versus to the debtors. It was no surprise to us when the results demonstrated a far more constructive result when debtors got the money than when lenders were bailed out. Debtors released it into the real economy. Banks are hoarding it.

Paul Krugman is concerned about the zero bound. The rest of the world views Krugman as a flaming liberal, and perhaps he is. But we are situated to his left. His complaint is about the zero bound. Monetary policy is stuck because you can't lend at below zero. In Demand Side's view, this is like saying if only we had a bigger feather, we could hammer that nail. It is not that the tool isn't big enough, it's just not up to the task.

Connecting the financial economy to the real economy has to be done on the demand side. Create the demand. That will create the investment opportunities. We go further, in saying the investment opportunities are in infrastructure, education, climate change action, energy and other public goods. These are investment, not spending, because there are real benefits produced that can be captured for debt service.

Otherwise the consturctive policy moves are writing down debts to real values that can be serviced by the debtors. No amount of supply side largesse will cure corporate banks of greed. If a CEO WERE to step out in support of the real economy, he would be fired.

The bottom line. The Fed's monetary policy is not going to work any better in the future than it has in the past. The longer these guys have the power, the longer we will be in the soup.

No comments:

Post a Comment