Illegal immigration is an economic problem, not a legal one. No matter what their status under the law, immigrants are going to come and they are going to stay, so long as their lives are better here than back home.

Whether they are categorized as illegals or guest workers, they will pull the market price down for unskilled and semi-skilled labor. The question is not how to keep them out, the real question is, Why don't they stay home?

Thom Hartmann makes the point repeatedly that corporations encourage illegal immigration from the callous calculation that increasing the supply of labor drives down the price. Other progressives, particularly in labor, agree. I agree. But the option of reducing this labor's influx does not exist in the real world. Increasing the demand for labor in the places that need building would be another option.

Most people would stay in their native countries were it not for persecution or abject poverty. And in some real sense we are going to import the products of those countries or we are going to import their people.

What used to be called the Third World is not doing well. While the rest of the world develops, dozens of countries and a billion people fall further and further into desperate conditions. It will only get worse as clean air and clean water become commodities that they cannot afford.

The development model promulgated by the corporate elite, with its henchmen the World Bank and the International Monetary Fund, is built on setting up little industries and competing with other countries on the basis of cheap labor. It ends up as a beggar-thy-neighbor race to the bottom.

A very little investment in roads and schools could generate a very great return in the capacity of these countries, providing their basic institutions are not corrupt. Nations which are not plantation economies have an organization around farming that ought to be encouraged, not destroyed by flooding their markets with the products of American industrial farms.

In the background of it all is a trade regime that does not work. And the U.S. has been the main beneficiary. For more than two decades, America has run massive trade deficits. We have not been trading goods for goods through the medium of money. We have been trading our money for their goods. Someday they are going to come to us and want to finish the exchange, giving us the money they have collected and getting our goods. We're going to look around and see a few airplanes and some agriculture, and realize that in the process we have exported our industry and we have no goods. If it makes their money worthless, so likewise it makes our money worthless.

It is in this context that “free trade” and “open markets” exist. The World Bank would not lend to the US with its balance sheet. They would enforce austerities on us that would drive us into depression.

Once I got off on the broken trade regime, I lost the opportunity for a clean path back to the subject of illegal immigration. I'll just say people are coming here because our money is worth more than theirs, and then close with a personal note. The Mexican people I know are industrious and hard-working and entrepreneurial. Coming to the US is not what their parents wanted for them. But what are their choices? It is a shame they cannot, for whatever reason, employ their skills in the land of their birth. It is a shame we cannot help them.

A low volume, high quality source from the demand side perspective.The podcast is produced weekly. A transcript is posted on the day of.

Friday, March 31, 2006

Tuesday, March 28, 2006

Sonics Recap

The Sonics want a theme park. The Seattle City Council doesn't want to pay for it. What are the economics?

First, the financing....

Key Arena was renovated last in 1995, to the basketball team's specs, with money from revenue bonds. Revenue bonds actually use money generated by the building to pay for its construction, a concept that was called "unique" .... Of course, they are tax-free bonds, so even these imply a significant public subsidy.

As late as October of ‘03, Sonics head man Wally Walker said, "Key Arena is a wonderful place to watch a basketball game. We are not unhappy with it." (PI, 10.20.03)

Then, as councilmember Jim Conlin puts it, "for reasons on which the interested parties do not agree," the revenues betan to fall short, and the city began to pay debt service out of the General Fund.

During this past legislative session the team pitched the legislature with a plan for a $220 million reconstruction of the Key to be financed by an extension of the current hospitality taxes. The new rehab was not so much to improve the "wonderful" basketball arena as to create internal capacity for dining and drinking .... Financed by taxes on restaurants.

Like Disneyland... The creation of Disneyland's Orlando site came about because the company looked across the street in Anaheim and saw all those motels and fast food stores making big bucks off being across the street from Disneyland. So the company built where it could own "across the street," capture the positive externalities, as it were. That's what the Sonics want to do. So there goes the last fig leaf of economic benefit for the city. Oh, and after the city builds it, the Sonics want to run the new building.

Now the politics ....

The city council was not too happy about the broken spokes on the revenue bond wagon. Times are tight in a post-Eyman world. So the Sonics went directly to the legislature, and they brought in David Stern, NBA commish, Mr. Fatuous, to say "A substantial amount has been done for the baseball and football teams. I'm here to personally find out whether the same is being considered fairly for the NBA. If not, that's a decision we can accept. But we'll have to act on it ourselves."

Meaning they'll move the franchise. And not to Bellevue. Oklahoma City, maybe.

Stern called the Key Arena deal the "least competitive lease in the league."

But sports are popular. Especially when the team is winning. Openly opposing a stadium or arena is a good way to get unelected. Gary Locke's finest hour was in leading the fight to keep the Seahawks in Seattle when they tried to sneak out the back door.

The current Guv did not object to the Sonics' request, but insisted that they get agreement with the city and then have a public vote of the taxpayers. Neither came true.

That brings us to the economics ....

A 1922 Supreme Court ruling essentially exempted pro sports from monopoly control because they are "exhibitions" and not interstate commerce. For many decades team owners used their monopoly position to exploit fans, and they used their monopsony (single-buyer) position to exploit the players. When players won free agency, they joined the owners in exploiting the fans.

There is only one league in each sport, baseball, hockey, basketball, football. Leagues intentionally keep the number of franchises below the number of markets which could support them in order to extort concessions from cities and arenas and to keep the value of the franchise high. If competition shows up, they coopt it or suppress it.

The supposed economic benefits for a city of having a team do not exist. Check out the bomb blast zone around Royal Brougham, the site of the baseball and football fields. Ringed by parking lots, the facilities are cut off from the surrounding area. The only businesses benefitting are a few in Pioneer Square catering to beer sucking.

One estimate is that a sports franchise has the economic impact of a small department store, hardly what you'd spend $220 million to keep.

The jobs are primarily low-wage seasonal jobs. The three dozen (max) good salaries in the Sonics organization don't stick very close in the off-season. (It's ironic that California and New York, with income taxes, actually see more contributions from Sonic players than Washington does. Incomes are pro-rated and allocated to the sites where teams play.)

The bottom line ....

Maybe Howard Schultz will sell or move the team. Fine. We'll just get a team from the other league. What? No other league! Talk about non-competitive.

First, the financing....

Key Arena was renovated last in 1995, to the basketball team's specs, with money from revenue bonds. Revenue bonds actually use money generated by the building to pay for its construction, a concept that was called "unique" .... Of course, they are tax-free bonds, so even these imply a significant public subsidy.

As late as October of ‘03, Sonics head man Wally Walker said, "Key Arena is a wonderful place to watch a basketball game. We are not unhappy with it." (PI, 10.20.03)

Then, as councilmember Jim Conlin puts it, "for reasons on which the interested parties do not agree," the revenues betan to fall short, and the city began to pay debt service out of the General Fund.

During this past legislative session the team pitched the legislature with a plan for a $220 million reconstruction of the Key to be financed by an extension of the current hospitality taxes. The new rehab was not so much to improve the "wonderful" basketball arena as to create internal capacity for dining and drinking .... Financed by taxes on restaurants.

Like Disneyland... The creation of Disneyland's Orlando site came about because the company looked across the street in Anaheim and saw all those motels and fast food stores making big bucks off being across the street from Disneyland. So the company built where it could own "across the street," capture the positive externalities, as it were. That's what the Sonics want to do. So there goes the last fig leaf of economic benefit for the city. Oh, and after the city builds it, the Sonics want to run the new building.

Now the politics ....

The city council was not too happy about the broken spokes on the revenue bond wagon. Times are tight in a post-Eyman world. So the Sonics went directly to the legislature, and they brought in David Stern, NBA commish, Mr. Fatuous, to say "A substantial amount has been done for the baseball and football teams. I'm here to personally find out whether the same is being considered fairly for the NBA. If not, that's a decision we can accept. But we'll have to act on it ourselves."

Meaning they'll move the franchise. And not to Bellevue. Oklahoma City, maybe.

Stern called the Key Arena deal the "least competitive lease in the league."

But sports are popular. Especially when the team is winning. Openly opposing a stadium or arena is a good way to get unelected. Gary Locke's finest hour was in leading the fight to keep the Seahawks in Seattle when they tried to sneak out the back door.

The current Guv did not object to the Sonics' request, but insisted that they get agreement with the city and then have a public vote of the taxpayers. Neither came true.

That brings us to the economics ....

A 1922 Supreme Court ruling essentially exempted pro sports from monopoly control because they are "exhibitions" and not interstate commerce. For many decades team owners used their monopoly position to exploit fans, and they used their monopsony (single-buyer) position to exploit the players. When players won free agency, they joined the owners in exploiting the fans.

There is only one league in each sport, baseball, hockey, basketball, football. Leagues intentionally keep the number of franchises below the number of markets which could support them in order to extort concessions from cities and arenas and to keep the value of the franchise high. If competition shows up, they coopt it or suppress it.

The supposed economic benefits for a city of having a team do not exist. Check out the bomb blast zone around Royal Brougham, the site of the baseball and football fields. Ringed by parking lots, the facilities are cut off from the surrounding area. The only businesses benefitting are a few in Pioneer Square catering to beer sucking.

One estimate is that a sports franchise has the economic impact of a small department store, hardly what you'd spend $220 million to keep.

The jobs are primarily low-wage seasonal jobs. The three dozen (max) good salaries in the Sonics organization don't stick very close in the off-season. (It's ironic that California and New York, with income taxes, actually see more contributions from Sonic players than Washington does. Incomes are pro-rated and allocated to the sites where teams play.)

The bottom line ....

Maybe Howard Schultz will sell or move the team. Fine. We'll just get a team from the other league. What? No other league! Talk about non-competitive.

Monday, March 27, 2006

Guilty as sin at Enron, and Crawford

Bush insider Ken Lay's face sagged like he'd gotten a cold look at himself in the Hereafter. Guilty on all counts. He and Jeff Skilling will spend the rest of their lives in jail. Most of their crimes will go unpunished, however, or at least unjudged by a court. As one commentator put it, it was like when they nailed Capone .... it was for tax evasion, not for gangland murders or racketeering.

The enormous damage Enron did to Western states in the energy market manipulations, the devastating impact on employees and investors, the corruption of the political process and the offices of government, these crimes are so immense that they make the punishment a joke for being no more than that for a repeated armed robber or drug dealer.

Sadly, not all of the Enron criminals will be judged or punished. I am not referring to the few who turned state's evidence for reduced sentences, but to the hundreds more who participated in the looting party, many of whom took big bonuses at the end, like the crew taking to lifeboats while the ship with all passengers aboard sinks behind them.

And to, of course, the major co-conspirators in Enron's crimes who will not face charges. Dick Cheney and George Bush aided and abetted the rise of Lay and Enron, and vice versa. Lay was the single largest contributor to the Bush political machine. His Enron money machine bought him a position on the board of El Presidente, Inc. It gave him the opportunity to set energy policy with Dick Cheney. Down came the regulations. Into the void stepped the Enron racketeers. (It's reported that Lay sat down with Cheney to mark up an oil map of Iraq -- pre-9/11.)

Bush made millions in Enron-style cheating, as we pointed out in a previous post (info courtesy of Paul Krugman's The Great Unravelling)

But is the current Medicare drug policy really any different? Let the Pharmaceuticals write the policy and then watch them feed on the sick and elderly and the taxpayer. It is identical to the way Enron fed on the energy markets. This corruption is a way of life. It's disgusting. It's not even well hidden, clearly visible behind a flimsy fence of ridiculous lies and FoxNews attacks.

It's similar to the Lay-Skilling defense itself. "We were doing a good and honorable job. A couple of our subordinants flim-flammed us and the rest was just bad luck. Anyone who says otherwise is a lying son of a bitch." That's a defense?

When the Feds got Skilling and Lay, they did good. But this is not netting a whale. It's just picking off one of the sharks. The others are still feeding.

PS: The one to hang for the Medicare drug fiasco is Doc Hastings of our own 4th District. (Yes, the same Doc Hastings who as chair of the Ethics Committee stonewalled investigation of Tom DeLay.) The one to fix the problem is the guy who is running against him -- Richard Wright. Check out our recent Q&A with Wright.

The enormous damage Enron did to Western states in the energy market manipulations, the devastating impact on employees and investors, the corruption of the political process and the offices of government, these crimes are so immense that they make the punishment a joke for being no more than that for a repeated armed robber or drug dealer.

Sadly, not all of the Enron criminals will be judged or punished. I am not referring to the few who turned state's evidence for reduced sentences, but to the hundreds more who participated in the looting party, many of whom took big bonuses at the end, like the crew taking to lifeboats while the ship with all passengers aboard sinks behind them.

And to, of course, the major co-conspirators in Enron's crimes who will not face charges. Dick Cheney and George Bush aided and abetted the rise of Lay and Enron, and vice versa. Lay was the single largest contributor to the Bush political machine. His Enron money machine bought him a position on the board of El Presidente, Inc. It gave him the opportunity to set energy policy with Dick Cheney. Down came the regulations. Into the void stepped the Enron racketeers. (It's reported that Lay sat down with Cheney to mark up an oil map of Iraq -- pre-9/11.)

Bush made millions in Enron-style cheating, as we pointed out in a previous post (info courtesy of Paul Krugman's The Great Unravelling)

But is the current Medicare drug policy really any different? Let the Pharmaceuticals write the policy and then watch them feed on the sick and elderly and the taxpayer. It is identical to the way Enron fed on the energy markets. This corruption is a way of life. It's disgusting. It's not even well hidden, clearly visible behind a flimsy fence of ridiculous lies and FoxNews attacks.

It's similar to the Lay-Skilling defense itself. "We were doing a good and honorable job. A couple of our subordinants flim-flammed us and the rest was just bad luck. Anyone who says otherwise is a lying son of a bitch." That's a defense?

When the Feds got Skilling and Lay, they did good. But this is not netting a whale. It's just picking off one of the sharks. The others are still feeding.

PS: The one to hang for the Medicare drug fiasco is Doc Hastings of our own 4th District. (Yes, the same Doc Hastings who as chair of the Ethics Committee stonewalled investigation of Tom DeLay.) The one to fix the problem is the guy who is running against him -- Richard Wright. Check out our recent Q&A with Wright.

Sunday, March 26, 2006

The economic answer to immigration

Non-answers to the immigration problem begin with those of Charles Krauthammer, which include erecting a wall along the entire border and in one motion legalizing those inside the country and slamming a miracle door that keeps everybody else out. This goofiness follows directly after Krauthammer lampoons Bush for thinking he can close the border with a military style action. And of course, there is no shortage of liberal straw men in Krauthammer's analysis.

In fact, liberals like Thom Hartmann have made the case that illegal immigration is a favor to Corporate America because it depresses the price of labor by increasing its supply. He and others have correctly pointed out that if employers of illegals were jailed for hiring them, the flow would be stanched quicker than any size electric fence could accomplish. (Notably, Krauthammer fails to mention this central alternative to the Berlin Wall of the South.)

But the real answer, the economic answer is to provide development support for the populations where they currently reside: Basic investment in roads, utilities and education, not subsidies to factories on the edge of town, whose only mission is to exploit cheap labor before it has to cross the border.

The advantages to this approach are numerous, beginning with the avoidance of silly spending on low-wage soldiers running around in the desert trying to catch an evil tide of Jack-in-the-Box counter clerks. If the same dollars were spent on schools, it would give the carpenters among those counter clerks work on that side of the border. Second, and more importantly, it would generate human capital there. And both sooner and later it would generate well-being, a truly indigenous economy, and even real demand for US goods.

Instead,we pretend we have something here that everyone wants. Hell, all we've got is debt. If they're looking for debt, we ought to let them have some. From that perspective, it's the IMF and the World Bank who are the primary coyotes. Let's lock up those guys.

OR

(before the depressing part)

(to expose the charade completely)

Let's just set up our retirement villages in Mexico, take the bedpans to the nurse's aids, rather than make them carry their kids across the desert to get to us. Our retirement checks will go further there, the climate is nice, and they need more fat people.

Now for the depressing part.

Imagine how much worse the immigration issue would be if the jobs dried up. The flood of immigrants seeking work in the US has already sparked its inevitable response. But the word "crisis" is misapplied to the current situation. With an economic downturn, a crisis will come into full flower. When employment starts dropping again, as it must, the pressure on these people will be enormous.

Now they are employed, in building trades and personal services. These would be the first jobs to go. When those occupations dry up, not only will the illegals begin to look elsewhere, but legal Americans will come looking for their jobs.

Lock them out! Deport them! It is an immigration problem!

In fact, it is an economic problem, a trade problem. To a very real extent, people flood into the US because the economies of their native countries have been decimated by a trade regime instituted by the US. The agriculture that has been the backbones of many of their economies and provided the framework for their societies has been wiped out by cheap American imports.

The point is often made that menials can earn four times the wage here in the United States that they can in Mexico. First, Four times nothing is still not a living wage. Second, People only need self-determination and a chance for survival, not big bucks, and it is these minimum conditions that are becoming scarce.

Since the 1970s the economies of the developed and newly industrial countries have increased steadily, if in some cases not spectacularly. Economies of underdeveloped countries have contracted by one-third. It is not material extravagance these folks are rushing into when they come across the border, it is want they are fleeing. All for the benefit of the industrial farm that has already wiped out the family farm here at home.

In the 1940s and 1950s a choice was made about how to support farmers in the US. One camp preferred income supports. The other preferred price supports. Price supports won. From that point on the industrial farm became inevitable, inevitable because of a simple calculation: the cost of farming an additional acre is always lower than the average cost. In econo-speak, the marginal cost is lower than the average cost.

Thus, bigger is always cheaper. And in the nearly perfectly competitive world of farming, that is the metric that destroyed the family farm. It is now destroying the farms of people all over the world.

In the United States, people have clung to the remnants of the agrarian lifestyle with ferocious intensity. To no avail. They have been forced into cities or live 80-hour work weeks, subsidizing their farms by employment elsewhere. The farmers of underdeveloped countries have it worse. There is no successful industry to transition into. There is no place to go.

What is the answer? The first real answer is to eliminate farm products from trade agreements. Every country has a national security need to grow its own food and have a diversified crop base, not a plantation-only economy. Further, in most societies which are not developed industrially, farming is an organizing structure, a healthy place to build, raise children, and so on. It rewards hard work and skill and can create family wealth.

Yes, population grows at a rate where not all farm children can grow up to be farmers, but it is likewise true that the decimation of the farm population both here and abroad is not a result of population pressure, but of mechanization, subsidies, and chemicals. And so long as marginal cost is less than average cost, the calculation comes out minus for a healthy agrarian society. (There are ways -- not all of which are income supports -- to reverse that equation.)

A solution in the end will mean higher farm prices, but higher incomes and greater demand for other goods, more stable societies, and far less pressure to "keep them out." Whether higher farm prices will translate into higher food prices is not completely a sure thing. Probably it would. But much of the price of food goes to the cartel of food processors. That is a story for another day.

By itself, allowing countries to protect a diversified and healthy farm society, by tariffs and otherwise, will not eliminate immigration problems. It is a step in the right direction, the direction of building and sustaining domestic demand in these struggling societies. But more is needed.

Nothing has ever in the history of economics been so nefarious as the insistence of the powerful that the developing world must balance its budgets and even run surpluses in trade to get investment capital, while the powerful themselves ignore those same rules and run massive deficits for themselves.

Schools and roads and water and power ought to be our exports to these countries, not slave-wage factories and ecological nastiness. We have made the world a plantation economy, not a global economy. Low-priced goods and commodities are the only product we will accept. Were these thriving societies, with effective demand of their own, the free trade model could work.

In fact, liberals like Thom Hartmann have made the case that illegal immigration is a favor to Corporate America because it depresses the price of labor by increasing its supply. He and others have correctly pointed out that if employers of illegals were jailed for hiring them, the flow would be stanched quicker than any size electric fence could accomplish. (Notably, Krauthammer fails to mention this central alternative to the Berlin Wall of the South.)

But the real answer, the economic answer is to provide development support for the populations where they currently reside: Basic investment in roads, utilities and education, not subsidies to factories on the edge of town, whose only mission is to exploit cheap labor before it has to cross the border.

The advantages to this approach are numerous, beginning with the avoidance of silly spending on low-wage soldiers running around in the desert trying to catch an evil tide of Jack-in-the-Box counter clerks. If the same dollars were spent on schools, it would give the carpenters among those counter clerks work on that side of the border. Second, and more importantly, it would generate human capital there. And both sooner and later it would generate well-being, a truly indigenous economy, and even real demand for US goods.

Instead,we pretend we have something here that everyone wants. Hell, all we've got is debt. If they're looking for debt, we ought to let them have some. From that perspective, it's the IMF and the World Bank who are the primary coyotes. Let's lock up those guys.

OR

(before the depressing part)

(to expose the charade completely)

Let's just set up our retirement villages in Mexico, take the bedpans to the nurse's aids, rather than make them carry their kids across the desert to get to us. Our retirement checks will go further there, the climate is nice, and they need more fat people.

Now for the depressing part.

Imagine how much worse the immigration issue would be if the jobs dried up. The flood of immigrants seeking work in the US has already sparked its inevitable response. But the word "crisis" is misapplied to the current situation. With an economic downturn, a crisis will come into full flower. When employment starts dropping again, as it must, the pressure on these people will be enormous.

Now they are employed, in building trades and personal services. These would be the first jobs to go. When those occupations dry up, not only will the illegals begin to look elsewhere, but legal Americans will come looking for their jobs.

Lock them out! Deport them! It is an immigration problem!

In fact, it is an economic problem, a trade problem. To a very real extent, people flood into the US because the economies of their native countries have been decimated by a trade regime instituted by the US. The agriculture that has been the backbones of many of their economies and provided the framework for their societies has been wiped out by cheap American imports.

The point is often made that menials can earn four times the wage here in the United States that they can in Mexico. First, Four times nothing is still not a living wage. Second, People only need self-determination and a chance for survival, not big bucks, and it is these minimum conditions that are becoming scarce.

Since the 1970s the economies of the developed and newly industrial countries have increased steadily, if in some cases not spectacularly. Economies of underdeveloped countries have contracted by one-third. It is not material extravagance these folks are rushing into when they come across the border, it is want they are fleeing. All for the benefit of the industrial farm that has already wiped out the family farm here at home.

In the 1940s and 1950s a choice was made about how to support farmers in the US. One camp preferred income supports. The other preferred price supports. Price supports won. From that point on the industrial farm became inevitable, inevitable because of a simple calculation: the cost of farming an additional acre is always lower than the average cost. In econo-speak, the marginal cost is lower than the average cost.

Thus, bigger is always cheaper. And in the nearly perfectly competitive world of farming, that is the metric that destroyed the family farm. It is now destroying the farms of people all over the world.

In the United States, people have clung to the remnants of the agrarian lifestyle with ferocious intensity. To no avail. They have been forced into cities or live 80-hour work weeks, subsidizing their farms by employment elsewhere. The farmers of underdeveloped countries have it worse. There is no successful industry to transition into. There is no place to go.

What is the answer? The first real answer is to eliminate farm products from trade agreements. Every country has a national security need to grow its own food and have a diversified crop base, not a plantation-only economy. Further, in most societies which are not developed industrially, farming is an organizing structure, a healthy place to build, raise children, and so on. It rewards hard work and skill and can create family wealth.

Yes, population grows at a rate where not all farm children can grow up to be farmers, but it is likewise true that the decimation of the farm population both here and abroad is not a result of population pressure, but of mechanization, subsidies, and chemicals. And so long as marginal cost is less than average cost, the calculation comes out minus for a healthy agrarian society. (There are ways -- not all of which are income supports -- to reverse that equation.)

A solution in the end will mean higher farm prices, but higher incomes and greater demand for other goods, more stable societies, and far less pressure to "keep them out." Whether higher farm prices will translate into higher food prices is not completely a sure thing. Probably it would. But much of the price of food goes to the cartel of food processors. That is a story for another day.

By itself, allowing countries to protect a diversified and healthy farm society, by tariffs and otherwise, will not eliminate immigration problems. It is a step in the right direction, the direction of building and sustaining domestic demand in these struggling societies. But more is needed.

Nothing has ever in the history of economics been so nefarious as the insistence of the powerful that the developing world must balance its budgets and even run surpluses in trade to get investment capital, while the powerful themselves ignore those same rules and run massive deficits for themselves.

Schools and roads and water and power ought to be our exports to these countries, not slave-wage factories and ecological nastiness. We have made the world a plantation economy, not a global economy. Low-priced goods and commodities are the only product we will accept. Were these thriving societies, with effective demand of their own, the free trade model could work.

Saturday, March 25, 2006

Pouring blood and treasure into the sand

The invasion and occupation of Iraq will cost $1 trillion or maybe twice that according to Joseph Stiglitz, a Nobel laureate in economics, and his co-author in the assessment, Linda Bilmes of Harvard's Kennedy School.

In addition to staging the event and maintaining the actors on the road until at least 2010, the costs include lifetimes of disability payments, the loss of the contributions of the dead and debilitated, higher recruitment costs, replacement of billions in military equipment and munitions, interest on the debt financing, higher oil prices, and of course, the payments to the corrupt.

Meanwhile the unemployment rate in Iraq is 60%, according to Rep. John Murtha, who has seen intelligence information. Presumably many of the existing jobs are in the military or police or in support to the occupation.

And the country descends into civil war. Except it's not civil war, because the unified Iraq was a fiction cobbled together by the British according to the geography of oil, a fiction then enforced by the Baathists and the brutality of Saddam Hussein.

Attempting to maintain the fiction, which is the official US policy, involves empowering "leaders" who are simply politicians in or out of religious garb, people who cannot produce a stable society, and can only exercise a kind of control over a particular faction.

Far better to empower workers and technocrats by bankrolling reconstruction enterprises, perhaps partnered with, but not directed by, non-Iraqi businesses. The UN could set up a contracting office that would have some legitimacy. Creating economic order would generate civil stability, irrespective of what party occupies Government House.

Restoring electricity and water service to their own neighborhoods and industries would generate a self-reliance far exceeding that of casting a vote in a foreign-sponsored election.

The only advantage of continuing on the current non-path is to the Bush regime, who can claim at the front end that it is working and at the back end that we were betrayed.

# Posted by Alan : 11:21 AM

In addition to staging the event and maintaining the actors on the road until at least 2010, the costs include lifetimes of disability payments, the loss of the contributions of the dead and debilitated, higher recruitment costs, replacement of billions in military equipment and munitions, interest on the debt financing, higher oil prices, and of course, the payments to the corrupt.

Meanwhile the unemployment rate in Iraq is 60%, according to Rep. John Murtha, who has seen intelligence information. Presumably many of the existing jobs are in the military or police or in support to the occupation.

And the country descends into civil war. Except it's not civil war, because the unified Iraq was a fiction cobbled together by the British according to the geography of oil, a fiction then enforced by the Baathists and the brutality of Saddam Hussein.

Attempting to maintain the fiction, which is the official US policy, involves empowering "leaders" who are simply politicians in or out of religious garb, people who cannot produce a stable society, and can only exercise a kind of control over a particular faction.

Far better to empower workers and technocrats by bankrolling reconstruction enterprises, perhaps partnered with, but not directed by, non-Iraqi businesses. The UN could set up a contracting office that would have some legitimacy. Creating economic order would generate civil stability, irrespective of what party occupies Government House.

Restoring electricity and water service to their own neighborhoods and industries would generate a self-reliance far exceeding that of casting a vote in a foreign-sponsored election.

The only advantage of continuing on the current non-path is to the Bush regime, who can claim at the front end that it is working and at the back end that we were betrayed.

# Posted by Alan : 11:21 AM

Thursday, March 23, 2006

Heck hath no fury like an economist scorned

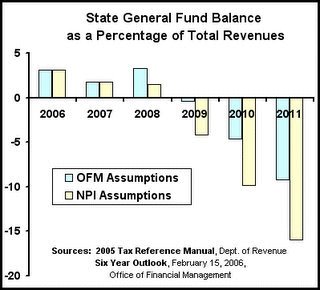

The projected long-term growth rate in state General Fund revenue is built on little more than hope and a fuzzy trend line. At the end of the day, it still comes up short.

Irv Lefberg is the state Office of Financial Management (OFM) chief forecaster. You may remember a post in which I was taking Irv to task for saying the underlying rate of growth in state revenues was 5% when it wasn't, and for picking 90% of personal income growth as a measure, when personal income has little to do with our tax yields. The actual experience of the past ten yeiers has been under 4% and dropping in the big three -- Retail Sales, B&O and Property.

Irv answered that the underlying growth rate is 5%, they expect it to be in the future, and besides which the Office of Forecast Council and Chang Mook Sohn agreed. And he sent me a spreadsheet on the legislative changes that have been made since 1993, the implication being, I guess, that if the legislature stops cutting taxes here and there, the growth rate will appear from the mist as 5%.

Bazz Fazz. Phooey.

I sent the e-mail: Irv, I am still puzzled. Maybe I didn't ask the right question. Let me try this one. Are state tax revenues projected to rise by five percent per year in the absence of legislative action? Thanks. Alan

Since then, the freeze, the dark night of space, the great silence. Up until this point, we had a pretty good thing going. I would ask questions, and he would respond by annotating each in blue. Now I feel rejected. I suppose it's possible that he doesn't want to go on record saying the legislature has to do something to generate the historical trend. I don't know. I'm confused and angry.

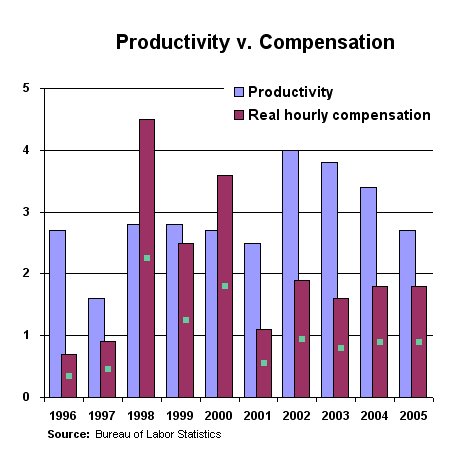

Look, if we're going to base revenue projections on inflation, let's use the same inflation for our expenditures. We don't. (Actually, we should work outside inflation entirely, if possible.) If we are using historical growth trends, let's use ones of recent vintage. And personal income is better used to mark a personal income tax. A sales/B&O/property mix should use median income. Median income is stagnating.

Here's the chart again.

Even if revenues come in under OFM's official figures, we'd still be 10 percent short in five years. That is, revenues need to grow at 7% just to make a balanced budget. They will grow about half that fast, excluding untoward inflation or population influxes that will bring costs along with their revenue.

In the absence of tax reform (and there seems to be an absence of tax reform), the choices are minimal if we want to remain somewhat civilized here in the state. The best one is to create a comprehensive health care system. Major costs coming up are related to health care, both for employees and for clients of the state's systems. Many of these are off the General Fund budget, but many are not.

Wednesday, March 22, 2006

Crunching the numbers to fit the PR box

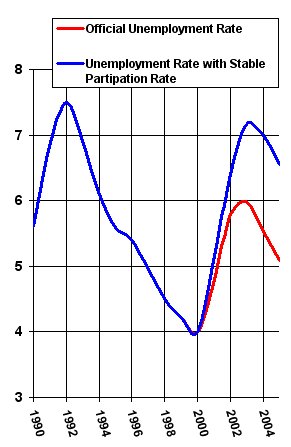

Coincidentally with the need for a happy face on the president's economic performance, unemployment statistics got a boost from a mysterious statistical genie.

Since the latest series began in 1959, the participation rate in the labor pool -- the number of working age people looking for jobs -- has climbed steadily. Beginning in 2001, the number began to fall, and it has continued to fall. Absent this curiousity, 2005's unemployment rate would be 6.5 percent, rather than the fairly moderate 5.1.

Something smells when the current administration can only claim the addition of 4.8 million jobs over five years, while adding 1.9 million to the rolls of the unemployed and still get something to brag about on the nightly news. Clinton's eight years saw 18.4 million new jobs, and a subtraction of 3.9 unemployed.

The labor pool has grown inexorably since statistics have been kept. It tends to react a bit with the availability of jobs, it's a fact, but not this much. One of the wonders of employment statistics is that even as the denominator has grown, under Democratic presidents the unemployment rate has consistently dropped from one year to the next.

The Bush II collapse of the labor pool is, however, unprecedented. While the participation rate has come down a tenth of a point here and there, it has come down more than one-tenth only four times since 1971 -- in 2001, 2002, 2003 and 2004.

I began to look closer at this when I caught on to John Williams pieces on how official numbers are crunched until they fit the PR boxes. I admit I don't know exactly the methodological gymnastics that produced these particular participation rate anomolies, but they are there, and they're in the breakouts for the state, too. Maybe I'll subscribe to Williams' newsletter for us.

Tuesday, March 21, 2006

I love to hate the B&O, but ...

The State's Business & Occupation tax (B&O) remains one of the worst taxes ever anywhere. Its base of gross receipts penalizes small business, growing business, in-state business, investing business. But worse is the myriad of baby B&Os that dot the Puget Sound region in the revenue architecture of three dozen cities. These baby B&Os are taxes separate in form and application from the State's version and until recently from each other. Their main purpose seems to be to create complexity, inefficiency and resentment.

So personal consistency was abandoned this week when I dropped a memo on Tacoma's Revenue Task Force proposing an expansion of the city's B&O as an alternative to city manager Eric Anderson's property tax based initiative. The memo is in two parts, a critique of Anderson's proposal and an outline of the alternative.

The alternative uses a reformed city B&O to target bigness and nonprofits, both of which are underrepresented at tax time. It drops well more than half of the smaller businesses from the rolls and thereby reduces compliance problems and further mitigates some of the bias of the State's B&O. Plus, it dispenses with a statutory dance with the legislature needed to squeeze the holdings of nonprofits into the city manager's proposed property tax base.

Of course, it is all still in the conceptual stage. The reception was pretty good at the Task Force meeting. But questions were many, and there was the requisite challenge from the Chamber of Commerce representative. At least it opens up the range of options. And it certainly enlivened the debate.

So personal consistency was abandoned this week when I dropped a memo on Tacoma's Revenue Task Force proposing an expansion of the city's B&O as an alternative to city manager Eric Anderson's property tax based initiative. The memo is in two parts, a critique of Anderson's proposal and an outline of the alternative.

The alternative uses a reformed city B&O to target bigness and nonprofits, both of which are underrepresented at tax time. It drops well more than half of the smaller businesses from the rolls and thereby reduces compliance problems and further mitigates some of the bias of the State's B&O. Plus, it dispenses with a statutory dance with the legislature needed to squeeze the holdings of nonprofits into the city manager's proposed property tax base.

Of course, it is all still in the conceptual stage. The reception was pretty good at the Task Force meeting. But questions were many, and there was the requisite challenge from the Chamber of Commerce representative. At least it opens up the range of options. And it certainly enlivened the debate.

Sunday, March 19, 2006

Get in the shoes of the taxpayer

We progressives make a big mistake when we insist that the only fair reform to state taxes is a personal income tax.

Bill Gates, Sr., busted the effort of the 2002 Tax Structure Study when he obsessed during legislative hearings about the virtues of the personal income tax. For one brief moment, he had the public's attention on this difficult subject. He ignored the Commission's first and best recommendation – to scrap the albatross of a B&O tax in favor of a subtraction method value added tax, and talked at length about income taxes. The public just shrugged it off as more of the same, and a great opportunity was lost. (Our "Basic Reform to the B&O Tax" accomplishes the intent of that recommendation, by the way, without all the folderol of scrapping one form and starting up a new one.)

Yes, a personal income tax is a fairer tax, and would be preferred absent the obvious political realities – and absent the tax structure realities facing the average taxpayer. The taxpayer is already faced with a personal income tax from the feds, and a payroll tax that is being operated as an adjunct to the income tax. She may be forgiven for not wanting another deduction on the pay stub.

I remember sitting in a House Finance Committee in Olympia and listening to Rev. John Boonstra of the Association of Washington Churches and the Tax Fairness Coalition. He gave impassioned testimony about how voters would respond responsibly if only they were given the straight scoop about the progressive advantages of an income tax. I thought it was a noble naivety, a feeling similar to the one from listening to Bill Gates.

Then the same feeling came over me the other night as I listened to the firefighters' local president Pat McElligott insist that voters would support new property taxes once they understood what they were getting for their money. Pat probably had the best case, but none of the three appreciated the difficulty of talking about taxes to the average citizen.

First, the word "tax" has been given the connotation of leprosy or incest in a targeted effort by the Radical Right to reduce the size and scope of government. Realizing that public programs like Social Security and schools have wide public support, the Right has chosen to focus on the financing mechanism – taxes. And they have largely been successful. People who would laugh if you told them they could have a house without a mortgage now sincerely think they should have public services without paying taxes.

Second, there is a cacophony of talk the average citizen has to sort through in dealing with taxes, and very little of it is economically informed. I watched a video produced by a city government with real citizens talking about where their tax money goes, how they didn't realize where it goes, and how they were happier when they realized it goes for this or that. Taxes don't "go" anywhere. They stay right in the community. More than eighty percent of your tax money goes to pay the salary of a fellow citizen. Match that with where your money goes at the gas station or the mall. This is an important thing to understand. If small business were not enthralled with fairy tale capitalism, they would understand that government not only provides services they need, but keeps market demand in the neighborhood.

Lastly, though, we need to see the tax structure from the taxpayer's point of view, not from the government's point of view. Instead of talking down to them, we need to get behind them and see things as they see them. State tax reform, as I said, often gets stuck on an income tax as if it were balanced. It is balanced from the perspective of state government, but not from the standpoint of the one who writes the checks. Voters distrust anything new in the realm of taxation, so when they don't see balance where it is advertised, they don't stop to listen to the rest of the pitch. Real balance would come with a turn to business taxes, broad-based, equitable business taxes founded on ability to pay.

Reforming the B&O in a way that generates revenue and ends the free ride of the big corporations will look good taxpayers (he said, with charming naivety).

Bill Gates, Sr., busted the effort of the 2002 Tax Structure Study when he obsessed during legislative hearings about the virtues of the personal income tax. For one brief moment, he had the public's attention on this difficult subject. He ignored the Commission's first and best recommendation – to scrap the albatross of a B&O tax in favor of a subtraction method value added tax, and talked at length about income taxes. The public just shrugged it off as more of the same, and a great opportunity was lost. (Our "Basic Reform to the B&O Tax" accomplishes the intent of that recommendation, by the way, without all the folderol of scrapping one form and starting up a new one.)

Yes, a personal income tax is a fairer tax, and would be preferred absent the obvious political realities – and absent the tax structure realities facing the average taxpayer. The taxpayer is already faced with a personal income tax from the feds, and a payroll tax that is being operated as an adjunct to the income tax. She may be forgiven for not wanting another deduction on the pay stub.

I remember sitting in a House Finance Committee in Olympia and listening to Rev. John Boonstra of the Association of Washington Churches and the Tax Fairness Coalition. He gave impassioned testimony about how voters would respond responsibly if only they were given the straight scoop about the progressive advantages of an income tax. I thought it was a noble naivety, a feeling similar to the one from listening to Bill Gates.

Then the same feeling came over me the other night as I listened to the firefighters' local president Pat McElligott insist that voters would support new property taxes once they understood what they were getting for their money. Pat probably had the best case, but none of the three appreciated the difficulty of talking about taxes to the average citizen.

First, the word "tax" has been given the connotation of leprosy or incest in a targeted effort by the Radical Right to reduce the size and scope of government. Realizing that public programs like Social Security and schools have wide public support, the Right has chosen to focus on the financing mechanism – taxes. And they have largely been successful. People who would laugh if you told them they could have a house without a mortgage now sincerely think they should have public services without paying taxes.

Second, there is a cacophony of talk the average citizen has to sort through in dealing with taxes, and very little of it is economically informed. I watched a video produced by a city government with real citizens talking about where their tax money goes, how they didn't realize where it goes, and how they were happier when they realized it goes for this or that. Taxes don't "go" anywhere. They stay right in the community. More than eighty percent of your tax money goes to pay the salary of a fellow citizen. Match that with where your money goes at the gas station or the mall. This is an important thing to understand. If small business were not enthralled with fairy tale capitalism, they would understand that government not only provides services they need, but keeps market demand in the neighborhood.

Lastly, though, we need to see the tax structure from the taxpayer's point of view, not from the government's point of view. Instead of talking down to them, we need to get behind them and see things as they see them. State tax reform, as I said, often gets stuck on an income tax as if it were balanced. It is balanced from the perspective of state government, but not from the standpoint of the one who writes the checks. Voters distrust anything new in the realm of taxation, so when they don't see balance where it is advertised, they don't stop to listen to the rest of the pitch. Real balance would come with a turn to business taxes, broad-based, equitable business taxes founded on ability to pay.

Reforming the B&O in a way that generates revenue and ends the free ride of the big corporations will look good taxpayers (he said, with charming naivety).

Tuesday, March 14, 2006

State Housing and Employment

Cheery news always sticks to the top of the Business page, while grimmer news seems to slip into the fold. Housing slows and its, "Home buyers don't have to pull the trigger as fast." An uptick in the jobless rate, "No problem... There is really no negative to put on this." (TNT) I'm here to put the negative on it. And the second Tuesday is now prediction Tuesday for state and local economic numbers.

While the overall economy in Washington will fare better than that of the rest of the country, as we enter the second dip of the Bush recession, state and local revenues will suffer, housing will suffer, and employment will suffer.

Housing

Home sales in most of the state have reached their peak. King County's will top out pretty soon. By this time next year (end of February reports), home prices will be down 5 to 10 percent in King County and 10-20 percent elsewhere in the state. Here are our benchmarks.

Actual February 2006 median home sale prices

King County - $345,000

Pierce County - $250,000

17-County Area * - $283,000

(*covered by Multiple Listing Service)

Predicted February 2007 median home sale prices

King County - $325,000

Pierce County - $220,000

17-County Area - $250,000

Picking the peak of a trend is the most difficult. Things tend to trend over long time periods. Can't find anybody else making predictions about housing. If you see some, drop us a line.

Employment

Employment growth will be nonexistent in Washington over the coming year. That is, zero job growth. I am not going to predict the unemployment rate, because it's been boogered by the Bush team and I haven't got a handle on it.

Background from economist John Williams:

"Richard Nixon had a highly publicized war with the Bureau of Labor Statistics on the unemployment data. Nixon wanted to report the unemployment rate as the lower of the seasonally adjusted or unadjusted number, at any given time, but not specify same to the public. While that approach was unconscionable at the time and never used, basically the same methodology was introduced in 2004 as "state-of-the-art" by the current Bush administration."

I just played with some employment growth v. employment rate figures from the 2006 Economic Report of the President. Clinton added 18.4 million jobs in his eight years. The unemployment rate dropped from 6.9 to 4.0. Bush added a total of 4.8 million jobs in five years, and the unemployment rate rose only to 5.1. Supposedly its down to 4.7 now. Something is very funky. I'll give you a chart next week.

State Revenue

Tax revenue growth has been set at 5% by OFM's chief forecaster Irv Lefberg. I've tried to budge him, but he's sticking to it. (Actually official baseline growth is only 2.2% next year, but it jumps to 5.7 in 2008 and continues at about 5 percent thereafter.) Barring legislative action, revenue will grow substantially slower -- 1.1% short term and 3.0% long term.

While the overall economy in Washington will fare better than that of the rest of the country, as we enter the second dip of the Bush recession, state and local revenues will suffer, housing will suffer, and employment will suffer.

Housing

Home sales in most of the state have reached their peak. King County's will top out pretty soon. By this time next year (end of February reports), home prices will be down 5 to 10 percent in King County and 10-20 percent elsewhere in the state. Here are our benchmarks.

Actual February 2006 median home sale prices

King County - $345,000

Pierce County - $250,000

17-County Area * - $283,000

(*covered by Multiple Listing Service)

Predicted February 2007 median home sale prices

King County - $325,000

Pierce County - $220,000

17-County Area - $250,000

Picking the peak of a trend is the most difficult. Things tend to trend over long time periods. Can't find anybody else making predictions about housing. If you see some, drop us a line.

Employment

Employment growth will be nonexistent in Washington over the coming year. That is, zero job growth. I am not going to predict the unemployment rate, because it's been boogered by the Bush team and I haven't got a handle on it.

Background from economist John Williams:

"Richard Nixon had a highly publicized war with the Bureau of Labor Statistics on the unemployment data. Nixon wanted to report the unemployment rate as the lower of the seasonally adjusted or unadjusted number, at any given time, but not specify same to the public. While that approach was unconscionable at the time and never used, basically the same methodology was introduced in 2004 as "state-of-the-art" by the current Bush administration."

I just played with some employment growth v. employment rate figures from the 2006 Economic Report of the President. Clinton added 18.4 million jobs in his eight years. The unemployment rate dropped from 6.9 to 4.0. Bush added a total of 4.8 million jobs in five years, and the unemployment rate rose only to 5.1. Supposedly its down to 4.7 now. Something is very funky. I'll give you a chart next week.

State Revenue

Tax revenue growth has been set at 5% by OFM's chief forecaster Irv Lefberg. I've tried to budge him, but he's sticking to it. (Actually official baseline growth is only 2.2% next year, but it jumps to 5.7 in 2008 and continues at about 5 percent thereafter.) Barring legislative action, revenue will grow substantially slower -- 1.1% short term and 3.0% long term.

Sunday, March 12, 2006

Politics, the Heartland, and "Stuff"

Two weeks ago today I was sitting in MSP marveling at the Goose-B-Gone posters and the Fox News bookstore outlets. (I'm not making this up.) I had more than a couple of hours between planes, so I wrote what I thought was a humorous little post about competence. Competence. How the Heartland values competence above all else and how linking GOP governance to the complete absence of competence – a very short link – would make them "the other guys" to a large part of America.

(Yes, I know Minnesota is the other way from South Dakota, but they have jets if you connect in that direction. Through Denver, it's prop planes flying low.)

I made the mistake of showing the post to a cousin whose opinion I value very much. Either the piece wasn't written very well or there's a deep-seated defensiveness I couldn't get by. In any event, the message heard was not that the Heartland cares about competence, but that they don't got any.

That, of course, is not so. Self-reliance and the distance between farms tends to generate ability out of seed corn.

The question turned not on the skill of city mice v. country mice, but on my being willing to wait a couple of days till the weather warmed to start a truck. This was not appropriate respect for a borrowed vehicle. But my goodness, it was minus twenty-six and the hood latch was frozen! (Note: I did start the truck and deliver it full of gas. Saving my reputation, I guess.)

Anyway, it was clear I didn't have the proper respect for property.

Guilty.

Then it hit me. This is what the Heartland cares most about. Even more than competence. This is what citizens of every state care most about. Stuff! Sometimes they even confuse it with the concept of "responsibility."

The upshot is that if we on the Left want to reach these people, we need to promise them more money and give them goodies. That means we're in trouble. We can promise the poor sufficience. The moderately well off can keep their stuff. The rich? We'll debate that later. But more? More material is not sustainable. No.

It is absolutely astounding how many of our fellow citizens spend all or most of their time obtaining, storing, cleaning, maintaining, insuring and displaying material goods. These are citizens we are not going to reach with messages on the environment, education, poverty, justice, civil liberties, women's rights, workers' rights, geopolitical balance, health care, or any of the other issues that matter and that the Radical Right is screwing up. Why? Because these citizens think all this noise is just an excuse to get them to give up some of their stuff.

That, or because they can't hear us. They're at the goddam mall getting more stuff or exchanging this stuff for that stuff.

There's a line called "object referral" in Hindu thought which says people will identify who they are by the things they own. A BMW owner is better than a Ford owner. Who are you? I'm a BMW owner. And driver. I live in a house in Sahalee. I'm an Ipod user. I'm a boat owner. I show horses. New shoes? Yes. You like them? Etc., etc. Who they really are is another discussion, but be sure, a person is not any aspect of a material thing through the mechanism of ownership.

Studies have shown that when it comes to material possessions and happiness, it is not the absolute level of possessions that contributes to subjective measures of happiness, it is the relative level. So if your mud hut has a better roof than your neighbor's, you are just as happy as if your garage has a BMW and Jim has to park his Jetta on the street.

Even the boys from the Black Hills tend to look at your pickup before they look at your face. The assembly of things in the shed often seems analogous to the phalanx of servants at the door in an earlier age.

But I ascribe virtue to myself where there is simply a missed gene. I have never understood the fever for stuff. Just like I never got disco, or even the Stones. I take some heart that the most gifted economist of the 20th century John Maynard Keynes did not have a material view of the world either, or an academic one, for that matter. According to Joan Robinson, another first-tier economist, Keynes had an aesthetic view of economies. Poverty was ugly. Unemployment was stupid.

My cousin said to me, "You keep right on with that political B.S., Al. I got business to take care of. But thanks for watching my back."

What he meant, I'm not sure. I have the image of watching the back of an ostrich. Ten years from now if he looks up and sees things are not like what he expected, he is going to get very excited. Is he going to have the wit to blame the right party, or will he just pick the closest one?

(Yes, I know Minnesota is the other way from South Dakota, but they have jets if you connect in that direction. Through Denver, it's prop planes flying low.)

I made the mistake of showing the post to a cousin whose opinion I value very much. Either the piece wasn't written very well or there's a deep-seated defensiveness I couldn't get by. In any event, the message heard was not that the Heartland cares about competence, but that they don't got any.

That, of course, is not so. Self-reliance and the distance between farms tends to generate ability out of seed corn.

The question turned not on the skill of city mice v. country mice, but on my being willing to wait a couple of days till the weather warmed to start a truck. This was not appropriate respect for a borrowed vehicle. But my goodness, it was minus twenty-six and the hood latch was frozen! (Note: I did start the truck and deliver it full of gas. Saving my reputation, I guess.)

Anyway, it was clear I didn't have the proper respect for property.

Guilty.

Then it hit me. This is what the Heartland cares most about. Even more than competence. This is what citizens of every state care most about. Stuff! Sometimes they even confuse it with the concept of "responsibility."

The upshot is that if we on the Left want to reach these people, we need to promise them more money and give them goodies. That means we're in trouble. We can promise the poor sufficience. The moderately well off can keep their stuff. The rich? We'll debate that later. But more? More material is not sustainable. No.

It is absolutely astounding how many of our fellow citizens spend all or most of their time obtaining, storing, cleaning, maintaining, insuring and displaying material goods. These are citizens we are not going to reach with messages on the environment, education, poverty, justice, civil liberties, women's rights, workers' rights, geopolitical balance, health care, or any of the other issues that matter and that the Radical Right is screwing up. Why? Because these citizens think all this noise is just an excuse to get them to give up some of their stuff.

That, or because they can't hear us. They're at the goddam mall getting more stuff or exchanging this stuff for that stuff.

There's a line called "object referral" in Hindu thought which says people will identify who they are by the things they own. A BMW owner is better than a Ford owner. Who are you? I'm a BMW owner. And driver. I live in a house in Sahalee. I'm an Ipod user. I'm a boat owner. I show horses. New shoes? Yes. You like them? Etc., etc. Who they really are is another discussion, but be sure, a person is not any aspect of a material thing through the mechanism of ownership.

Studies have shown that when it comes to material possessions and happiness, it is not the absolute level of possessions that contributes to subjective measures of happiness, it is the relative level. So if your mud hut has a better roof than your neighbor's, you are just as happy as if your garage has a BMW and Jim has to park his Jetta on the street.

Even the boys from the Black Hills tend to look at your pickup before they look at your face. The assembly of things in the shed often seems analogous to the phalanx of servants at the door in an earlier age.

But I ascribe virtue to myself where there is simply a missed gene. I have never understood the fever for stuff. Just like I never got disco, or even the Stones. I take some heart that the most gifted economist of the 20th century John Maynard Keynes did not have a material view of the world either, or an academic one, for that matter. According to Joan Robinson, another first-tier economist, Keynes had an aesthetic view of economies. Poverty was ugly. Unemployment was stupid.

My cousin said to me, "You keep right on with that political B.S., Al. I got business to take care of. But thanks for watching my back."

What he meant, I'm not sure. I have the image of watching the back of an ostrich. Ten years from now if he looks up and sees things are not like what he expected, he is going to get very excited. Is he going to have the wit to blame the right party, or will he just pick the closest one?

Saturday, March 11, 2006

Fudging the numbers, scripting the happy talk

Available today at this link is an interview with John Williams, a Republican kind of guy and an economist who has been tracking how government statistics have diverged from reality over time. His Shadow Government Statistics project displays a much different economy than the official figures, an economy more like the one you and I experience. The cherry picking of numbers I razzed EPI about last week is a sneeze to the finagling of officials' hurricane.

Inflation, for example, is systematically understated, and has been since the early 1990s. Williams estimates about 2.7% should be added to official inflation figures to compensate for dubious statistical tricks. The consumer price index (CPI) should be at 7%, rather than the official 4%. Particularly annoying to Williams is the geometric weighting of the CPI, a scheme devised by Alan Greenspan and George I's chief economist Michael Boskin, and later incorporated into official numbers under Bill Clinton.

Inflation was previously measured by checking the price of a fixed "basket" of goods from one period to the next, a collection of goods such as might be purchased by an average consumer. Under the Greenspan/Boskin scheme, the substitution effect was incorporated. The idea is when steak gets too expensive, people will substitute hamburger, so hamburger instead of steak should be in the basket. The price of the basket with hamburger is, of course, not so expensive as the basket with steak, so inflation does not rise so much. In other words, the CPI has become the price rise of a deteriorating standard of living.

Other clever means of suppressing inflation include "hedonics," from the same root as hedonism, which allows products which have improved in quality – say a washer with electronic controls as opposed to twist dials – to be valued at a lower price. The theory is they are not perfectly comparable.

Williams dismisses out of hand any claim to legitimacy such machinations have, but he says the exercise was not primarily to amuse voters around election time, though this was definitely a welcome adjunct. No, the real intent was to reduce the payments and obligation sunder Social Security, since these are tied to the CPI. And it has done that. Williams suggests that if all the tricks and their cumulative effects were reversed, payments to Social Security recipients would be 43% higher.

Equally insidious, however, is the tendency of this operation to overstate economic growth. The most popular economic measurement is the growth of real GDP, real meaning inflation-adjusted. If inflation is understated, real GDP is overstated. (Maybe you just count the "for rent" and "for sale" signs.)

By Williams calculations, the economy is on the verge of the second part of a double dip recession, and may already be in contraction. Inflation is 7%. And unemployment – as measured by the formula of the Depression years – is running at 12%.

In some parts, maybe he is over the top. Using accrual accounting for Social Security is not particularly apt. But Williams adjustments do make the numbers and the experience of the average working person come into the same picture.

Inflation, for example, is systematically understated, and has been since the early 1990s. Williams estimates about 2.7% should be added to official inflation figures to compensate for dubious statistical tricks. The consumer price index (CPI) should be at 7%, rather than the official 4%. Particularly annoying to Williams is the geometric weighting of the CPI, a scheme devised by Alan Greenspan and George I's chief economist Michael Boskin, and later incorporated into official numbers under Bill Clinton.

Inflation was previously measured by checking the price of a fixed "basket" of goods from one period to the next, a collection of goods such as might be purchased by an average consumer. Under the Greenspan/Boskin scheme, the substitution effect was incorporated. The idea is when steak gets too expensive, people will substitute hamburger, so hamburger instead of steak should be in the basket. The price of the basket with hamburger is, of course, not so expensive as the basket with steak, so inflation does not rise so much. In other words, the CPI has become the price rise of a deteriorating standard of living.

Other clever means of suppressing inflation include "hedonics," from the same root as hedonism, which allows products which have improved in quality – say a washer with electronic controls as opposed to twist dials – to be valued at a lower price. The theory is they are not perfectly comparable.

Williams dismisses out of hand any claim to legitimacy such machinations have, but he says the exercise was not primarily to amuse voters around election time, though this was definitely a welcome adjunct. No, the real intent was to reduce the payments and obligation sunder Social Security, since these are tied to the CPI. And it has done that. Williams suggests that if all the tricks and their cumulative effects were reversed, payments to Social Security recipients would be 43% higher.

Equally insidious, however, is the tendency of this operation to overstate economic growth. The most popular economic measurement is the growth of real GDP, real meaning inflation-adjusted. If inflation is understated, real GDP is overstated. (Maybe you just count the "for rent" and "for sale" signs.)

By Williams calculations, the economy is on the verge of the second part of a double dip recession, and may already be in contraction. Inflation is 7%. And unemployment – as measured by the formula of the Depression years – is running at 12%.

In some parts, maybe he is over the top. Using accrual accounting for Social Security is not particularly apt. But Williams adjustments do make the numbers and the experience of the average working person come into the same picture.

Friday, March 10, 2006

Tacoma Taxk Force Underway

Tacoma's Revenue Task Force is accelerating rapidly. We may not be going very fast yet, but considering we started at zero mph, the acceleration is great.

The City Services Tax Task Force was nominally created by the city council, but more by the effort of new city manager Eric Anderson. He wasn't on the job six months before he recognized the long-term squeeze Tim Eyman and the rest of the deadbeat dads have put on the city's revenue.

At our first meeting we introduced ourselves and listened to the Finance Director and pretended we knew what we were supposed to be doing. At the second we heard from Anderson and got some of our own ideas on the table.

Anderson carried in from Iowa and Illinois an idea of spreading the cost of basic city services – police and fire – to all those who benefit. Seemingly an admirable sentiment, except when those free riders are powerful nonprofits like hospitals and private universities. In an earlier life, it had been Northwestern University. Anderson tried to enact a tuition tax, and "it took four days for the legislature to pass a bill outlawing the idea."

In Tacoma, it's the University of Puget Sound and the hospitals surrounding Wright Park. Two people from UPS are on the task force, David Droge, a professor in small group dynamics and task force chair, and John Hickey, from the business office. Nonprofits have two representatives as well, Liz Heath and Mike Renner.

Anyway, Anderson's idea of extending taxation to nonprofits is going to get a severe review. (Prior to our meeting with Anderson last week we were set to see a video on property tax. The television showed a few seconds of the news as the video was being cued. The image was of the effigy of somebody, maybe George Bush, in flames. "That's part of our video," Anderson said. "Right after my last meeting with the nonprofits.")

To me, anyway, the key is not the nonprofits, although the idea of taxing them is certainly the issue arousing the most heated debate. The big ones can afford to help the city out. The little ones we can let go. There's not enough revenue there to make it worth trying to collect anyway.

The key is Anderson's idea of using the property tax as the vehicle. At the outset, we need the okay of the legislature to tax the property of nonprofits. It's allowed, but only to fire districts. Then he proposes abandoning the city's B&O, abandoning the city's 1% of the sales tax, and expanding the property base by the holdings of the nonprofits. This new base would be responsible for perhaps 75% of the city's general fund expenditures. Since right now the property tax is only about one-fifth of revenues, even if nonprofits expand the base 30 percent as Anderson estimates, the shift of the load means a bump up in the rate of 2.3x.

Billing monthly is part of the plan, and that would take away some of the sting, but not enough to get by the voters, I'm afraid. And it will need to go past the voters, not only at the beginning, but periodically. That's the last part of the scheme, to submit increases to a "city services referendum" periodically to the voters, allowing them to choose whether they want the services or the few dollars a month they'd save.

There are two other major troubles connected to a big shift to a property tax base. First, the size of the increase would mean a renegotiation of tens of thousands of private contracts between landlords and tenants. Not a happy event for either party. Second, the property tax is not exportable. Tacoma residents traveling to Seattle to shop leave a little in the kitty in the form of the sales tax. Seattle residents in Tacoma should return the favor. Likewise, the B&O tax is collected from businesses operating in the city, whether or not they have property here. The property tax, by contrast, is paid almost exclusively by Tacoma.

I have an alternative based on using both the B&O and property taxes which retains the advantages of transparency and accountability from the Anderson proposal. I'll post it or a link to it after I submit it to the group next week.

One good thing, we changed the name from the City Services Tax Task Force to the Revenue Task Force. Try saying City Services Tax Task Force.

The City Services Tax Task Force was nominally created by the city council, but more by the effort of new city manager Eric Anderson. He wasn't on the job six months before he recognized the long-term squeeze Tim Eyman and the rest of the deadbeat dads have put on the city's revenue.

At our first meeting we introduced ourselves and listened to the Finance Director and pretended we knew what we were supposed to be doing. At the second we heard from Anderson and got some of our own ideas on the table.

Anderson carried in from Iowa and Illinois an idea of spreading the cost of basic city services – police and fire – to all those who benefit. Seemingly an admirable sentiment, except when those free riders are powerful nonprofits like hospitals and private universities. In an earlier life, it had been Northwestern University. Anderson tried to enact a tuition tax, and "it took four days for the legislature to pass a bill outlawing the idea."

In Tacoma, it's the University of Puget Sound and the hospitals surrounding Wright Park. Two people from UPS are on the task force, David Droge, a professor in small group dynamics and task force chair, and John Hickey, from the business office. Nonprofits have two representatives as well, Liz Heath and Mike Renner.