Get a Grip: Austerity Does Not Produce Prosperity

Robert Kuttner

May 23, 2010

Austerity has suddenly become the universally prescribed cure for the fallout from the financial collapse. If widely adopted, it will prove worse than the disease.

The price of the rescues of Greece, Spain and Portugal is to be brutal deflation. The International Monetary Fund, which supposedly learned from its earlier mistakes of imposing austerity on already damaged economies, is back in cold-bath mode, demanding higher taxes and dramatically reduced spending as its pound of flesh.

The European Central Bank and key leaders of the E.U. are promoting economic pain as the price of relief. Here at home, President Obama has sworn off serious new outlays for jobs or aid to the states, and is using his fiscal commission to pursue a bipartisan consensus on spending cuts and higher taxes.

The nations of the European Union are being treated as the object lesson in the costs of profligacy. This is supposedly what happens when you provide decent social benefits to regular people. In fact, most of Europe had reasonably well-disciplined budgets until a made-on-Wall-Street economic crisis took down their economies.

The budget deficit here and overseas does need to return to a more moderate level -- after we get an economic recovery. But the problem with the austerity treatment during a recession is that if everyone tightens their belts at once, there is nobody to buy the products; the economy shrinks and repayment of debt is even more arduous. As John Maynard Keynes famously wrote, "The patient does not need rest. He needs exercise."

You don't have to be a Keynesian to recognize that the economics of belt-tightening is a fool's errand in a recession.

With the exception of a few smaller nations, the large deficits in the OECD countries are not the result of fiscal profligacy, but of revenue losses caused by the downturn. And in the case of Greece, supposedly the poster child for profligacy, the new Socialist Papandreou government is having to clean up after the fiscal finagling of its conservative predecessor. Greece certainly needs tax reform to make sure that so many of its very wealthy do not hide their assets. It does not need general austerity.

The US has been spared this phase of the crisis so far, because the Federal Reserve has been willing to be buyer of last resort of all manner of securities, including government debt. This remedy is far from ideal, and it needs to be wound down as soon as recovery comes, as well as combined with structural reforms. But the Fed rescue certainly beats a total collapse

In Europe, by contrast, this rescue act is far more difficult politically and institutionally. Sovereignty is divided along nations pursuing their own self-interests, a fledgling E.U. and a central bank that lacks either the Fed's full powers, its history, or its self-confidence.

But Europe had better come through this test as a more unified and politically effective system or we will all suffer. This is no time for skeptics of the Euro or the E.U. to be gloating.

In fact, the Germans and the French have put their self-interest aside, and have pushed for a rescue plan that prevents default on government bonds and benefits Europe's less affluent nations. With aid to Greece monumentally unpopular, German Chancellor Angela Merkel was willing to lose a key state election in order to prevent a Euro collapse This statesmanship is admirable -- but the austerity demands are not.

The current global economic crisis, now entering a new phase as a crisis of sovereign debt, has only one rough precedent. The last time major nations (such as Germany, its European creditors, and much of Latin America) faced insolvency, the combination of financial collapse and deflation helped create depression, dictatorship, and then World War II.

In the US, we finally ended the Great Depression with massive wartime borrowing and public outlay. We ended the war with a debt-to-GDP ratio of more than 120 percent, more than double today's ratio. In Britain, debt-to-GDP peaked at about 250 percent.

But all of the war spending recapitalized industry, re-employed and trained jobless workers; and after the war pent up consumer demand powered a record boom and rising revenues paid down the debt.

There was plenty of wartime sacrifice, but it was shared. Citizens bought war bonds and used ration books. There were wage and price controls. Surtaxes on high incomes were over 90 percent. Interest rates were administered through a deal between the Treasury and the Fed, and the war debt was financed with cheap money. Inflation rose slightly after the war, but was manageable. And thanks to the deferred demand and careful economic management of the war years, peacetime conversion brought not a recession but a boom.

Today's situation is different. The origin of all the debt is not a war but a financial collapse. The new round of financial panic is the result of still fearful markets, a still fragile banking system, and deficits caused mainly by reduced output, not overspending.

In this context, it is insane to think that we can recover from a financial panic and an economic recession by inducing a worse recession in the name of fiscal soundness. For now, while the real economy heals, there is no substitute for aggressive central bank intervention to restore markets in sovereign debt. The right grand bargain is tough financial reform and limits on Wall Street--so that this crisis is never repeated. The wrong grand bargain is austerity for everyone else.

A low volume, high quality source from the demand side perspective.The podcast is produced weekly. A transcript is posted on the day of.

Monday, May 31, 2010

Robert Kuttner bemoans austerity as the road to ruin in Europe

The current global economic crisis, now entering a new phase as a crisis of sovereign debt, has only one rough precedent. The last time major nations (such as Germany, its European creditors, and much of Latin America) faced insolvency, the combination of financial collapse and deflation helped create depression, dictatorship, and then World War II.

Sunday, May 30, 2010

Dean Baker and J.M. Keynes point 180 degrees from the current course

The problem is aggregate demand, not government deficits.

Politicians ignore Keynes at their peril

Dean Baker

The Guardian

May 17, 2010

Deficit reduction is a big mistake when unemployment is high, as anyone familiar with the basics of economic theory can tell you.

John Maynard Keynes explained the dynamics of an economy in a prolonged period of high unemployment more than 70 years ago in The General Theory. Unfortunately, it seems very few people in policymaking positions in the United States or Europe have heard of the book. Otherwise, they would be pushing economic policy in the exact opposite direction than it is currently heading.

Most wealthy countries have now made deficit reduction the primary focus of their economic policy. Even though the US and many eurozone countries are projected to be flirting with double-digit unemployment for years to come, their governments will be focused on cutting deficits rather than boosting the economy and creating jobs.

The outcome of this story is not pretty. Cutting deficits means raising taxes and/or cutting spending. In either case, it means pulling money out of the economy at a time when it is already well below full employment. This can lower deficits, but it also means lower GDP and higher unemployment.

This might be OK if we could show some benefit from lower deficits, but this is a case of pain with no gain. Ostensibly, there will be a lower interest-rate burden in future years, but even this is questionable. First, the contractionary policy being pursued by the deficit hawks will slow growth and lead to lower inflation or possibly even deflation. It is entirely possible that the debt-to-GDP ratio may actually end up higher by following their policies than by pursuing more expansionary policy.

In other words, we may end up with smaller deficits and therefore accumulate less debt, but we may slow GDP growth even more. The burden of the debt depends on the size of the economy and in the scenario where we do more to slow GDP growth than the growth of the debt, then we end up with a higher interest-rate burden, not a lower one.

The other reason why we may not end up with a lower interest rate-burden is that we need not issue debt to finance the budget deficits. Countries such as the United States and the United Kingdom that control their central banks can simply have the central banks buy up the bonds used to finance the deficits. In this story, the interest payments on the bonds are paid to the central bank, which is in turn refunded to the government. This means that there is no interest-burden created by these deficits.

If that sounds impossible, then it's necessary to pick up Keynes again. The economies of Europe and the United States are not suffering from scarcity right now. They are suffering from inadequate demand. This means that if governments run deficits, and thereby expand demand, the economy has the capacity to fill this demand. The decision of central banks to expand the money supply by buying bonds simply leads to an increase in output, not to inflation.

The idea that there is a direct link between the money supply and inflation is absurd. Do any businesses raise their prices because the Fed has put money into circulation? How many businesses even have a clue as to how much money is in circulation? In the real world, prices are set by supply and demand. If any businesses tried to raise their prices just because the Fed has put more money into circulation they would soon find themselves wiped out by the competition – at least as long as we are in this situation of having enormous excess supply.

This story should be old hat to those who have studied Keynes. In a period of high unemployment, like the present, governments can literally just print money. Not only will this put people back to work, this process can also lay the basis for stronger growth in the future by creating better infrastructure, more energy-efficient buildings, supporting research and development of clean energy and improving the education of our children.

Unfortunately, our political leaders don't give a damn about mundane issues such as unemployment and economic growth. It is far easier for them to bandy about silly cliches about fiscal responsibility and generational equity, even though the policies they are pushing are 180 degrees at odds with anything that will help our children or grandchildren. Their main concern is pushing policies that keep the financial industry happy. And 10 million unemployed never bothered anyone at Goldman Sachs, just ask Fabulous Fabio.

Saturday, May 29, 2010

A short interview with James K. Galbraith on the deficit, real problems, and fake ones

At Demand Side we have argued that reducing the deficit by taxing the rich and financial transactions is an effective way of reducing the deficit and allowing the economy to move into a government investment phase. Below, James K. Galbraith suggests there is no danger from the deficit, so we should ignore it and get to the work at hand right away.

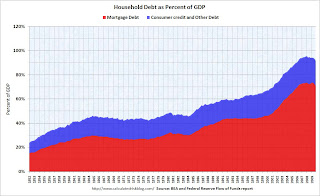

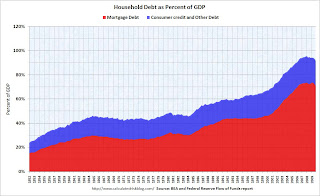

Our positions are not so far apart. We believe at least a fig leaf of fiscal responsibility is needed for political support for big new government investing and that taxing the rich and financial transactions would reduce a lot of what is harmful in the incentive structure of the economy. We most completely converge on the point that the long-term deficit of the government is a problem of negligible dimensions, but that the immense private debt -- mortgage debt of households, in particular -- is a serious drain on the economy.

Inflation will arise with investment. We've talked that to death. But such inflation poses no danger to the deficit. The danger lies in, as Galbraith says, focusing on fake problems rather than real ones.

Our positions are not so far apart. We believe at least a fig leaf of fiscal responsibility is needed for political support for big new government investing and that taxing the rich and financial transactions would reduce a lot of what is harmful in the incentive structure of the economy. We most completely converge on the point that the long-term deficit of the government is a problem of negligible dimensions, but that the immense private debt -- mortgage debt of households, in particular -- is a serious drain on the economy.

Inflation will arise with investment. We've talked that to death. But such inflation poses no danger to the deficit. The danger lies in, as Galbraith says, focusing on fake problems rather than real ones.

Galbraith: The danger posed by the deficit ‘is zero’

James K. Galbraith interviewed by Ezra Klein

Washington Post

EK: You think the danger posed by the long-term deficit is overstated by most economists and economic commentators.

JG: No, I think the danger is zero. It's not overstated. It's completely misstated.

EK: Why?

JG: What is the nature of the danger? The only possible answer is that this larger deficit would cause a rise in the interest rate. Well, if the markets thought that was a serious risk, the rate on 20-year treasury bonds wouldn't be 4 percent and change now. If the markets thought that the interest rate would be forced up by funding difficulties 10 year from now, it would show up in the 20-year rate. That rate has actually been coming down in the wake of the European crisis.

So there are two possibilities here. One is the theory is wrong. The other is that the market isn't rational. And if the market isn't rational, there's no point in designing policy to accommodate the markets because you can't accommodate an irrational entity.

EK: Then why are the bulk of your colleagues so worried about this?

JG: Let's push a bit deeper on the CBO forecasts. They publish a baseline set of projections. One of those projections holds the economy will return to a normal high-employment level with low inflation over the next 10 years. If true, that would be wonderful news. Go down a few lines and they also have the short-term interest rate going up to 5 percent. It's that short-term interest rate combined with that low inflation rate that allows them to generate, quite mechanically, these enormous future deficit forecasts. And those forecasts are driven partially by the assumption that health-care costs will rise forever at a faster rate than everything else and by interest payments on the debt will hit 20 or 25 percent of GDP.

At this point, the whole thing is completely incoherent. You cannot write checks to 20 percent to anybody without that money entering the economy and increasing employment and inflation. And if it does that, then debt-to-GDP has to be lower, because inflation figures into how much debt we have. These numbers need to come together in a coherent story, and the CBO's forecast does not give us a coherent story. So everything that is said that is based on the CBO's baseline is, strictly speaking, nonsense.

EK: But couldn't there be a space between the CBO being totally correct and the debt not being a problem? It seems certain, for instance, that health-care costs will continue to rise faster than other sectors of the economy.

JG: No, it's not reasonable. Share of health-care cost would rise as part of total GDP and the inflation would rise to be nearer to what the rate of health-care inflation is. And if health care does get that expensive, and we're paying 30 percent of GDP while everyone else is paying 12 percent, we could buy Paris and all the doctors and just move our elderly there.

EK: But putting inflation aside, the gap between spending and revenues won't have other ill effects?

JG: Is there any terrible consequence because we haven't prefunded the defense budget? No. There's only one budget and one borrowing authority and all that matters is what that authority pays. Say I'm the federal government and I wish to pay you, Ezra Klein, a billion dollars to build an aircraft carrier. I put money in your bank account for that. Did the Federal Reserve look into that? Did the IRS sign off on it? Government does not need money to spend just as a bowling alley does not run out of points.

What people worry about is that the federal government won't be able to sell bonds. But there can never be a problem for the federal government selling bonds. It goes the other way. The government's spending creates the bank's demand for bonds, because they want a higher return on the money that the government is putting into the economy. My father said this process is so simple that the mind recoils from it.

EK: What are the policy implications of this view?

JG: It says that we should be focusing on real problems and not fake ones. We have serious problems. Unemployment is at 10 percent. if we got busy and worked out things for the unemployed to do, we'd be much better off. And we can certainly afford it. We have an impending energy crisis and a climate crisis. We could spend a generation fixing those problems in a way that would rebuild our country, too. On the tax side, what you want to do is reverse the burden on working people. Since the beginning of the crisis, I've supported a payroll tax holiday so everyone gets an increase in their after-tax earnings so they can pay down their mortgages, which would be a good thing. You also want to encourage rich people to recycle their money, which is why I support the estate tax, which has accounted for an enormous number of our great universities and nonprofits and philanthropic organizations. That's one difference between us and Europe.

EK: That does it for my questions, I think.

JG: I have one more answer, though! Since the 1790s, how often has the federal government not run a deficit? Six short periods, all leading to recession. Why? Because the government needs to run a deficit, it's the only way to inject financial resources into the economy. If you're not running a deficit, it's draining the pockets of the private sector. I was at a meeting in Cambridge last month where the managing director of the IMF said he was against deficits but in favor of saving, but they're exactly the same thing! A government deficit means more money in private pockets.

The way people suggest they can cut spending without cutting activity is completely fallacious. This is appalling in Europe right now. The Greeks are being asked to cut 10 percent from spending in a few years. And the assumption is that this won't affect GDP. But of course it will! It will cut at least 10 percent! And so they won't have the tax collections to fund the new lower level of spending. Spain was forced to make the same announcement yesterday. So the Eurozone is going down the tubes.

On the other hand, look at Japan. They've had enormous deficits ever since the crash in 1988. What's been the interest rate on government bonds ever since? It's zero! They've had no problem funding themselves. The best asset to own in Japan is cash, because the price level is falling. It gets you 4 percent return. The idea that funding difficulties are driven by deficits is an argument backed by a very powerful metaphor, but not much in the way of fact, theory or current experience.

Friday, May 28, 2010

Transcript 387: Black holes in financial regulation — too big to fail, derivatives

Listen to this episode

Today on the podcast,

What did financial regulation not do? Forecast Friday with Nouriel Roubini. A Look at markets. And the recurring Demand Side solution with some help from Irving Fisher.

On recent regulation

Many, particularly some in the Obama administration, have applauded the provisions of the new financial sector regulation passed by the Senate last week. No doubt positive is the financial product safety commission, whatever its title and location, that threatens to return some structure and order to financial products shopped to consumers. But there are a couple of holes, black holes, that mean as a remedy for future crisis, this legislation does not have the strength attributed to it.

CANTWELL

That was Maria Cantwell, Senator of Washington State, speaking on the Senate Floor. Cantwell and Russ Feingold were the two Democrats to vote No on the Senate bill. Here is Nouriel Roubini, talking about the other essential that was missed. Too big to fail.

ROUBINI

Nouriel Roubini

Indeed, getting a grip on the derivatives, breaking up the big banks, and shaking some sense into the economics profession might give us a chance against the upcoming crises. Sadly, that was not done in response to the current downturn. Maybe the next one will be big enough.

Elsewhere in this London Telegraph interview, Roubini was adamant that the great recession is not over. But a temporary economic pick-up, which would convince governments that reform is unnecessary, could bring its own problems.

Which is a good segue into the Forecast portion of Friday's podcast

Two things we noted from a recent ECRI chart: One: the recession shading has mysteriously swept past June 31, 2009, the shading we remember from the last ECRI chart we saw, and into the present. This is a period that includes the Anapurna of spikes of ECRI leading indicators into positive territory. And two: we remember sidling over to the great flock of economists on the NO RECESSION side of the boat in January 2008 to see what they were smoking. They were looking at the ECRI leading indicators which were still in positive territory at the outset of 2008. Edward Harrison of Credit Writedowns responded to our raising this point by saying you have to look at the second derivatives. Maybe. But Lakshman Achuthan of ECRI was talking about the possible recession ahead in January 2008, three months after its onset.

The recession shading is correct, in any event.

Read more: http://www.creditwritedowns.com/2010/05/ecri-leading-economic-index-at-42-week-low-recovery-is-already-fading.html#ixzz0oyHmnaCK

As to the timing of the second dip, David Rosenberg put out another list of ten, pointing out that ECRI's leading index has peaked, as have the Conference Board's leading economic indicators (in March), the ISM orders to inventory ratio (in August 2009), the University of Michigan's consumer expectations (In September 2009), the U of M's index of big ticket consumer purchases (in February-March), Single family building permits (in March), Mortgage purchase applications (April 30 and now down to a 13-year low even though mortgage rates have come down), Auto production (in January) and electrical utility output was down 0.1% YOY as of May 15.

The Markets: As we record this, the Dow is back above ten thousand and oil is continuing to rebound, from a low last week of below 69 to now above 74.

But here from a Marketwatch podcast, we find someone on Wall Street has been reading George Soros.

JIM PAULSON

That's Jim Paulson. Who has a positive spin in the remainder of his comments which we excise for our purposes here. Indeed, financial markets have been operating in a virtual environment for a long time now. Their punching and kicking is hurting real people out here. Hard to know what they're seeing behind the headsets.

Now finally, and more briefly than we had planned, the two steps to economic recovery, assisted by Irving Fisher

DEBT DEFLATION AND THE WAY OUT

"Debt deflation" is the brainchild of Irving Fisher, who -- writing in the 1930s -- sounds a lot more coherent than most economists today. One might think it is an odd name, since it is not debt that deflates, but asset prices. The term should have a hyphen. It's two primary explanatory events for depressions are, first, an outsized level of debt, which is then followed by deflation and the deflationary spiral.

Perhaps it is worth quoting Fisher for a moment.

It is investment in productive assets that generate cash flow in the private sector which can be tapped to cover debt service. Thus if these are safe, hedge financial structures. Such structures cannot contribute directly to the liquidation, further deflation and bankruptcy spiral that leads down, since there is no need to sell an asset whose debt service is accounted for. Selling assets to cover debt payments is needed only in Ponzi and speculative situations, recognizing that deflation may turn previously safe hedge positions into speculative positions by reducing the cash flows.

This was all spelled out in Fisher and in the work of Hyman Minsky. Note, however, that the ability of the public sector to invest was as foreign to Minsky as to most economics. It is our contention at Demand Side that the government investments can accrue benefits to the public sector that can be tapped to cover the debt service. Avoiding the worst events of global warming, for example, is a positive economic and financial benefit that needs only honest accounting to be available to capture for debt service.

One feature of successful recoveries from recession in the postwar period is inflation. The Fed has typically eased monetary policy, and the authorities have traditionally backstopped and bailed out financial innovation creating easy money for investors, which has created inflation.

(That, we would argue, and the actual investment.) This inflation has effectively reduced the debt burden by reducing the real value of the debt.

As Minsky points out, nominal values matter. Debt is a contract typically described in nominal dollars. If the price level goes up and the contracted debt price remains the same, the debt is easier to service. It is messy and people do get hurt in inflations, but the economy recovers.

In a condition of debt deflation, or balance sheet recession, when inflation cannot be ignited even with every dollar the Fed can print because people won't or can't borrow it for legitimate investment, debt must be written down as asset prices deflate.

It is the Demand Side view that absent an inflation response to central bank efforts, mechanisms to write down the debt contract can abort debt deflation in the context of investment by the public sector. Thus in the 1930's the Home Owners Loan Corporation facilitated direct negotiations between mortgage holders and lenders to do just that, write down the nominal value of the loan. Debt restructuring by firms or governments is sometimes called "default," because the original contract is abrogated. But it is nothing more than this negotiation between borrower and lender to put the contract into the context of the value of the assets in question.

Writing down the debt repairs the balance sheet in a straightforward way, not by siphoning off cash flow for a decade or more as in the case of Japan. If these returns to capitalists are given a haircut, there is no reason not to do the same with the profits side. In this way, balance is maintained and Kalecki's and Minsky's famous equation deficits plus investment equal profits is maintained without reducing the investment. Reduce profits -- by which Minsky meant more than just the top line return to owners and managers -- and you reduce deficits. This is not a moral argument to tax the rich, but a logical program to support government investment without damaging the economy, recognizing the deflation of asset values in a constructive way.

We are looking at total debt levels to GDP massively exceeding those of any other period in modern history, counting both private and public debt. We are not going to plug all the holes in the dike. Even if we do, the wall of water will only get bigger. A methodical and fair restructuring strategy will cause the financial sector to hyperventillate, but if they knew what was good for them, they would throw in with the rest of us. As it is, they have redefined risk as the bill you send to the government.

Here is worth remembering Fisher again, who offered the example of a stick, which may bend under strain, ready all the time to bend back, until a certain point is reached, when it breaks. Quoting "This simile probably applies when a debtor gets 'broke,' or when the breaking of many debtors constitutes a 'crash,' after which there is no coming back to the original equilibrium." Fisher offers another simile, quoting "such a disaster is somewhat like the 'capsizing' of a ship, which under ordinary conditions, is always near stable equilibrium, but which, after being tipped beyond a certain angle, has no longer this tendency to return to equilibrium, but instead a tendency to depart further from it."

Where are we now?

Today on the podcast,

What did financial regulation not do? Forecast Friday with Nouriel Roubini. A Look at markets. And the recurring Demand Side solution with some help from Irving Fisher.

On recent regulation

Many, particularly some in the Obama administration, have applauded the provisions of the new financial sector regulation passed by the Senate last week. No doubt positive is the financial product safety commission, whatever its title and location, that threatens to return some structure and order to financial products shopped to consumers. But there are a couple of holes, black holes, that mean as a remedy for future crisis, this legislation does not have the strength attributed to it.

CANTWELL

That was Maria Cantwell, Senator of Washington State, speaking on the Senate Floor. Cantwell and Russ Feingold were the two Democrats to vote No on the Senate bill. Here is Nouriel Roubini, talking about the other essential that was missed. Too big to fail.

ROUBINI

Nouriel Roubini

Indeed, getting a grip on the derivatives, breaking up the big banks, and shaking some sense into the economics profession might give us a chance against the upcoming crises. Sadly, that was not done in response to the current downturn. Maybe the next one will be big enough.

Elsewhere in this London Telegraph interview, Roubini was adamant that the great recession is not over. But a temporary economic pick-up, which would convince governments that reform is unnecessary, could bring its own problems.

Which is a good segue into the Forecast portion of Friday's podcast

Two things we noted from a recent ECRI chart: One: the recession shading has mysteriously swept past June 31, 2009, the shading we remember from the last ECRI chart we saw, and into the present. This is a period that includes the Anapurna of spikes of ECRI leading indicators into positive territory. And two: we remember sidling over to the great flock of economists on the NO RECESSION side of the boat in January 2008 to see what they were smoking. They were looking at the ECRI leading indicators which were still in positive territory at the outset of 2008. Edward Harrison of Credit Writedowns responded to our raising this point by saying you have to look at the second derivatives. Maybe. But Lakshman Achuthan of ECRI was talking about the possible recession ahead in January 2008, three months after its onset.

The recession shading is correct, in any event.

Read more: http://www.creditwritedowns.com/2010/05/ecri-leading-economic-index-at-42-week-low-recovery-is-already-fading.html#ixzz0oyHmnaCK

As to the timing of the second dip, David Rosenberg put out another list of ten, pointing out that ECRI's leading index has peaked, as have the Conference Board's leading economic indicators (in March), the ISM orders to inventory ratio (in August 2009), the University of Michigan's consumer expectations (In September 2009), the U of M's index of big ticket consumer purchases (in February-March), Single family building permits (in March), Mortgage purchase applications (April 30 and now down to a 13-year low even though mortgage rates have come down), Auto production (in January) and electrical utility output was down 0.1% YOY as of May 15.

In the week ending May 22, the advance figure for seasonally adjusted initial claims was 460,000, a decrease of 14,000 from the previous week's revised figure. The 4-week moving average was 456,500, an increase of 2,250 from the previous week's revised average.

The current level of 460,000 (and 4-week average of 456,500) is still high, and suggests ongoing weakness in the labor market. The 4-week average has been moving sideways for almost five months. This in the context of the strongest quarter to be expected from the stimulus bill, as gauged by the nonpartisan CBO

The Markets: As we record this, the Dow is back above ten thousand and oil is continuing to rebound, from a low last week of below 69 to now above 74.

But here from a Marketwatch podcast, we find someone on Wall Street has been reading George Soros.

JIM PAULSON

That's Jim Paulson. Who has a positive spin in the remainder of his comments which we excise for our purposes here. Indeed, financial markets have been operating in a virtual environment for a long time now. Their punching and kicking is hurting real people out here. Hard to know what they're seeing behind the headsets.

Now finally, and more briefly than we had planned, the two steps to economic recovery, assisted by Irving Fisher

DEBT DEFLATION AND THE WAY OUT

"Debt deflation" is the brainchild of Irving Fisher, who -- writing in the 1930s -- sounds a lot more coherent than most economists today. One might think it is an odd name, since it is not debt that deflates, but asset prices. The term should have a hyphen. It's two primary explanatory events for depressions are, first, an outsized level of debt, which is then followed by deflation and the deflationary spiral.

Perhaps it is worth quoting Fisher for a moment.

... These two economic maladies, the debt disease and the price-level disease (or dollar disease), are, in the great booms and depressions, more important causes than all others put together.

Some of the other and usually minor factors often derive some importance when combined with one or both of the two dominant factors. Thus over-investment and over-speculation are often important; but they would have far less serious results were they not conducted with borrowed money. That is, over-indebtedness may lend importance to over-investment or to over-speculation.

The same is true as to over-confidence. I fancy that over-confidence seldom does any great harm except when, as, and if, it beguiles its victims into debt.

...

Disturbances in these two factors -- debt and the purchasing power of the monetary unit -- will set up serious disturbances in all, or nearly all, other economic variables. On the other hand, if debt and deflation are absent, other disturbances are powerless to bring on crises comparable in severity to those of 1837, 1873, or 1929-33."

It is investment in productive assets that generate cash flow in the private sector which can be tapped to cover debt service. Thus if these are safe, hedge financial structures. Such structures cannot contribute directly to the liquidation, further deflation and bankruptcy spiral that leads down, since there is no need to sell an asset whose debt service is accounted for. Selling assets to cover debt payments is needed only in Ponzi and speculative situations, recognizing that deflation may turn previously safe hedge positions into speculative positions by reducing the cash flows.

This was all spelled out in Fisher and in the work of Hyman Minsky. Note, however, that the ability of the public sector to invest was as foreign to Minsky as to most economics. It is our contention at Demand Side that the government investments can accrue benefits to the public sector that can be tapped to cover the debt service. Avoiding the worst events of global warming, for example, is a positive economic and financial benefit that needs only honest accounting to be available to capture for debt service.

One feature of successful recoveries from recession in the postwar period is inflation. The Fed has typically eased monetary policy, and the authorities have traditionally backstopped and bailed out financial innovation creating easy money for investors, which has created inflation.

(That, we would argue, and the actual investment.) This inflation has effectively reduced the debt burden by reducing the real value of the debt.

As Minsky points out, nominal values matter. Debt is a contract typically described in nominal dollars. If the price level goes up and the contracted debt price remains the same, the debt is easier to service. It is messy and people do get hurt in inflations, but the economy recovers.

In a condition of debt deflation, or balance sheet recession, when inflation cannot be ignited even with every dollar the Fed can print because people won't or can't borrow it for legitimate investment, debt must be written down as asset prices deflate.

It is the Demand Side view that absent an inflation response to central bank efforts, mechanisms to write down the debt contract can abort debt deflation in the context of investment by the public sector. Thus in the 1930's the Home Owners Loan Corporation facilitated direct negotiations between mortgage holders and lenders to do just that, write down the nominal value of the loan. Debt restructuring by firms or governments is sometimes called "default," because the original contract is abrogated. But it is nothing more than this negotiation between borrower and lender to put the contract into the context of the value of the assets in question.

Writing down the debt repairs the balance sheet in a straightforward way, not by siphoning off cash flow for a decade or more as in the case of Japan. If these returns to capitalists are given a haircut, there is no reason not to do the same with the profits side. In this way, balance is maintained and Kalecki's and Minsky's famous equation deficits plus investment equal profits is maintained without reducing the investment. Reduce profits -- by which Minsky meant more than just the top line return to owners and managers -- and you reduce deficits. This is not a moral argument to tax the rich, but a logical program to support government investment without damaging the economy, recognizing the deflation of asset values in a constructive way.

We are looking at total debt levels to GDP massively exceeding those of any other period in modern history, counting both private and public debt. We are not going to plug all the holes in the dike. Even if we do, the wall of water will only get bigger. A methodical and fair restructuring strategy will cause the financial sector to hyperventillate, but if they knew what was good for them, they would throw in with the rest of us. As it is, they have redefined risk as the bill you send to the government.

Here is worth remembering Fisher again, who offered the example of a stick, which may bend under strain, ready all the time to bend back, until a certain point is reached, when it breaks. Quoting "This simile probably applies when a debtor gets 'broke,' or when the breaking of many debtors constitutes a 'crash,' after which there is no coming back to the original equilibrium." Fisher offers another simile, quoting "such a disaster is somewhat like the 'capsizing' of a ship, which under ordinary conditions, is always near stable equilibrium, but which, after being tipped beyond a certain angle, has no longer this tendency to return to equilibrium, but instead a tendency to depart further from it."

Where are we now?

Thursday, May 27, 2010

Simon Johnson and Peter Boone and economic reality deconstruct the Irish miracle

The Very Bad Luck of The Irish

By Peter Boone and Simon Johnson

Baseline Scenario

May 20, 2010

With the European Central Bank announcing that it has bought more than $20 billion of mostly high-risk euro zone government debt in one week, its new strategy is crystal clear: We will take the risk from bank balance sheets and give it to the central bank, and we expect Portugal-Ireland-Italy-Greece-Spain to cut fiscal spending sharply and pull themselves out of this mess through austerity.

But the bank’s head, Jean-Claude Trichet, faces a potential major issue: the task assigned to the profligate nations could be impossible. Some of these nations may be stuck in a downward debt spiral that makes greater economic decline ever more likely.

Prime Minister George Papandreou said this week that Greece needs to see strong investment in order for the austerity program to work. While the government cuts fiscal spending, he said, it needs new private business to employ the dismissed workers so that they are productive, can pay taxes and do not need unemployment benefits.

The problems are strikingly reminiscent of Latin America in the 1980s. Those nations borrowed too heavily in the 1970s (also, by the way, from big international banks) and then — in the face of tougher macroeconomic conditions in the United States — lost access to capital markets. For 10 years they were stuck with debt overhangs, just like the weak euro zone countries, which made it virtually impossible to grow.

Debt overhangs hurt growth for many reasons: business is nervous that taxes will go up in the near future, the cost of credit is high throughout society, and social turmoil looms because continued austere policies are needed to reduce the debt. Some Latin America countries lingered in limbo for a decade or more.

Mr. Trichet and Mr. Papandreou can look more closely at home to see what might soon be going wrong. Ireland was one of the first nations to introduce tough fiscal austerity in this cycle — in spring 2009 the government slashed public-sector spending and raised taxes. Despite the cuts, the European Commission forecasts that Ireland will have one of the highest budget deficits in the world at 11.7 percent of gross domestic product in 2010. The problem is clear: when you cut spending you also lose tax revenues from people who earned incomes from that money. Further, the newly unemployed seek benefits, so Ireland’s spending cuts in one category are partly offset by more spending in another. Without growth, the budget deficit still looms large.

Ireland’s problems are, sadly, far deeper than the need for simple fiscal austerity. The Celtic tiger’s impressive reported growth over the past decades was in part based on its aggressive attempts to help major corporations in the United States reduce their tax bills. The Irish government set corporate taxes at just 12.5 percent of profits, thus attracting all sorts of businesses — from computer services such as Google and Yahoo, to drug companies such as Forest Labs — that set up corporate bases and washed profits through Ireland to keep them out of the hands of the Internal Revenue Service.

The remarkable success of this tax haven means that roughly 20 percent of Irish gross domestic product (G.D.P.) is actually “profit transfers” that raise little tax for Ireland and are owned by foreign companies. Since most of these profits are subject to the tax code, they are accounted for in Ireland where they are lightly taxed; they should not be counted as part of Ireland’s potential tax base. A more robust cross-country comparison would be to examine Ireland’s financial condition ignoring these transfers. This is easy to do: a nation’s gross national product excludes the profits of foreign residents. For most nations, gross national product and G.D.P. are near-identical, but in Ireland they are not.

When we adjust Ireland’s figures accordingly, the situation is dire. The budget deficit was about 17.9 percent of G.N.P. in 2009, and based on European Commission projections (and assuming the G.N.P.-G.D.P. gap remains the same) it will be roughly 14.6 percent in 2010 and 15.1 percent in 2011, while the debt-to-G.N.P. ratio at the end of this year is expected – by our calculation – to be 97 percent, and 109 percent at the end of 2011. These numbers make Ireland look similarly troubled to Greece, with a much higher budget deficit but lower levels of public debt.

Ireland’s politicians, rather than facing up to their problems, are making things ever worse. Simply put, the Irish miracle was a mirage driven by clever use of tax-haven rules and a huge credit boom that permitted real estate prices and construction to grow quickly before now declining ever more rapidly. The biggest banks grew to have assets twice the size of official G.D.P. when they essentially failed in 2008. The government has now made a fateful choice: rather than make creditors pay some part of the losses, it is taking the bank debt onto the national balance sheet, effectively ballooning its already large sovereign debt. Irish taxpayers are set to be left with the risk of very large payments to make on someone else’s real estate deals gone bad.

There is no simple escape, but if the government hopes to avoid a sovereign default, the one overriding priority should be to stop bailing out the banks. Instead, the government should wind down existing banks in a “bad bank,” while moving their deposit base and profitable businesses into new, well-capitalized banks that can function without a taxpayer burden. This will be messy, but it is far better than a sovereign default.

Second, the Irish must take the tough fiscal steps that will be required under any circumstances. The International Monetary Fund and the European Union have made clear that funding is available to Ireland — so the government should use this to bridge the tough journey of fiscal cuts ahead.

Finally, the Irish need to consider seriously whether being in the euro zone is worth the cost. The adjustment to this awful situation would be far easier outside the euro zone — even though leaving the zone might have adverse repercussions for other nations. Once again, a comprehensive program with European Union/I.M.F. support might make this the least worse option.

Given the depths of Ireland’s problems, it is no wonder the markets are looking with skepticism at the announced eurozone-wide bailout package provided by the E.U. and the I.M.F. Policy makers are still not dealing with the core problems of each nation in the euro zone. With the debt hangovers remaining, who will want to invest in Europe’s periphery, and so how can Greece, let alone Ireland, grow? One thing we can be sure of: Europe’s political leaders are doomed to be spending much more time at emergency meetings in Brussels over the coming months and years.

Wednesday, May 26, 2010

Simon Johnson and Peter Boone say Hayek got the direction right, but the mechanism wrong

Aside from the obsession with sovereign debt and lack of concern about the far larger and more dangerous private debt, Johnson and Boone have a point

The Road To Economic Serfdom

Peter Boone and Simon Johnson

Baseline Scenario

May 22, 2010

According to Friedrich von Hayek, the development of welfare socialism after World War II undermined freedom and would lead western democracies inexorably to some form of state-run serfdom.

Hayek had the sign and the destination right but was entirely wrong about the mechanism. Unregulated finance, the ideology of unfettered free markets, and state capture by corporate interests are what ended up undermining democracy both in North America and in Europe. All industrialized countries are at risk, but it’s the eurozone – with its vulnerable structures – that points most clearly to our potentially unpleasant collective futures.

As a result of the continuing euro crisis, European Central Bank (ECB) now finds itself buying up the debt of all the weaker eurozone governments, making it the – perhaps unwittingly – feudal boss of Europe. In the coming years, it will be the ECB and the European Union who dictate policy. The policy elite who run these structures – along with their allies in the private sector – are the new overlords.

We can argue about who exactly are the peasants, the vassals, and the lords under this model – and what services exactly will end up being exchanged. But there is no question we are seeing a sea change in the post-war system of property, power, and prosperity across Western Europe, just as Hayek feared. An overwhelming debt burden will bring down even the proudest people.

The ECB-EU approach will not of course return countries to reasonable levels of growth – the debt overhang is simply too large. The southern and western periphery of the eurozone cannot grow out of their debts under these arrangements, and so will stumble from stabilization program to stabilization program – just like Latin America did during the 1980s. This is bound to be acrimonious, leading to hostile politics, social unrest, and more economic crises.

The International Monetary Fund will do just what the EU and ECB asks to keep the charade in place. The old days when all member countries got nice presents from the euro zone are long gone; now it is all instructions and austere requirements. But enough resources will be provided to keep rolling everything over.

The top three French players – President Nicolas Sarkozy, Jean-Claude Trichet (ECB), and Dominique Strauss-Kahn (IMF) – seem to be enjoying themselves; presumably they think they will end up running things. More surprising is the reaction of other European leaders, who genuinely seem able to convince themselves that what they are doing makes sense – as opposed to being a series of crazed improvisations.

The market is telling them that their euro rescue schemes make no sense, and the market is probably right. Faced with the ugly reality of the loss of confidence in European finance and institutions, the Germans and even the normally sensible Swedish government are increasingly blaming “irrational” markets and speculators for homegrown problems.

The currently preferred messy solution of the EU leaves the world at risk of shocks like we observed this week. This particular iteration may blow over, but another will arise when there is backlash in Athens, Dublin, Lisbon, or – heaven forbid – Madrid.

Meanwhile, rational market participants are selling debt of risky nations, and getting out of the euro. The whole fiasco is now leading to a messy shift away from risky assets all around the world, and the cost to the world of such volatility is not small. Debt peonage looms for a wide range of countries that were recently thought immune to serious fiscal crisis, including the United States and UK.

It is inappropriate for the Europeans to subject the rest of the world to these large, chronic risks. Europe should also recognize how disorderly insolvencies end – it is never pretty. The 1970s crisis in Britain is the model for what may go wrong. Ongoing large strikes, populations disenchanted with all authority, and great economic disruption are inevitably the outcome. When the assets are very cheap, deep-pocketed investors from the US, China, India and of course Russia will swoop in for the crown jewels.

What should be done? It is time to look in the mirror and recognize the problem. Several nations in Europe are bordering on insolvency, and it is now pretty clear that we shouldn’t just “bandage” that over for a few years with large aid packages.

To deal with this insolvency we need to restructure the debts of those nations. But this has to be done in a way that does not destabilize Europe’s fragile banking system. And it needs to be credible enough so that once restructured, the troubled nations will be able to finance themselves easily.

Europe now has the 750bn package of assistance in place, and they should use it to fix the problem once and for all. The ingredients for a solution include:

•Announcing an orderly restructuring of the periphery countries’ debt (Greece, Portugal, Ireland and possibly others also). This should start with a standstill and a program of fiscal financing while budget cuts are put in place.

•Regulatory forbearance should be explicitly provided to all European banks, with a backstop of ECB liquidity, and a 500bn euro support program to provide capital injections – as was done in the United States, 2008-09.

•The nations that are not restructured need to be supported via ECB liquidity lines that guarantee the rollover of their government debt.

•The G20 needs to provide support to prevent chaotic foreign exchange markets but also accept a large further devaluation of the euro. At some point the G20 will need to intervene to support the euro via central banks.

Such a comprehensive package of measures would be painful, but it is the only realistic solution to this chaos. It would also restore some credibility to Mr. Trichet and the ECB, who, at this stage, appear captives the fiscal crises in the euro zone.

Unfortunately, there is no leadership today in Europe that could take such decisive actions, so Europe will only reform itself dragged kicking and screaming through successive crises until the current, and many ensuing, problems are resolved.

The UK and US need to prepare themselves for more storms. The United States will be in the more pleasant position as the world’s safe haven, but this will only encourage America’s profligate politicians to spend more and build more debt.

The UK will bear much more pain from euro devaluation and financial dislocation, all exacerbated by its own large deficit and debts. We might well see one more invasion across the channel, this time by bond vigilantes who question Britain’s ability to rein in inflation as it builds too large debts.

At the end of this great tumult, Europe and the UK will have sound fiscal regimes. Debt will be defaulted on or inflated away, and nations will have dramatically cut spending.

Hayek’s predicted demise of western society will prove correct, but welfare systems will prove the victim, rather than the mechanism, erased by a political and financial elite gone awry.

Tuesday, May 25, 2010

Transcript: 386 Real world, fantasy solutions, are making a mess

Listen to this episode

Today on the podcast, the results of the Revere Award for the economists who best predicted the collapse. That and the two-step plan that can create an economy able to deal with real challenges: debt writedown and government investment financed on the books. But first, we step out of our fantasies and into the real world, which is a mess, reviving an earlier feature of Demand Side podcasts, Idiot of the Week. We honor Tyler Cowen of the New York Times

COWEN

Cowen is channeling the Washington Consensus, which is barely more rational than tea party economics, insufficient even for the mildest of examination. We'll put up a sequence of basic Keynesian pieces this week, just to remind you that economics does not have to be so obtuse. The fact that Cowen's opinion is widely held -- and held by many in positions of policy influence -- is only sad.

Which country or corporation is going to pay off all its debts? None, of course. All are going to roll them over and pay interest. It is not the debt, but the debt service that threatens companies, countries and individuals.

It's not that Cowen is alone, it's that it is so wrong. Peter Boone and Simon Johnson offer this view:

The model for this "pull themselves out of this mess through auserity?" Well. With flagging global demand? There are no examples. You could say the Asians of 1997-2007 did it, but they had the export markets. Johnson and Boone cite Latin America in the 1980's. Hardly a success. This save the banks scheme is not going to work. The banks have failed. Johnson and Boone agree, saying

If that is the plan, it is the equivalent of a military plan that begins by marching the army into the swamp. [See the full article on the blog later in the week.]

And the U.S. is not protected by the Atlantic. These markets were global by design, the design of the big banks and financial interests. Asset quality will rise and fall together. Since we have not fixed anything, we ought not to expect it to work any better than last time.

It is becoming ever more clear that saving the euro has come to mean saving the big banks and the big banks are so fragile that they cannot accept the risk they took on in any sphere. But there is an additional problem. The financial sector is in full casino mode. Since there are no real economy borrowers with prospects, the way to make money is to speculate on failure.

When the housing bust began in late 2007 and the stock market peaked, Demand Side watched as the money moved into commodities. We predicted the oil and commodities bubble, watched it rise, called its peak and collapse -- all on the basis of the simple idea that quote investment quote capital was moving into a new arena and would bid up the prices in that arena. The boom in commodities prices wreaked havoc on those in the world who used oil and gasoline, metals or ate food.

Now we see the money moving into these derivatives, credit default swaps, bidding up their prices.

Here, from earlier in the Weekend Business podcast out of which we found our idiot.

DERIVATIVES FROM WEEKEND BUSINESS

Let's see. Six hundred trillion dollars. Who has six hundred trillion dollars? It's Monopoly money, obviously. Warren Buffet doesn't even want to post a margin on his purchases. Yet action in this monopoly money market is supposed to indicate something about the real economy. The only thing it indicates is that this is the table to which the casino players have moved. High prices for protection against default are being created at this table because there is so much money there.

Consider what is averred here, that this is a kind of insurance.

As a friend of mine in insurance pointed out to me, it is not insurance, which is a pool of money from people facing similar risks, so that if your house burns, you can collect from the pool. In credit default swaps, the insurance policies are written for any body who wants them, not just those with houses to burn, or Greek bonds to default. So when the house burns, it is not just one person who collects, but many. But it is not insurance, it is a wager.

Now consider if Greece or another country actually defaults -- restructures its debt. Something we have advocated here if done in a methodical way. Or actually will advocate in the second half of today's podcast.

Somebody has to pay. We don't know how many credit default swaps have been written on the tiny Greek debt, because -- as Weekend Business' discussion of the financial reform legislation points out -- there is no exchange or oversight of these instruments. It is all done in the back rooms at the bar. But we do know that people like Warren Buffet have big positions without any margin. Zero margin. Of course that's how you can create a fictitious sum like six hundred trillion, which is many multiples of total gross world product.

This makes AIG look like a schoolyard game of marbles.

There is not enough government money to backstop the banks on this one.

Will this market crash? Will credit default swaps writers be discovered to have written them -- like AIG -- without the wherewithal to pay them off? Yes.

The same process is going on now that went on in the S&L debacle of the 1980s and 1990s. S&L's suffered when interest rates went up as a result of the inflation of the 1970's and the response to it by the Fed. They had written long-term mortgages at low rates and financed them with short-term borrowing. Their spreads went negative. The preferred answer? Deregulate the S&L's and allow them into the more lucrative activities that would yield higher interest and maybe they could earn their way out. More lucrative meant higher risk. Fraud. They didn't earn their way out. They created a bigger problem.

The same thing is happening here. Can't make money the old fashioned way? Invent something new, more lucrative, more risky, and watch it blow up. After all, the government is there to ... wait, we're betting the government will fail. As soon as insurance is written for somebody without an insurable interest, it ceases to be insurance.

Our answer is to immediately end the ability of anybody to buy a swap without owning the bond that swap is written against. Add one percent margin required for writers every month for the next one hundred months on current swaps without insurable interests. Such a process would deflate the value of these swaps, move them from Monopoly money into real money, and perhaps allow an orderly decline in the values in question without a crisis that brings down the system. At least it would make investment in the real economy more attractive. As long as you're playing with real money, you might as well do real things.

Would this scheme work? Probably not. Debt will be written down. Indeed we argue, it has to be. Another name for writing down debt is default.

Isolating the players in this game and letting them take the fall for their behavior is the least worst way of resolving it.

This is the idiocy of the Bernanke strategy of saving the big banks. We are saving whatever games they want to play. Let's instead identify the games and activities that are the real purpose of banking, structure those markets rationally, and let the institutions rise or fall according to their own merits.

And we remind you, we called for new crises several months ago in European debt and also in small and regional banks in the U.S. as a result of the commercial real estate crash.

Look out below!

DEFLATION

Some -- among them Paul Krugman -- have made a point of the tiny deflation in consumer and producer prices. As Minsky told us, this was to be expected, as the work force moves into producing strictly consumer goods. Price rises are to be expected when the work force is divided between producing investment goods and consumer goods, since both groups are bidding for the output of the consumer goods sector.

To get focused on this tiny drop, or really stability in prices in the CPI and PPI is to miss the enormous and continuing drops in the prices of assets. Asset price deflation -- when untreated -- is the cause of depressions. No investment means asset prices are deflating.

One feature of successful recoveries from recession in the postwar period is inflation. The Fed has typically eased monetary policy, and the authorities have traditionally backstopped and bailed out financial innovation creating easy money for investors, which has created inflation.

But let's do the Revere Award first

This has just been posted on the Real World Economics Review

Revere Award for Economics for the 3 economists who warned the world

Results

For Immediate Release

13 May 2010

Keen, Roubini and Baker win Revere Award for Economics

Steve Keen (University of Western Sydney), receiving more than twice as many votes as his nearest rival, has been judged the economist who first and most cogently warned the world of the coming Global Financial Crisis. He and 2nd and 3rd place finishers Nouriel Roubini (New York University) and Dean Baker (Center for Economic and Policy Research) have won the Revere Award for Economics. The award, sponsored by the Real World Economics Review Blog is named in honor of Paul Revere and his famous ride through the night to warn Americans of the approaching British army.

In announcing the winners, Edward Fullbrook, editor of the Real World Economics Review, said:

Keen, Roubini and Baker have been judged in a poll by their peers, over 2,500 of them, to be the three economists who first and most cogently warned of the approaching Global Financial Collapse.

If the powers of the world had listened to these guys or any of the other finalists, instead of Greenspan, Summers and that lot, the collapse and all the human misery and lost opportunity it caused and is still causing would have been avoided.

More than 2,500 people voted — most of whom were economists themselves from the 11,000 subscribers to the real-world economics review. With a maximum of three votes per voter, a total of 5,062 votes were cast. The voters were asked to vote for:

•the three economists who first and most clearly anticipated and gave public warning of the Global Financial Collapse

•and whose work is most likely to prevent another GFC in the future.

The poll was conducted by PollDaddy. Cookies were used to prevent repeat voting.

Commenting on the results, Fullbrook said:

The general failure to warn of the approaching Global Financial Collapse showed that in the economics profession today the general level of competence at real-world economics is grievously less than what society requires.

Worse, some people in the economics establishment have attempted to evade all responsibility for the Collapse by calling it an unpredictable, “Black Swan” event.

Such statements are plainly untruthful. Some economists did–and on the basis of deep analysis–foresee the crisis and warn the public of its approach. At the time they were widely ridiculed for doing so.

Hopefully the Revere Award will give these economists some of the professional and public recognition they deserve, and encourage others to utilize their methods, and increase the likelihood that, for the benefit of humankind, empirically responsible economists, instead of faith-based ones, will be listened to in the future.

I must emphasize that it is not just for the winners’ sake but for everyone’s that Keen, Roubini and Baker should be given public credit for their competence and courage.

Revere Award Citations

Steve Keen (1,152 votes)

Keen’s 1995 paper “Finance and economic breakdown” concluded as follows:

The chaotic dynamics explored in this paper should warn us against accepting a period of relative tranquillity in a capitalist economy as anything other than a lull before the storm.

In December 2005, drawing heavily on his 1995 theoretical paper and convinced that a financial crisis was fast approaching, Keen went high-profile public with his analysis and predictions. He registered the webpage www.debtdeflation.com dedicated to analyzing the “global debt bubble”, which soon attracted a large international audience. At the same time he began appearing on Australian radio and television with his message of approaching financial collapse and how to avoid it. In November 2006 he began publishing his monthly DebtWatch Reports (33 in total). These were substantial papers (upwards of 20 pages on average) that applied his previously developed analytical framework to large amounts of empirical data. Initially these papers analyzed the Global Financial Collapse that he was predicting and then its realization.

Nouriel Roubini (566 votes)

In summer 2005 Roubini predicted that real home prices in the United States were likely to fall at least 30% over the next 3 years. In 2006 he wrote on August 23:

By itself this [house price] slump is enough to trigger a US recession.

And on August 30 he wrote:

The recent increased financial problems of … sub-prime lending institutions may thus be the proverbial canary in the mine – or tip of the iceberg – and signal the more severe financial distress that many housing lenders will face when the current housing slump turns into a broader and uglier housing bust that will be associated with a broader economic recession. You can then have millions of households with falling wealth, reduced real incomes and lost jobs…”

In November 2006 on his blog he wrote:

[t]he housing recession is now becoming a construction recession; and the construction recession is now turning into a clear auto and manufacturing recession; and the manufacturing recession will soon turn into a retail recession as squeezed households – facing falling home prices and rising mortgage servicing costs – sharply contract their rate of consumption.

Dean Baker (495 votes)

In August 2002 Baker published “The Run-Up in Home Prices: Is It Real or Is It Another Bubble?” in which he concluded that it was the latter. In December 2003 he published in the Los Angles Times “Who to Blame When the Next Bubble Bursts”. This was the first of dozens of columns appearing in US newspapers that Baker wrote on the bubble. In one from May 2004, “Building on the Bubble”, he wrote:

The fact that people are borrowing against their homes at a rapid rate (more than $750 billion in 2003) is more evidence of an unsustainable bubble. The ratio of mortgage debt to home equity is at record highs.

In 2006 he put out repeated warnings of the systemic implications of the housing bubble, and in November published the paper “Recession Looms for the U.S. Economy in 2007” in which he wrote:

The wealth effect created by the housing bubble fuelled an extraordinary surge in consumption over the last five years, as savings actually turned negative. …This home equity fuelled consumption will be sharply curtailed in the near future…. The result will be a downturn in consumption spending, which together with plunging housing investment, will likely push the economy into recession.

The vote totals for the other finalists were:

•Joseph Stiglitz 480

•Ann Pettifor 435

•Robert Shiller 409

•Paul Krugman 399

•Michael Hudson 351

•Wynne Godley 281

•George Soros 262

•Kurt Richebächer 168

•Jakob Brøchner Madsen 64

Next time we'll get into a clear explication of what can be done, writing down debt and financing big new government investment.

This is so far down the road and so far outside the current discussion that any real recovery is far away. Instead tea party economics based on fantasy, ignoring history, whose impetus apparently derives from unprocessed emotional problems, gets the press. Instead of writing down debt, we are going to cling to the schemes that haven't worked, let the banks tell us what to do, and watch the economies and peoples of the world sink.

Today on the podcast, the results of the Revere Award for the economists who best predicted the collapse. That and the two-step plan that can create an economy able to deal with real challenges: debt writedown and government investment financed on the books. But first, we step out of our fantasies and into the real world, which is a mess, reviving an earlier feature of Demand Side podcasts, Idiot of the Week. We honor Tyler Cowen of the New York Times

COWEN

Cowen is channeling the Washington Consensus, which is barely more rational than tea party economics, insufficient even for the mildest of examination. We'll put up a sequence of basic Keynesian pieces this week, just to remind you that economics does not have to be so obtuse. The fact that Cowen's opinion is widely held -- and held by many in positions of policy influence -- is only sad.

Which country or corporation is going to pay off all its debts? None, of course. All are going to roll them over and pay interest. It is not the debt, but the debt service that threatens companies, countries and individuals.

It's not that Cowen is alone, it's that it is so wrong. Peter Boone and Simon Johnson offer this view:

With the European Central Bank announcing that it has bought more than $20 billion of mostly high-risk euro zone government debt in one week, its new strategy is crystal clear -- Take the risk from bank balance sheets and give it to the central bank, and let or expect Portugal-Ireland-Italy-Greece-Spain to cut fiscal spending sharply and pull themselves out of this mess through austerity.

The model for this "pull themselves out of this mess through auserity?" Well. With flagging global demand? There are no examples. You could say the Asians of 1997-2007 did it, but they had the export markets. Johnson and Boone cite Latin America in the 1980's. Hardly a success. This save the banks scheme is not going to work. The banks have failed. Johnson and Boone agree, saying

The European Central Bank's head, Jean-Claude Trichet, faces a potential major issue: the task assigned to the profligate nations could be impossible. Some of these nations may be stuck in a downward debt spiral that makes greater economic decline ever more likely.

Prime Minister George Papandreou said this week that Greece needs to see strong investment in order for the austerity program to work. While the government cuts fiscal spending, he said, it needs new private business to employ the dismissed workers so that they are productive, can pay taxes and do not need unemployment benefits.

If that is the plan, it is the equivalent of a military plan that begins by marching the army into the swamp. [See the full article on the blog later in the week.]

And the U.S. is not protected by the Atlantic. These markets were global by design, the design of the big banks and financial interests. Asset quality will rise and fall together. Since we have not fixed anything, we ought not to expect it to work any better than last time.

It is becoming ever more clear that saving the euro has come to mean saving the big banks and the big banks are so fragile that they cannot accept the risk they took on in any sphere. But there is an additional problem. The financial sector is in full casino mode. Since there are no real economy borrowers with prospects, the way to make money is to speculate on failure.

When the housing bust began in late 2007 and the stock market peaked, Demand Side watched as the money moved into commodities. We predicted the oil and commodities bubble, watched it rise, called its peak and collapse -- all on the basis of the simple idea that quote investment quote capital was moving into a new arena and would bid up the prices in that arena. The boom in commodities prices wreaked havoc on those in the world who used oil and gasoline, metals or ate food.

Now we see the money moving into these derivatives, credit default swaps, bidding up their prices.

Here, from earlier in the Weekend Business podcast out of which we found our idiot.

DERIVATIVES FROM WEEKEND BUSINESS

Let's see. Six hundred trillion dollars. Who has six hundred trillion dollars? It's Monopoly money, obviously. Warren Buffet doesn't even want to post a margin on his purchases. Yet action in this monopoly money market is supposed to indicate something about the real economy. The only thing it indicates is that this is the table to which the casino players have moved. High prices for protection against default are being created at this table because there is so much money there.

Consider what is averred here, that this is a kind of insurance.

As a friend of mine in insurance pointed out to me, it is not insurance, which is a pool of money from people facing similar risks, so that if your house burns, you can collect from the pool. In credit default swaps, the insurance policies are written for any body who wants them, not just those with houses to burn, or Greek bonds to default. So when the house burns, it is not just one person who collects, but many. But it is not insurance, it is a wager.

Now consider if Greece or another country actually defaults -- restructures its debt. Something we have advocated here if done in a methodical way. Or actually will advocate in the second half of today's podcast.

Somebody has to pay. We don't know how many credit default swaps have been written on the tiny Greek debt, because -- as Weekend Business' discussion of the financial reform legislation points out -- there is no exchange or oversight of these instruments. It is all done in the back rooms at the bar. But we do know that people like Warren Buffet have big positions without any margin. Zero margin. Of course that's how you can create a fictitious sum like six hundred trillion, which is many multiples of total gross world product.

This makes AIG look like a schoolyard game of marbles.

There is not enough government money to backstop the banks on this one.

Will this market crash? Will credit default swaps writers be discovered to have written them -- like AIG -- without the wherewithal to pay them off? Yes.

The same process is going on now that went on in the S&L debacle of the 1980s and 1990s. S&L's suffered when interest rates went up as a result of the inflation of the 1970's and the response to it by the Fed. They had written long-term mortgages at low rates and financed them with short-term borrowing. Their spreads went negative. The preferred answer? Deregulate the S&L's and allow them into the more lucrative activities that would yield higher interest and maybe they could earn their way out. More lucrative meant higher risk. Fraud. They didn't earn their way out. They created a bigger problem.

The same thing is happening here. Can't make money the old fashioned way? Invent something new, more lucrative, more risky, and watch it blow up. After all, the government is there to ... wait, we're betting the government will fail. As soon as insurance is written for somebody without an insurable interest, it ceases to be insurance.

Our answer is to immediately end the ability of anybody to buy a swap without owning the bond that swap is written against. Add one percent margin required for writers every month for the next one hundred months on current swaps without insurable interests. Such a process would deflate the value of these swaps, move them from Monopoly money into real money, and perhaps allow an orderly decline in the values in question without a crisis that brings down the system. At least it would make investment in the real economy more attractive. As long as you're playing with real money, you might as well do real things.

Would this scheme work? Probably not. Debt will be written down. Indeed we argue, it has to be. Another name for writing down debt is default.

Isolating the players in this game and letting them take the fall for their behavior is the least worst way of resolving it.

This is the idiocy of the Bernanke strategy of saving the big banks. We are saving whatever games they want to play. Let's instead identify the games and activities that are the real purpose of banking, structure those markets rationally, and let the institutions rise or fall according to their own merits.

And we remind you, we called for new crises several months ago in European debt and also in small and regional banks in the U.S. as a result of the commercial real estate crash.

Look out below!

DEFLATION