Monday, January 30, 2006

Goodbye Maestro Magoo

I am certain the central bankers have found another person who will not threaten them in new Fed chairman Ben Bernanke. I am even more certain they have found a person with more integrity.

No single person exercises more control over the economy than the chairman of the Federal Reserve with his control over monetary policy. Greenspan was not elected and he didn't need a spotless private life, yet he held office through four administrations, Democrat and Republican. He maintained office simply on the reputation of being an inflation hawk, a reputation he built and maintained to the detriment of millions of Americans.

A great deal of credit for his appointment and longevity goes to his skill in cultivating the power elite. As described in Bob Woodward's book Maestro, few couples are more prominent on the A-list social scene in the nation's capitol than the Fed chairman and his wife NBC White House correspondent Andrea Mitchell.

Perhaps less surprising, but surprising nonetheless, is the portrayal of Greenspan as a master manipulator of the bureaucracy at the Fed. More than one governor has quit in frustration at being unable to influence policy.

As familiar as Greenspan's coke bottle glasses and his deeply furrowed face is his manner of speaking, an obfuscating and convoluted style that he apparently inherited from his father. It goes with him wherever he goes. He is said to have proposed marriage twice to Mitchell before she accepted. She had not understood the first time.

Let's hear it in his own words.

"Economic conditions and considerations addressed by the committee are essentially the same as when the committee met in February. The committee remains concerned that increases in demand will continue to exceed the growth in potential supply, which could foster inflationary imbalances that would undermine the economy's record economic expansion."

That was from March 2001. Seems to make sense in a way, "inflationary imbalances" is kind of a odd way of saying inflation, perhaps. Except there was no inflation. There was never any inflation. The statement accompanied a quarter point hike in the federal funds rate.

Skip ahead a year.

"Our accelerated action reflected the pronounced downshift in economic activity, which was accentuated by the especially prompt and synchronous adjustment of production by businesses utilizing the faster flow of information coming from the adoption of new technologies."

This was accompanied by a lowering of the federal funds rate. It should have read, "I screwed up big time."

Between those two pronouncements, Greenspan's stock tumbled as far as that of any of the dot.com start-ups. Once revered as the architect of permanent prosperity, Greenspan was then blamed for an unnecessary slump, before he was forgotten in the fallout from the tragedy of 9-11. That event, in fact, caught him in Europe where he was begging the EU central banks to lower their interest rates to bail out the economy. He was locked out of the country for three days when air travel was shut down.

Both Greenspan and Bush later took advantage of the terrorist attacks to excuse the subsequent economic downturn. In the past, wars have been identified as good for the economy. This time they were just good for cover.

Let's go over it again. At the beginning of 1999 the American economy was booming, the stock market was booming, help wanted signs were everywhere. The U.S. had barely paused on its upward trajectory as Russia defaulted on its bonds and Asian currencies melted down. We were invulnerable.

Then Alan Greenspan saw inflation in the tea leaves, or said he did, and the Fed began to ratchet up interest rates. Wall Street scratched its collective head. What inflation? The only thing on the horizon was the 2000 presidential election. By the time he stopped, the prime rate stood at 9.5 percent. In real terms it was the highest since the Reagan/Volcker recession of 1981.

The worst of it was that it occurred at the same time as a rise in oil prices and an explosion in energy costs, definite drags on an economy which certainly did not need the additional burden of higher interest rates. Too late, the Fed found out that it was much easier to stop an economy with monetary policy than it is to restart one. The prime rate sat at post-war lows for more than two years, and the recovery is still doubtful.

Prior to its occurrence I would have bet large amounts of money that George W. Bush would not reappoint Greenspan for his last four-year term. W's father, H.W., was no great friend of Greenspan's, blaming him for the slowdown in 1991 which hurt his reelection chances. The elder Bush is quoted as saying, "I reappointed him and he disappointed me."

My amazement wore off quickly when Greenspan strode into Congress and said the budget surplus was a threat to our nation's future. Without support from this so-called economic genius, the Bush tax cuts would likely never have come into being. I posted the nonsensical reasoning last month.

His chairmanship of the Social Security Commission in the early 1980s that raised payroll taxes with the promise of putting Social Security on firm financial footing has been completely discredited by his contributions to the undermining of fiscal integrity in the federal budget, in concert with George W. Bush, and its inevitable toll on the entitlement funds.

As he retires, Greenspan can look out on a sea of red ink, both federal deficits and private debt, and count it as his legacy. He can point to his contribution in keeping the dollar overpriced and thus our trade deficits high. He can say with confidence that he has reduced the Fed's tools for affecting the economy to one, the federal funds rate. Maestro Magoo can know with confidence that he operated in a manner consistent with retaining his job and consistent with nothing else.

Monday, January 30, 2006

Sunday, January 29, 2006

"Fat Boy," "Death Star" and "Lucky Dub"

These are George Bush's fellow travellers, not only because "Kenny Boy" Lay and other Enron insiders were among his buddies and prime political backers, but more so because Enron-type fraud was Dubya's preferred MO. Tom DeLay and Jack Abramoff are into low-brow graft next to Bush and corporate cooking of the books.

One mode of corporate fraud, the "fictitious asset sale," was beneficial to both Bush and Enron. Company A sells its asset to Company B at an enormous price, adds the gains to profits, wows the market with the balance sheet, sells a lot of high priced stock, and hopes nobody finds out that Company B was just Company A under another name and the asset was worth a fraction of the sale price.

Details: The story was recounted by Paul Krugman in the July 2, 2002, NYT. In 1989 George had gotten on the board of Harken Energy when Harken bought his tiny, money-losing, highly indebted company Spectrum 7 for $2 million ("because his name was George Bush"). Harken was losing money too, but was able to hide its losses with profits generated by the sale of an asset, its subsidiary Aloha Petroleum. Eventually the SEC ruled the transaction to be phony because the purchasers of Aloha were simply a group of Harken insiders (who had, in fact, borrowed much of the money from Harken itself).

Before the stock tanked, Mr. Bush sold off two-thirds of his share, $848,000 worth, and in spite of insider trading laws requiring prompt disclosure, neglected to inform the SEC for 34 weeks. An internal SEC memorandum concluded that he had broken the law. No charges were filed. Daddy was president.

The rest of Bush's business career reeks as well. The proceeds from Harken were invested in the Texas Rangers baseball club, and after "an equally strange story," as Krugman puts it, George became a truly rich man.

So when we relive the Enron market-rigging scandal, think not only of "Fat Boy," "Death Star," and "Get Shorty," but also of "Lucky Dubya." They've all cost us dearly.

These and other stories from his NYT columns were collected in Krugman's best-selling book The Great Unraveling: Losing our Way in the New Century. Krugman is an object lesson in why economists speak of things with the term "relative." Today he is viewed by all as definitely on the left, but during the first part of his career the economist was so much in the center you might have called him "apolitical." It wasn't Krugman who changed position, it was the rest of the landscape that moved to the right.

Footnote: Son of Enron. The New York Stock Exchange welcomed Refco, a commodities broker, in August. Refco stock spiked 25 percent. In October its CEO Phillip Bennett was arrested for fraud when it was found that $430 million in debt had been kept off the books. A week later Refco filed for bankruptcy.

Saturday, January 28, 2006

Economists "oops" day

The Economic Policy Institute (EPI) snapshot depicts slow growth across the board, not just in autos. Growth in consumption, business investment, residential investment, and exports all fell from the third quarter into the fourth quarter. Final sales of domestic output actually shrank in absolute terms.

An earlier EPI piece showed that federal tax cuts have produced no new jobs. Forget the happy talk. Employment growth was generated not in the private economy from tax cuts, but came from new government spending. Jobs from Defense-related and discretionary spending was estimated at 2.82 million between 2001 through the end of 2006. Total job growth, as above, was only 2.0 million. Jobs generated by the tax cuts have actually declined the difference of 820,000. This in spite of the rock bottom interest rate regime the Fed has been following until recently.

Without job growth, there is no possibility of overall economic growth. Even the total of 2 million jobs over five years is fewer than Bill Clinton averaged every single year of his presidency, while shrinking the deficit.

What does this mean?

The Bush tax cuts have produced less than nothing. The economy is weaker for the effort. This is because those cuts have been targeted to the rich. The rich don't spend out of new income such as they get from tax refunds, but rather out of accumulated wealth.

It also means George Bush does not know what he is doing. Wait, you say, Dubya knows exactly what he is doing -- He is operating fiscal policy for the benefit of his rich corporate buddies. Fair point. What Bush does not know is that in the process he is killing the economy for everyone and choking off any possibilities for a rebound with big new debt.

He invaded Iraq with a purpose, too, but without understanding reality or the ramifications of his adventure. He and his Neocon ditto tank have produced a situation without an answer in the Middle East. They may have done the same thing with the domestic economy.

As Robert Rubin pointed out last week, the US -- alone among industrial nations -- has combined huge federal deficits and stagnant incomes with a very low personal savings, high personal debt and enormous trade deficits.

Yes, I am the voice of doom and gloom. It may surprise you that the economy of these posts is different than that witnessed to by the talking heads. It surprises me as well. Economics is not in the height of its glory right now, but surely we can do better than the line by Laurence J. Peter: "An economist is an expert who can explain precisely tomorrow why the things he predicted yesterday didn't happen today."

Most of the problem is politicization, both internal academic politics and the Heritage Foundation style. A new report from scientists at Emory University studied committed political partisans with MRIs. They discovered that reasoning centers in the brain were quiescent during the process of evaluating politically charged material, but circuits lit up that are connected with emotion and resolving conflicts. When acceptable conclusions were reached -- often by suppressing or ignoring difficult information -- circuits associated with behavior reward came on line. "Much like that seen when addicts get a drug," according to Drew Westen, director of clinical psychology at Emory. (See "Partisans don't let the facts get in the way of the truth.")

If you've ever seen economists argue, you know this is what is happening. Entire schools are built on logical flaws or assumption errors, supported only by vigorous debate and polemics. Very much too bad.

Thursday, January 26, 2006

Tacoma tax plan needs a shot

Things change. Anderson’s presentation has changed for one. He’s dropped the "user fee" tag he began with and now he calls it a tax. It is a tax. He’s dropped the occupancy part, so it is no longer subject to criticism as a poll tax.

And I changed. I have a new appreciation for a voter approved tax dedicated to the core missions of city government. Police, fire and libraries comprise the main business of city government, and it is these services that are most directly threatened by the current flimsy revenue architecture.

So far as I know, this is the only forward looking plan in the state to address the inevitable funding shortages to come. If anyone else is aware, please let me know. Otherwise it appears cities are willing to watch doe-eyed as their services come under the knife year after year. Tacoma will be opening the door for all cities if the plan goes through, because its implementation will require state approval. The state needs to approve any new forms of local taxation. That step is part of what will be a difficult road.

The shortfalls we face are, of course, the handiwork and the something-for-nothing right wing and their tax-cut initiatives. We are witnessing the same dynamic on the national stage, where an enormous new tower of debt is being built, a tower which is more and more unstable and which threatens to collapse on our futures, all so tax cuts can continue for the rich.

Locally we don’t have the option of constructing such a tower, since states and municipal governments are required to balance their budgets. This means if we tell the city to cut taxes, we tell the city to cut services. Our kids may not get the schools and police and parks they need, but the tax bills they get from us in twenty years will be entirely federal.

This city services tax is a way of making things, as they say, "transparent." Voters get to choose whether to have the appropriate level of services or not. Increases to the baseline level of revenue would be submitted in a periodic referendum, probably synchronized with the budget cycle.

Eyman and his cohorts ought to love this voter inut, but they won’t. They are in the business of bashing a vague "big government." They are not in the business of making the painful choices that follow when people buy their fiscal snake oil. For that they employ the simple if disingenuous tactic of denial. And then they leave it to the bureaucrats and politicians to do the dirty work.

One valid complaint heard from many citizens is they don’t want to give up their representative government. We hired these officials to make these decisions, they say, not to put them up for voter micromanagement. It’s a good point, but at least it could be an object lesson and a wake-up call. Taxes are simply the financing for public goods. You can’t have the goods without the taxes.

Let’s give Anderson’s idea a fair hearing and tweak it if it needs tweaking. There are dozens of complexities and a couple of potential dead-ends that need to be examined. But before that there are also misconceptions to be eliminated, and not left to stew for months and confuse public discussion. The following points ought to be broadcast to a wary public at the beginning of the process:

1. Your regular property tax bill will go down.

2. Your utility bill will go down.

3. You will get a new bill, possibly every other month.

4. No government agencies, no schools, no park districts will be taxed.

But first! Even before that! If I get chosen, I will force (by filibuster if necessary, so watch out!) a change in the name of the tax. "City services tax" is not right. It is not a tax on city services, like a utility tax is a tax on utilities, or an income tax is a tax on income. This would be a tax based on property value for the benefit of city services. I like "city services assessment," differentiating it from the bi-yearly bill, which would be a "parks and schools assessment." Besides "assessment" is more alliterative.

Wednesday, January 25, 2006

The economic model is broken

NBA Commissioner David Stern before the Senate Ways and Means Committee on Thursday.

It's a tag team match! Yes, the Seahawks' billionaire owner got a new stadium, and before that the Mariners' billionaire owner got a new stadium, but before that there was a mega-million dollar remake of the Sonics' home. Heck, the bonds on the Key (funny how they forgot the name) aren't even paid off. The fans and the taxpayers are getting the stuffing beaten out of them, and now we're supposed to feel guilty?

Seattle is not alone. The same edition of the Seattle Times that had Stern in the Local section had an article in Sports with the header "Blazers future uncertain." According to Portland Trailblazer owner Paul Allen's spokesman Lance Conn "all options are on the table" because "the economic model is broken."

Yes, the economic model is broken! We're paying players and coaches literally millions of dollars a year and now we're supposed to pony up to build better suites for high rollers. It is just absurd.

It's the worst of all economic models, a monopoly run by millionaires where cities are manipulated into a financing contest with each other. "The team can't win unless we've got the money." Phooey. Let them play the game on the court, not in our wallets.

Restaurants are already taxed on everything that moves and some things that don't. Sales tax, B&O tax, lots of payroll taxes, syrup taxes, alcohol taxes, and probably some I don't remember. Meanwhile Ray Allen pays the same state tax on his $14.5 million salary (team total is $52 million) as the minimum wage busboy. The corporate honchos who rent the fancy new suites get a deduction. Even Key Bank writes off the cost of paying to put its name on the place.

If they really end up taking the team to Kansas City, I have an idea. A new league. Seattle, Tacoma, Portland, Spokane, Fresno, Boise, San Jose. A cities group sells franchises for, say, a million. The maximum public investment is set, so big markets can't play George Steinbrenner and break the small markets. Maybe a salary scale for players is included.

And then we play basketball. What a concept.

We might even be able to watch people like Wil Conroy and Tre Simmons without having to go to Fargo or Marseilles.

FYI, there was one coherent voice in the house at the Ways & Means Committee.

Message Testimony of SEIU 775 President David Rolf

Senate Ways and Means

Members of the committee, my name is David Rolf. I am the President of SEIU 775, with 30,000 members in the long-term care industry, in every zip code in the state.

I cannot imagine a lower priority for the use of the public's money then the purpose this bill anticipates.

This contemplated act of corporate welfare takes place within the following context:

Incomes are stagnant or declining for 2/3 of households. Health care costs are eating up a greater percentage of employee paychecks and employer profits, even while benefits get cut and hundreds of thousands are uninsured. The average home price is now out of reach for an average income family in Seattle . Tuition costs put higher education out of reach for some working families. Fifty-two percent of all baby boomers have no retirement savings besides social security and their home equity. And, of course, the impoverishment of nursing home and home care workers threatens the quality of care for tens of thousands of elderly and disabled Washingtonians. The profitability of a sports facility should not be a higher priority than the health care of frail elderly people, or education, or housing.

The indirect transfer of public wealth to private, for-profit sports teams should not be a priority of our government, under any circumstances, at any time.

If you do pass this bill, we urge you to authorize the use of this tax for housing, health care, arts, education, and social services, but not to help subsidize the profitability of professional sports teams.

Thank you.

Rubin's Rx

Rubin says (in my translation, see below):

We are in deep do-do, and the Supply Side nonsense that things are going to turn around is bull.

Big deficits cannot be tolerated, since we are facing big payouts in entitlements, exorbitant health care costs, and years of underfunding education. Medicare is several times as great a problem as Social Security.

Our fiscal problems are made worse because the U.S., alone among the developed nations, has combined them with very low personal savings rates, high personal debt, and enormous trade deficits -- currently over 6% of GDP -- stemming partly from our budget deficits. [It is fair to note here that trade deficits were not much better under Clinton/Rubin.]

We can close more than three-quarters of the deficit by rescinding the tax breaks for the rich. There is no other practical means.

The current illusion of strength in the economy comes from the housing boom, which was generated by low interest rates. Low interest rates have come from (1) Greenspan rolling over for W like he never did for Bill and me, (2) foreign central banks propping up the dollar for their own trade purposes, and (3) lack of demand for capital from business (not a good thing). Interest rates will go up soon, largely because federal deficits are going to bid them up.

We need significant new public investment, both to turn around the decline in people's incomes and to equip our citizens to participate in economic growth.

Global integration, including all nations, must continue. Essential to its success is reducing global poverty. Further integration will be politically possible only if everybody is "participating" here at home, as above. It is problemmatic that who want global integration do not support the significant domestic investment needed to get people participating on a broad scale, and those who want the domestic investment on people are not so sure about globalization.

End of translation, you saved 745 words.

Rubin has experience turning bad situation around, although he and Clinton did have a couple of breaks not available today. For example, when they cut the deficit and interest rates fell, a huge re-fi boom followed. This will not happen again; interest rates are already low and all the re-fi-ing has been done. And oil prices fell for Clinton and Rubin, then stayed low, and fell some more before rising a bit at the end. Low oil prices are no longer on the horizon. Also, the technology boom was probably not entirely invented by the Clinton or his vice president.

I was impressed particularly by Rubin's call for broad public investment to first develop human and physical capital, but also to get people's incomes going up again. The likelihood of such a program is dim at best, even under a Democrat. The return to fundamentals in the first year of the Clinton administration was far from painless. The modest tax increase it required cost Democrats control of Congress. (Recall that Maria Cantwell's yes vote cost her a second term in the House, when she was defeated by anti-tax demagoguery.)

But it would work.

Translator's technical notes:

One thing I didn't know about Rubin is he has a very abstruse style of writing. While he is not purposefully ambiguous as is Alan Greenspan, it is very thick. The following examples depict how the original text has been transposed into blogish.

The title "We Must Change Policy Direction," to "Change Policy!"

A sample paragraph: "Re-establishing seriousness of purpose regarding economic policy and acting to meet the challenges of our era will require our political system to do what it is not doing today: making choices that are very difficult politically, compromising among divergent views in order to reach common ground, and putting aside ideology in favor of facts and analysis."

This paragraph was omitted as superfluous. Had it been included, it would have read, "We need to get together, face facts and show some backbone before it is too late."

Mine is simply an aggressive rendition of Rubin's opinions. They are not my own, even if there are some similarities.

Tuesday, January 24, 2006

A jobless recovery is not a recovery III

In 1946, the object lessons of the Great Depression and then World War II were fresh in the minds of the people and their lawmakers. They knew that the Depression was only the deepest in a series of crippling troughs that had afflicted the prewar capitalist economy. Previously these events were called "panics." (The much milder downturns subsequent to World War II have been termed "recessions.") But the Great Depression was the formational event of generations.

The economics of this period was energized by three things: the development of Demand Side economics under John Maynard Keynes (KANES), the commitment of many of the most capable minds of the era to solving the social pandemic of Depressions, and the patent fact that the successful economies of the 1930s were those of Nazi Germany and Stalinist Russia.

The economic discipline suggested by Keynes, which is now considered so left wing, actually delivered capitalism from its own internal contradictions. The mobilization of the country during World War II demonstrated beyond a doubt that government action and organization could effectively focus the apparently uncontrollable energies of a capitalistic market economy.

What emerged from the Depression and the War has been called welfare capitalism or social capitalism. It was not the unfettered capitalism of pre-Depression years, but capitalism nonetheless. To be clear, though he was a prominent figure in political circles, and an able advocate, no country implemented Keynes' prescriptions as a blueprint, not even Britain. Roosevelt's New Deal was more an American invention than a knock-off of the British economist's ideas. To demonstrate his reach, however, realize that prior to Keynes macroeconomics did not even exist conceptually.

The Americans, followers of Keynes and others, who schooled themselves on the Depression and instituted the New Deal, were key players in the financing and industrial organization of World War II. They then managed a very dicey transition back to peacetime. After that they sponsored a postwar economics focused on jobs, and won the peace with the Marshall Plan to rebuild Europe (arguably saving democracy and capitalism there). From this period arose the steady trend line in growth we now take for granted. (We take more or less steady growth for granted even though it has not been the experience for half of our population for the past 25 years.)

Richard Nixon said in 1972, "We're all Keynesians now." Since the moment he spoke the words, they have become less and less true. The stagflation of the 1970s, the Supply Side debacle of the 1980s, even the return to fundamentals under Clinton and Rubin in the 1990s, and especially the bullshit first, ask questions later, policies of George II, have left us adrift in a confusion of laissez faire combined with corporatism that allows only tinkering at the margins.

The successful economy of the 1950s and 1960s and 1970s has gradually been left behind. Calling the current US economy successful when its citizens are hungry, cold, sick without care, homeless, uneducated, clinging to meaningless jobs, unable to meet clear and obvious environmental challenges, uncertain of their futures, is simply sick. The class structure that has emerged and now demands dominance is not a necessary evil to promote dynamic markets. It is simply decadence and decay.

The successful economies are those of Scandinavia, where 50 percent of GDP goes to taxes, and the government is a true partner with business and labor. That 50 percent includes true social security with health care, plus other high-value public goods, including government sponsored R&D that helps business. (Helping business in America means tax giveaways to the rich and powerful.) Even to dream of this system is impossible in the political and economic climate of modern America.

We sit at a crisis point in the governance of the country, a crisis point in the ecological life of the planet, and a crisis point in the social welfare of our society. We see education, energy, transportation, health care, the environment as burdens too heavy for our aging population. We experience a globalization captured by corporate powers and have little idea of what to do about it but object. We hear a lot about the information economy, and the needs of the new technical age, and looking forward is essential. But equally important is to reform the old technologies and systems, to rid ourselves of the entrenched corporatism that controls them, and to regain control of the government, with its disastrous incompetence and cronyism, they have put in power.

The magic of the 1990s was new industries, the tech industries, that demanded skilled workers and created an upward mobility that refreshed everything. Rational work-first economics is still viable. It requires appropriate valuation of public goods such as education, environmental balance, public health, etc., and the willingness to structure government and the market accordingly. These many challenges can be the very engines of growth, if we but define value and then create and realize that value by putting people to work.

That would be a recovery.

Saturday, January 21, 2006

A jobless recovery is not a recovery II

Employment growth is the best simple measure to watch in judging economic well-being. GDP is misleading. It describes the agitation of a market economy and includes borrowing as earning. We covered that last week. Employment is better. Aside from the obvious benefits to job holders and their families, which ought to be a primary consideration, job growth is closely related to investment, balanced budgets, falling poverty levels and other measures.

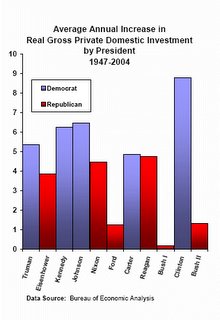

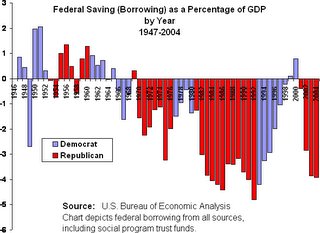

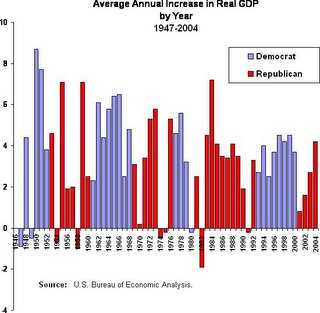

The following charts describe economic performance by president. (I am pressing them into service for the present discussion because they're what I have at hand. ) We can assume that presidents determine economic policy and that Democrats are more bottom up vs. Republicans top down.)

First, notice the correlation between investment and employment. Employment growth and investment are mutually reinforcing and create a productive cycle of growth. Investment creates jobs which creates demand which stimulates production and more investment, which creates jobs which stimulates.... You could begin with jobs create demand which stimulates production and investment.... Or demand stimulates production and investment which creates jobs which stimulates....

This last was the genius of Keynesian fiscal stimulus. It has been bastardized by the current administration to read tax cuts for the rich are good for the economy. In fact, tax cuts for the rich do not create demand because the rich spend out of accumulated wealth, not out of new income, which they just put in the bank. The same money to the poor or middle class -- boom! The sonic barrier. Cuts to social programs are patently inefficient economically.

It is a cycle. One element cannot be isolated and glorified to the exclusion of the other elements. Trickle down economics has attempted to isolate investment through investment tax breaks and preferences to savings. Insofar as these reduce demand from other sources or jobs, the experience is frustration. Witness the abysmal performance of Supply Side measures under Reagan. I do understand that all investment is not created equal. Investment in palatial residences will not yield the same long-term benefits as, say, investment in energy technology.

Next, notice the absence of a relationship between the unemployment rate and employment. The unemployment rate is calculated as the number of unemployed people looking for work as a percentage of the total civilian labor force. The labor force expands when there are good jobs to be had, and it contracts when there are no jobs worth having. People go to school, go on disability, go underground, hang out, become "discouraged workers," etc.

This expands and contracts the denominator, which makes a weak measure that unfortunately has been relied on too much. The Fed, for example, treats the unemployment rate as sensitive indicator of impending inflation, which it is not.

(To be fair, see that these numbers are through 2004. I guess W is finally on the positive side in terms of creating jobs. New annual numbers are out next month.)

Just so we cover it, and assume that employment growth means bad news for profits, notice that profits are steady in all weather -- as a percentage of total income. The implication of this "as a percentage" is that Democrats and stronger growth mean a stronger bottom line in absolute terms as well. The fascination of corporations for Republicans has more to do with CEOs and managers and an insider control mentality than it does for all shareholders' interests.

The business community seems to be captive to the Republicans, even small businesses, though I suspect it is more the organizations that purport to represent these folks that are in the Republican camp (easier to lobby for tax breaks than sound economics?). But look again at the jobs numbers when you hear, "Being a successful businessman, I know how to create jobs." Entrepreneurs are in the business of identifying opportunities for investment, which means potential demand. Investment can be stimulated by technical innovation or pressing public need or other factors. Jobs are created by the cycle of investment and demand as identified above.

Now, see how GDP is stronger under Democrats, but kind of respectable under Republicans. This is because -- thump -- a lot of that GDP under the GOP is generated by borrowing. I posted the federal borrowing chart last week, as well as a measure unique to me called "Net GDP," which was GDP minus federal borrowing, what GDP would have done without the borrowing. If you look that one up, you will see its similarity to the two charts at the top. Federal borrowing as a short-term stimulus effort is okay. It cannot become a way of life, as it has under Republican administrations.

Finally, in a chart that is not going to come through very well on the blog, but I find in my tedious way extremely fascinating is the unemployment rate year over year. I know I just panned the unemployment rate as flaccid and weak on fundamentals. But look, under Democrats the unemployment rate goes down, like stair steps, consistently, no matter what other evens are going on, no matter how many new job-seekers come into the market. (Exceptions, 1948, when Truman had to deal with 9 million men and women returning from service in the War, and in 1980, when Volcker panicked and restricted the money supply and Carter choked under the Iran crisis.) No matter how big the denominator gets, the numerator outpaces it. Very cool.

Debt, monetizing debt, lying about debt

It's not that I mind filling Social Security Retirement and other funds with federal bonds. What I mind is the bankrupting of the operating budget by incompetence and lying and then concealing the extent of the crime. The level of borrowing is an important measure of solvency. A bond is a debt instrument. Claiming we're not borrowing when we are is a fraud.

I also mind the hoopla of a couple of Republican Senators objecting to this casino financing in the name of fiscal responsibility. This is strictly a show for the benefit of the folks back home. Big debt and Republicans go together (see chart).

The great preponderance of debt, as you can see, has been incurred during the stewardship of Republican presidents.

This is business as usual for them. Much like John Ashcroft showing up behind the desk of his own K street lobbying firm is business as usual.

A NYT story says that in an hour long interview, "Mr. Ashcroft used the word ‘integrity' scores of times." )

Integrity for Ashcroft is similar to fiscal responsibility for Republicans as a party, just labels on marketing props, not actual codes of conduct. The amount we owe has now ballooned to such an extent that, along with the impending expansion of Social Security and Medicare and the unwillingness of the GOP to face facts, the continued solvency of the federal government has come into question.

Will we be able to raise taxes to the level needed to pay off these debts and meet our entitlement obligations at the same time? Particularly when the party putting on the show is the hate-taxes party? Some financial advisors and economic observers have begun talking openly about "monetizing the debt."

"Monetizing the debt" is lingo for using the printing press to pay off bonds. It's an act of desperation. Obviously it is not expected by investors, because US government bonds are still trading at a high price. But they should worry. The security and liquidity of government bonds, which is why they are trading at such a price, is not guaranteed.

Most folks worry about inflation, which is inevitable with monetizing debt. I worry about default, or a "change in terms," where bonds are not paid as promised, but on an "adjusted schedule." After all, the printing presses are in control of the bankers, the Federal Reserve being the central bank. Bankers hate inflation. Screws up their interest rate calculations. Or it could be a combination.

Whatever happens won't be pretty. These are financial stresses never before seen, and the fallout will be both domestic and international.

But what else do we do? We are incurring debt at a sickening rate. Pretty soon money is going to cost more. Rising interest rates will mean a slowing domestic economy and higher debt service for the government.

In ten or fifteen years (no, not tomorrow), or when the cracks become apparent, we're into the deep doo-doo. In the Clinton era, Rubinomics combined with very low energy prices gave us the break we needed. Unfortunately, we didn't take advantage of it.

# Posted by Alan : 9:48 PM

Thursday, January 19, 2006

Good news on midnight budget machinations

Southwest Washington's Rep. Brian Baird was understating it with "a shame, a disgrace, and an embarrassment that these critically important bills were brought up in the dead of the night, laden with unrelated provisions, and passed by sheep-like members who had but the slightest idea what was in them.”

The subject was the "martial law" gambit by which Congressional leaders evaded normal House rules for the budget reconciliation and defense appropriations bill and rushed through a 774 page report between midnight and 6:00 a.m. December 19, exactly one month ago. (The affair was lost a bit in the furor over ANWR drilling, foiled nicely, thank you, by our state's junior senator.)

“The people’s elected representatives deserve time to read and debate legislation that will have such an enormous impact on our national defense and domestic programs,” said Congressman Baird.

They didn't get it. The final vote on the reconciliation spending bill was taken after all of 40 minutes of debate. Never mind a monopoly on power, some things still need to be done in the middle of the night.

That is the bad news. We told you about it at the time. There is good news.

The Senate deleted some minor provisions and the bill has to go back to the House for another vote. This time there will be no confusion about what the legislation would do, and maybe some public accountability. The next vote may be as early as February 1.

The bill as it sits now:

- Increases in Medicaid co-payments and premiums, and reductions in Medicaid benefits (many affecting children), that total $16 billion over the next ten years, according to the Congressional Budget Office.

- Institutes substantial and controversial changes in welfare policy.

- Reduces in child support enforcement funding which would, according to CBO, mean $8.4 billion of child support over the next ten years will go uncollected.

- Delays certain SSI payments for up to a year for many poor individuals with disabilities who are found eligible for SSI.

- Changes federal foster care rules that will hamper states from supporting certain relatives who are raising children because the children’s parents are unable or unfit to do so.

- For the first time since Medicaid began, the conference agreement allows states to deny contraception to poor women. Family planning services are a mandatory under current Medicaid law.

- It drops key elements of the Senate bill that would have garnered substantial savings in the corporate exploitation Medicare and Medicaid programs.

- Abandons the Senate's preference to eliminate a $10 billion fund to encourage preferred provider organizations to participate in Medicare.

Tuesday, January 17, 2006

A jobless recovery is not a recovery Part I

GDP is a bad measure of economic activity. It does not measure the health of the economy, nor the well-being of its citizens, only the agitation on the market side. Wars, crime, alcoholism -- the economy's "bads" -- count just as much as the "goods" of food and shelter.

Environmental damage is completely ignored. Actually, we count the clean-up in GDP, but the original damage? Didn't happen. Also see the current Bush defense of oil-based energy policy. No longer does he doubt the science of climate change, now he says our economy cannot afford to do anything about it. Bill Clinton has labeled the claim "flat wrong." (What happened to "Bull!"?) Clinton has, in fact, proposed an economic future for America based on the development of energy technology.

An alternative measure to GDP -- the Genuine Progress Indicator (GPI) -- which takes into account the facts on the ground is actually down more than 45% since 1975.

GDP counts borrowing as earning. And growing debt is the only explanation for the current rise in GDP. The value of goods purchased, added together, equals Gross Domestic Product. This is like adding your paycheck to your credit card balance and calling the total your earnings.

Am I just a loyal liberal footsoldier dissing the good news of GDP and exploiting the bad news of massive debt, falling incomes and tepid employment growth, all for the prurient interest of my fellow radic-libs? I don't think so.

I am more like the nonplussed Frenchman who objected to the US invasion of a Middle East country on flimsy pretext. When the adventure turned out to be a catastrophe, I was not surprised. The economy is similar. I'm just happy economist jokes are less offensive than French jokes.

The parallels are striking. The Bush-Cheney axis decides what they are going to do, and the facts and "official" rationale are relegated to the PR department, where they will be adjusted daily for public consumption. In Iraq, the "imminent threat of WMD" changed to "getting rid of Saddam" changed to "establishing democracy."

With tax cuts, Bush first promoted them "because it's your money" (talking about the surplus). Subsequently we learned it wasn't our money, after all, it was our kids' money. But, don't worry, it's not going to us anyway, it's going to the rich.

When things started to tank, tax cuts became "a necessary measure to help the economy after the terrorist attacks." This is, in fact, the line that sold Congress. Bull! One, 9-11 had a mild effect at most on the economic trajectory. Airlines, for example, suffered far more from fuel prices than from the temporary discouragement of travellers. Two, and more to the point, the Bush tax cuts and the shameless slicing away at our social and educational programs cannot help the economy. That policy gun is pointed 180 degrees away from the target. To improve spending and consumer confidence, and thus demand for domestic business, fiscal decisions should favor the middle and lower class, not the rich.

Now he says, "Stay the course." If we are lucky, the course is circular, because off the bow it looks like we are heading straight for the rocks.

Next time, a look at employment as an alternative measure of economic health.

Sunday, January 15, 2006

Is China dumping the dollar?

Why? What does it mean? John Campanelli at DKos says, "In sum, we're screwed." (It was more descriptive yesterday, but has apparently been edited down.)

This was and is inevitable. "Trade" is trade of goods through the medium of exchange, the currency. It is not trade of the currency for the goods. It is supposed to be goods for goods. China can't eat all the dollars it has absorbed in its years of trade surplus with the US.

Standard economic theory predicts that in situations of trade imbalance, the currencies' exchange rates will adjust, making the goods of the surplus country relatively more costly and those of the deficit country more cheap. Standard economic theory, so far as I know, does not have an answer to why this has begun only after 30 years of immense US trade deficits -- if it is even happening now.

The dollar's value as de facto reserve currency may have made it valuable in itself. Remember, the last truly stable exchange mechanism went down with the collapse of the Breton Woods system under Nixon. Currencies have floated against each other since then, often to the detriment of the weaker nations. A notable exception is the aforementioned China, which pegs its ruan against the dollar and does not allow it to float.

Be that as it may, if as the Post report suggests, China is moving away from the dollar toward the euro, what is the catastrophe that will follow?

DKos put their finger right on it. The main problem is PANIC!

Markets operate on the principle of the herd. The currency market is a herd of rhinos. Too many people have too much money stuck in too many dollars. If they get spooked and the run starts, it could get ugly before it is over, as they try to get out before their investment loses value. This has been a worry of the Progressive Caucus of the US House for a decade. That group extrapolated a run on the dollar from the experience of the Asian currency crisis; they identified rogue speculators as the likely cause. There was some support at the time for the Tobin Tax, a tiny tax on currency transactions that would not hurt legitimate trade, but would multiply for speculators as they roam the world in search of small gains.

The cause of the dollar's demise will not be speculators, although George Soros and others stand to make a bundle from their short positions in the greenback. The dollar is the victim of decades of trade deficits, the renewed and now apparently unending federal budget deficits, and the myopia of the Federal Reserve.

A simple depreciation of the dollar which did not produce immediate panic might not be so bad. The goods of Boeing and other American manufacturers would be more competitive. It could ease our sea of red ink, since most of the debt is denominated in dollars. But it would be bad for prices. Imports would go up. American goods would be bid up by foreigners. A key commodity that we cannot avoid importing is energy, oil and natural gas. Some of the recent rise in oil prices is, in fact, not an increase in the price of oil but a decrease in the value of the dollar. Energy price increases would increase costs for manufacturers, and it would create a cost-push inflation.

Inflationary pressures will always cause an overreaction at the Fed. The Fed will panic. Anything over 5% will bring out the artillery. It doesn't matter that energy costs are reducing the purchasing power of American consumers, the Fed assumes that any inflation is to be snuffed out by higher interest rates. The distinction between cost-push and demand-pull inflation is invisible to Alan Greenspan, his successor and all the bankers who control monetary policy. Whenever they see inflation, they see an overheated economy and they apply the remedy, higher interest rates, tighter credit and higher unemployment. (Of course, you can't have people borrowing expensive dollars and paying them back with cheap ones, but you have to have some sense about it.)

I am not predicting the future, I am predicting the past. It has been the uniform, universal, continual and unchanging response of the Fed, when inflation rises, to pour water on the fire, even if inflation comes in the form of rain. It is not inconceivable that higher interest could lead to higher costs and thus to the dreaded "spiraling inflation." More panic.

The appropriate response to a significant depreciation of the dollar and consequent inflationary pressure is to take our medicine, which is the sea change in the price level. This will not be happy news to those whose non-indexed pensions lose their value, or to those workers whose wages do not follow the general rise in prices, or to those sectors who are left behind, or to those investors .... to a lot of people. But it is a return to reality and the inevitable result of a significant decline in the dollar.

But don't worry. That won't happen. The Fed most certainly will not allow a sea change in the price level without a fight. They will misidentify the cause and apply the nuclear remedy. Millions of unemployed will be the unwilling soldiers drafted into the battle. This will not lead to any other destination, but will make the road there a lot more volatile and dangerous.

A significant depreciation of the dollar would have one more result. Economists would have to pay attention to trade deficits again. During the Reagan years, trade imbalances were the big econom news. Economists explained them by pointing to the Reagan budget deficits, saying the higher interest rates needed to attract capital into bonds produced a higher dollar. The higher dollar disadvantaged domestic manufacturers. The period is often called the de-industrialization of America.

Unfortunately for economists, the budget deficit went away during the Clinton years, but it did not take the trade deficit with it. In fact, the trade deficit increased. Economists simply ignored their mistake and switched to the "they like us" model. Trade deficits were good because the capital inflows (the dollars returning to the land of dollars) meant the rest of the world thought America was a good place to invest.

Now we simply ignore it and pretend things are okay. After all, it's been like this for a long time.

Until now.

Saturday, January 14, 2006

Economic prognosis from the state's forecaster

Moore did a good job, but I've covered the budget elsewhere.

One Note: Low-income heating assistance has already passed both houses and been signed by the governor. The Guv had called for speedy action. She got it. Kudos.On the revenue side, Sohn's revenue update for January 10 shows another increase to the surplus. Real Estate Excise taxes were up 6.5% and Revenue Act taxes (retail sales, B&O, utility, mostly) were up 4.1%, netting a neat $27.8 million. The update displays a drop in school levy collections without explanation, and what is likely to be a continuing disappointment in cigarette taxes (as smokers avoid the tax by stopping or smuggling).

Quite a difference from the disgrace in the other Washington, where in an apparent fit of pique over losing drilling rights in ANWR, Republicans took federal low-income heating assistance off the table. It had lost its meaning as a bargaining chip. See December 27, NPI "Payback ..." post or CBPP.

To the committee, Sohn was slow in his delivery, but he was pointed on one topic. He said that while the acceleration of housing activity would level off, the sector would continue to be strong, and would not collapse. This and continuing higher oil prices were the two primary economic determinants for the coming year.

When asked about interest rates, Sohn pointed to the rise in short-term rates due to Fed action, probably to 4.75% later this month, while long-term rates seem to be stuck at 4.5%. The good doctor did not fret, as some others have, about the so-called interest rate "inversion," (although it was covered in his November forecast). Short-term interest rates should always be lower than long-term rates, because of the risk premium.

Interest rates are a poser. As Sohn points out, short-term rates are rising. Long-term rates ought to be rising, too. But they're not. Is this a good thing? Or does it indicate basic weakness? (Or maybe strength? There are many who see it this way. Imagine stable, low interest rates as far as the eye can see. It's a worthy goal, but this is not how you do it. I am reminded of Dow 36,000 and the "New Economy" of the late 1990s, an economy which had finally outrun recessions.)

Long-term rates should be rising not only to reflect short-term rates plus risk premium, but because mortgages and federal debt are stoking demand, while at the same time the weakness of the U.S. trade situation should be weakening the dollar.

The fact that long-term rates are not rising means to me that there is plenty of supply. Which means investors want safety over return. Not a good sign. Boomers are scared out of the stock market. Asian countries are flush with the booty of huge trade surpluses and are stashing dollars. Wealthy individuals have tax cuts they don't know what to do with. It certainly ain't coming from working families, since household debt has increased markedly since Bush got in, and net savings went negative for the first time in history according to a December report by EPI.

A creative alternative explanation is available at the Economist's View blog. (Please keep in mind when reading this stuff that inflation has been dormant since the early 1990s, and Greenspan gets the credit no matter what he does, raise the rate to 7% or lower it to zero. Please review my previous takes on Maestro Magoo, and discard the idea that the market has confidence in the Fed.)

(The Economist's View blog and this one would be useful to compare over a period of time. The author believes housing is poised to take off again. I do not.

An end to the bubble or no?

Predicting an end is not so difficult. The alternative is to forecast a boom that goes on forever, like the .... Well, I guess we haven't had one. If it's a bubble, it will burst. This is my opinion. When houses stop appreciating, things will not flatten out, as Dr. Sohn predicts. They will begin to descend, because the speculative motive will have disappeared. Dean Baker of the Center for Economic Policy Research has shown that house prices are already well outside their historic relationship with the rental market. It is by no means the case that houses are being bought exclusively by first-time homebuyer. Quite the contrary. Prices are often outside the range of this group, except with the off-the-wall mortgage instruments.

Dr. Sohn's view is that this is not a bubble, but a run-up in housing that will level off benignly. Thee are plenty of folks who present this view. I hope so. Though if you've made your money, you might want to get out of the market now, just to be safe. You could always put your gains in ... government bonds.

Thursday, January 12, 2006

The surplus is off the table

Chris Gregoire did not say the V word, but the implication was clear in her message to the legislature Tuesday. She did not say, "I'm sure we all want to do the prudent thing, so let's make nice and be cautious." She did not say, "Let's all go along to get along." She said,

"As we look ahead to the next year, we will need every dime just to cover the increased cost of our existing services, particularly in education and health care.The people in the chamber understood her, even if the news reports the next day missed the point.

...

"Saving the amount of new revenue I propose is something that has never been done before – but its time has come. [This is] a budget that is practical, prudent, and responsible. I accept the fact that we may have differences over how to spend this supplemental budget. But let me be clear, I cannot sign a budget that next year would require cuts harmful to the people of this state."

And they did.

Most reports I saw were along the lines of "a laundry list of spending proposals thrown out by the spendthrift Democrats." In other words, wrong.

Gregoire's budget has some mandated spending increases, for caseloads and teachers COLAs and the like. But there are very few new proposals -- biodiesel, cleaning up Puget Sound, low-income heating cost relief. And there was detail and organization, showing this may be visionary, but it is not pie in the sky.

The press is still preoccupied with looking for some kind of illegitimacy in Gregoire's election. Get over it. The judge threw every Republican argument on the legal garbage heap. Rossi couldn't salvage a scrap to cover an appeal. These guys in the press wouldn't know fraud if Kenneth Blackwell bit them on the leg.

(I notice nobody on the Republican side of the aisle has proposed a change to the process, in spite of their demands for a revote last time.)

Again, this budget and the address to the state legislature Tuesday demonstrate leadership. There were clear priorities, concentration on core missions, and little doubt about the direction. This is the kind of person who will get us where we want to go, whether or not you agree with her on every jot and tittle.

I think it has to do with her coming out as who she is. This is the lesson of Paul Hackett. Don't give them what the focus groups say they want, give them who you are and what you believe. Otherwise, as with a certain former governor, you end up looking superfluous, like someone hunting for a parade to jump in front of.

Another leader who has apparently been talking to Gregoire is John Kitzhaber, former governor of Oregon. The Guv's health care discussion has nuances that seem to be right out of Kitzhaber's excellent new proposal. Kitz is another real person. Check out his program at the Oregonian or the Onward Oregon blog, January 9.

Tuesday, January 10, 2006

No wonder they chose the color red

"Political business cycle" was a term used to describe the ginning up of the economy just prior to a presidential election. The data in these charts describes another political business cycle.

Subsequently, Ronald Reagan erased the memory of the most desperate recession in postwar history (1981) with some good economic news in 1983-84. Never mind the debt we are still paying off. George Bush I did not get the response from Alan Greenspan he needed, and thus not the bump he needed.

Jimmy Carter was perhaps the worst player, since he backed off expansionary policies out of fears for inflation, suffered a slowdown in the last year of his first term, and did not see a second. Clinton was surely aware of the phenomenon. He didn't need to do much but crow in 1996, but in 2000, he made a calculated and unprecedented move to release stockpiles from the strategic petroleum reserve to cut energy prices in the year running up to the election. I still think if Gore had run on the economy, he would have won, instead of running on ... morals? Well, whatever he ran on.

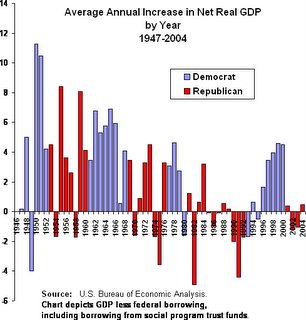

The following charts have nothing to do with that. These simply describe the behavior of GDP and budget under the administration of the two parties. "Net GDP" is my formulation to show what the economy would have done without the borrowing. GDP is more a function of demand than supply, and when you increase demand by borrowing, GDP loses its usefulness in describing the health of the economy. Nobody is going to say credit cards are the same thing as paychecks.

If you want to get the full discussion, you'll have to buy the book. But this is what happens to GDP when you subtract the borrowing (or add surpluses), including the borrowing from Social Security and other social programs.

Note to W: Borrowing massive amounts of money because you cut taxes on the rich does not lead to economic strength.

Sunday, January 8, 2006

History Sez: Budget surpluses lead to program cuts

Experience contradicts a recent Yakima Herald Republic piece that began, "When the state Legislature convenes Monday, you can bet that $1.4 billion surplus is going to be burning a hole in its collective pocket -- despite promises from everyone from the governor on down to be 'prudent' .... Every special interest in the state will argue that its desire for more money and new programs will best serve the young/ old/ poor/ underprivileged/ needy/ disadvantaged/ most deserving." cite

Wrong.

In fact, both at the state and national levels, and with the enthusiastic support of the wingnuts at the Yakima paper, short-term budget surpluses have been turned into long-term program cuts. How? By cutting taxes irresponsibly. Tax cuts have swamped spending increases. Since taxes are simply the financing mechanism for public goods, when you cut taxes, you cut public goods.

(What used to be one of my favorite columnists, Peter Callaghan of the Tacoma News Tribune, pulled out the same stereotype in a column in mid-December, although I see he recently has attempted to finesse the issue, saying the legislature "and initiative writers" have historically "spent" surpluses in the form of tax cuts.

At the national level, the budget surplus passed on to the Republican power elite was transformed overnight into tremendous tax cuts. The cuts were portioned out as an early snack for working families followed by an unending series of banquets for the already wealthy. These tax cuts have been absorbed primarily by borrowing, that is, shifting the taxes plus interest to our future selves and after we die to our children.

The Radical Right has sold the notion that we can have the house, but paying the evil mortgage is optional. In order to maintain this myth, we are literally taking out more loans to make the monthly payment. When the day arrives that we need to pay both our current tax bills and that from these Bush giveaway years (plus interest), we will be facing some very tough choices.

Now these self-created budget deficits have offered Republicans an opportunity to grandstand, trumpeting as "fiscal responsible" cuts in social programs, student loans, Medicaid benefits, and child support enforcement (of course). These cuts are short-sighted and mean, and are driven only by ideological myopia. Rescinding the tax cuts for the rich is the fiscally responsible move.

Here in the state, we are all familiar with the Eyman initiatives which sold the voters "painless" tax cuts. They were painless only as long as a temporary surplus numbed our nerves. That anesthetic wore off quickly and we are still suffering. (Pity the cities and transit agencies whose tax base was lopped off. The state filled in its own holes with sin taxes, but has left local agencies to bite the bullet.)

The $1.4 billion surplus is an uptick in a downward trend. It needs to be allocated along the lines of Gregoire's supplemental budget proposal -- reserving the bulk of it against the shortfalls ahead. This can be an object lesson on the inadequacy of the state's revenue architecture. By following the governor's lead, the Dems can demonstrate which party is fiscally responsible in both Washingtons and make selling responsible tax reform much easier when the time comes.

Saturday, January 7, 2006

It was George W, drunk at the wheel!

The problem of a supine media is not only that they deliver lies so long as they are spoken by the President in front of the flag, it is also that there is no place to go to find the truth that is not under attack by the Radical Right. Reporting has become a balance of "opinions." This is confusing to the nonpolitical, and they would prefer to tune out the raucousness. This, and the need to win politically and soon, have distilled themselves into a recurring dream.

I am in the front passenger's seat of the car. It is dark and raining. Mom, Grandma and the two kids are in the back seat. My idiot brother-in-law is driving, and he's drunk. I'm telling him to watch out, pull over, let me drive, and he's just getting madder and going faster. I'm faced with the dilemma of whether to try to wrestle the wheel away, pull the key from the ignition, or continue a fruitless argument."Democrats can't win and Republicans can't govern," it is said. The Right has focused on winning at all cost and gotten hold of the keys without learning how to drive. But winning has to do with getting the people in the back seat to say, "Pull over George. Let John drive." Getting them to say that means we need to talk to them where they are, about the issues they can see.

The folks in the back seat definitely know something is wrong, but they can't quite see what. I try to tell them, and point out the lurching and hitting barricades and driving in the wrong lane against traffic is not what we want. But the idiot brother-in-law screams louder about how I'm trying to destroy the family and it's my jealousy and all kinds of BS that don't even make sense to me. I look over, and it is not my brother-in-law, it is George W. Bush with his knuckles white on the wheel.

The dry drunk has control of the car. The people with the real power are the people with the purses in the back seat. He will do what they tell him, but they're scared, confused and can't see clearly out the windshield.

This does not mean abdicating the defense of the Bill of Rights nor foreign policy issues that get indistinct in the mist of competing claims. But the same sponsors that brought you the lies of Iraq bring you the lies of Big Oil, the Medicare drug fiasco, the denial on climate change, the corruption, and inevitably the absence of security.

One trick the Rove media machine pulls out is to make outrage look like hysteria. And a little bit of excess neutralizes a lot of good when it gets twisted by the master. Look like what happened in the George W was AWOL situation. The guy got special treatment from pulling strings, didn't show up for training, and at best sat in an office reading magazines hiding from the War, but because CBS ran a piece with some forged papers, the issue is neutralized. Never mind that the roster of chicken hawks didn't serve, compared to the Democrats whose patriotism they challenged.The issues that resonate with the back seat are everywhere.

Who remembers the duplicity exposed in Newt Gingrich's phone call? All we remember Jim McDermott's endless defense against the leak.

The first one is character. It is becoming more and more clear that you cannot trust these guys. Enumerate the One Thousand One Lies of George W. Bush. This is even the softest spot about Iraq, the intentional public lying. The corruption, both the Abramoffs and the Enrons.

Then security. Climate change with no possibility of a missile shield, the incompetent ignoring of the WMD stockpiles in the former Soviet Union, and really, the inadequacy of secret police action in protecting us against terrorism.

Finally, the economy. The evaporation of a surplus into an enormous and growing debt, the continual bleeding of jobs, losing the social safety net. Careful, don't get hysterical again.

Speaking to the people in the back seat is a little bit of what George Lakoff was talking about in his moral politics. The perspective is completely changed when W turns out not to be the solid citizen, but the drunk behind the wheel.

Thursday, January 5, 2006

It's SS, Social Security, not BS

Some folks decided to comment. Before I answer those comments (and while I cool down a bit), let's find one that resonates with many and hit a few high points on the social programs front. (If you must, you can join me in the mud at the end.)

"Social Security, Medicare and Medicaid consume nearly half of all federal spending, and within the foreseeable future could consume the entire federal budget."Because the population that is served by these great social programs is growing, the programs themselves are growing. They are, excepting Bush's Medicare drug boondoggle, well-designed and well run. Social Security is impeccably financed. Even critics during the recent privatization campaign pointed to complete solvency until 2030, and some even granted 2050. The operating budget is insolvent today by the same measures.

[Note: So when you hear "smaller government," please understand it is code for gutting these programs.]

The high points:

Point 1: Social Security is well run, costing 1% in administration for benefits to hundreds of millions of Americans.Financing advice to George II: When faced with easily anticipated costs (after all, the boomers weren't born yesterday), balance the books, shed debt and program efficiently.

Point 2: The Medicare Part D drug benefit program is, as Sen. Tom Harken D-IA put it, "a debacle." The giveaway to the drug companies costs too much and its creating confusion, anxiety and anger among seniors.

Point 3: President Bush, in mid-December, became the first and only president in the fifty-year history of the White House Conference on Aging to dodge the event. Preferring not to get feedback on his misbegotten privatization plan for social security or on the Medicare drug fiasco, Bush instead met in closed session with a hand-picked group of oldsters in a high-end gated community in suburban Virginia. (see NPR coverage)

Point 4: Only single-payer health care can cut the costs, bring corporate profiteering to heel, and deliver the services everyone needs. Such a system could be a boon to strapped state and local governments whose budget projections are blown up by ever-expanding health care costs.

Now for those pot-shots that missed the pot:

"The Social Security program is the epitome of our (selfish) generation saying a fiscal "F-You" to our grandchildren, and always has been. Despite the fact that the US Government has outlawed pyramid schemes, they have allowed this largest of all pyramid schemes to continue for almost 70 years."Listen to yourself, "pyramid scheme .... 70 years."

It is an intergenerational contract. We've supported it with patently regressive payroll taxes only because we like the program. Prior to the New Deal, retirement security was bought by having lots of kids and hoping they liked you when you got older. When social security arrived, children had the assistance of the government. Everybody's children supported everybody's parents. Instead of a room in the back, oldsters kept their own places. (Is this really so hard?)

From the same commenter:

"Contrary to Alan's statement in this article that Social Security "raised millions of seniors from poverty and humiliation almost immediately when it was enacted. Later revisions lifted even more. Its financing is impeccable in terms of internal sufficiency", Social Security started paying out very slowly - because no money had been paid in. And its financing is NOT impeccable, because it depends on contributions from a workforce that is increasing at a MUCH lower rate than are the ranks of those who will receive benefits."Please see the SSA's history. A program of this scale had never been tried. It was passed in 1935. By 1937 people were registered, and the program began. In March, the first lump-sum benefit was paid (albeit only 17 cents). In the first year $1.25 million was paid out to 53,000+ beneficiaries. By 1940 $35,000,000 was paid out to 222,000 beneficiaries. Dependents and survivors were added in 1939, disabled workers were added under Eisenhower, and SSI was established by Nixon.

Yes the workforce is increasing slower than beneficiaries. That's why we've been paying into the trust fund. And don't tell me we haven't been paying. The trust fund will continue to run $200 billion surpluses into the next decade.

"Had Congress never been allowed to tap the SSI Trust Fund, the program would be OK. But because Congress has spent all Social Security moneys collected since the 1950s, and all that is in the Trust Fund is a series of IOUs, the program is somewhat of a joke to begin with, and is definitely on shaky ground. This did NOT start with GWB; it started with the 40 years that Congress was controlled by the Democrats, starting in the 50s."Bull. These "IOUs" are government bonds. Until George II, US bonds were considered the safest investment in the world. These are not IOUs.

Bull 2 Reagan and the two Bushes built the debt that bleeds the trust funds, not Democrats. Democrats are the party of fiscal responsibility. Democrats have produced the only balanced budgets, under Truman, Johnson and Clinton. Only Eisenhower among Republicans produced responsible budgets.

"The revisions to the program that Alan speaks of so reverently will ultimately be the downfall of SSI. It was never intended to be a retirement fund for everyone, or a social safety net for spouses or children of those who died before retirement. The selfish members of Congress over the last 50 years made changes to please their constituents that they knew would put more weight on future generations - to whom they would not have to be accountable.It's very thick in here. It WAS intended to be "a retirement fund for everyone and a social safety net for spouses and children." That was the explicit, loudly proclaimed and applauded function.

[The commenter confuses OASDI - Old Age Survivors and Dependents; Disability; and SSI. Not a big point.]

Social Security is solvent. It is the operating budget that is in disarray. And Medicare and Medicaid may not be in good shape. They are being exploited by people who pay themselves poor and used to funnel money to Bush's pharmaceutical donors, but these are not Social Security.

Another says,

"On one hand the liberals want to cut the deficit and on the other hand they want more spending. I don't get it!"This is the distillation of the crap. Is it liberal to want to cut the deficit? No, it is just responsible. Is it conservative to sabotage the government? I don't think so. Maybe.

Okay, that's it for the year. I won't do it again. I promise.

Tuesday, January 3, 2006

This recovery quacks like a hippo

A policy statement from the Economic Policy Institute ("What's wrong with the economy?" included the following numbers:

This is the trend. At this rate we are not going to survive our "recovery." Remember, we've added trillions of dollars in new debt to get here.Inflation-adjusted hourly and weekly wages are below November 2001.

Median household income (inflation-adjusted) has fallen five years in a row, from $46,129 in 1999 to $44,389 in 2004.

The inflation-adjusted debt of U.S. households has risen 35.7% over the last four years.

The number of people living in poverty has increased by 5.4 million since 2000.

More than 3 million manufacturing jobs have been lost since January 2000.

The personal savings rate is negative for the first time since WWII.

Private sector jobs are up a miserable 0.8%. (If this is a recovery, it doesn't quack like one. Never before has a recovery produced less than 6.0% job growth over the same time span.)

Households health care bills rose 43-45% for married couples with children, single mothers, and young singles from 2000 to 2003.

Nearly 3.7 million fewer people had employer-provided insurance in 2004 than in 2000.

Oh, the good news?

35% of the growth of total income in the corporate sector has been distributed as corporate profits, far more than the 22% in previous periods.

Monday, January 2, 2006

Think long term, like two years

Fully $900 million is set aside in reserve accounts and pension hedges, and rightly so. Much of the rest ($281 million) goes to cover caseload and classroom increases (in DSHS, Corrections, K-12 enrollment, teacher's salaries) that are required, mostly, to serve populations drawn to the state by its "strong economy."Today's revenue architecture is archaic and inadequate in Washington, a rattletrap of pre-war vintage. It is looking at handling $2.9 billion in new costs over the next biennium, according to preliminary estimates cited in the supplemental. These costs will suck up the Guv's $900 million in reserves and come looking for more. There won't be more. There will be less.

Washington does have strength in its economy with Microsoft and Boeing, high-tech, agriculture and trade, but these sources are not what is floating job growth nor the up-tick in Olympia's revenue. The source of those has been the housing boom, or bubble. I can't put my finger on it right now, but I read somewhere that half of new jobs in the state since 2000 have come in residential construction and services from mortgage lending to landscaping. State revenues benefit from the boom by way of retail sales, home sales, construction labor (which is subject to sales tax), and the added property value represented by new homes.

Once the boom is over, the hangover begins. The equity people have routinely taken out of their homes to pay their credit cards off disappears, along with its attendant spending, because house values will no longer be appreciating. Residential construction dries up, and with them the special sources of revenue strength to the state. And we are stuck economically.

Not only can we not cut taxes, we are going to have to add capacity. Because of the scale of new revenue needed and the fact that current sources are maxed out, this means we are going to have to remodel the system. It is no longer a question mainly of regressivity and fairness, it is now also a question of basic adequacy. Both can be addressed in the same reform.

The 2007-09 legislature may be the place. Democrats may expand their majority, and it would be a good use of political capital to get Washington's fiscal ship seaworthy for what may be some difficult economic times ahead.