In spite of the evidence, the Republican pretension that they are the party of low taxes and light government remains intact.

If you don't have a real issue, make one up, I guess.

By their incompetence alone they have created a government which is becoming more burdensome by the day, but it is not the damage of buffoonery I mean by "taxes." I am talking about real dollar payments by middle class Americans.

In some cases there are outright tax increases -- as with the loss of the sales tax deduction here in Washington. That's hundreds or thousands of dollars more you and I will owe on our federal returns next April. In other cases it is the paring back of government support, such as for child tax credits and college loan and grant supports.

Real tax hikes come in the form of deficits, too. These are taxes, just not this year. By borrowing from China, from wealthy America, and from its own social insurance funds to run the government, Bush, Inc., has effectively raised taxes on future America.

(We like to say "our children," but unless you're eighty years or older, those bonds are going to be paid back in your lifetime.)

Direct benefits to corporations through the tax code were instituted with the cuts in dividend and capital gains taxes.

These were extended last spring by Congressional action. As we've written here before, these were the highest priority of the Republican Congress. They were enacted in the spring because they couldn't stand the scrutiny of the election season. This is a direct shift of tax burden to Middle America.

But as big as these taxes are, most of the real dollars extracted by Republican legislation are paid to the corporate branch of the Party. Thus they escape attention. For Enron and Halliburton, Big Oil and Pharmaceuticals, government action has reached right into the pocket of Middle America and extracted the cash.

The hundreds of billions of dollars in excess Oil profits are taxes we pay to corporate America as a result of government (in)action.

These are taxes which result in nothing -- no schools, no roads, no police, no national defense. Considering the damage fossil fuels do to our health and environment, it is these payments which deserve the name "Death Tax."

The Great Enron Debacle was a huge tax on energy here in the West, a utility tax that drove some companies out of business and burdened households to the tune of thousands of dollars a year before the fraud was exposed. This was a direct result of corporations writing the regulations -- or in this case, the deregulations.

The Medicare Part D drug fiasco, which Central Washington's Doc Hastings played such a pivotal role in getting enacted, is a tax for the benefit of Big Pharmaceuticals.

By explicitly barring the government from using its market leverage, Congress ensured that hundreds of drugs are priced 10 to 70 percent above market value. This is shown in a recent study on the differential between Veterans Administration prices, but can also be gauged by looking at Canadian prices.

The difference is the tax.

Lastly, and most sadly, there is the tax of the Iraq War. The contribution of tens of thousands of Americans to our national future has already been lost, and every day we pay more in blood and treasure to this fiasco.

That sacrifice is trivialized by the Republicans' tax cuts for the rich. No sacrifice is expected on Wall Street or Park Avenue, even as we expect the ultimate sacrifice from these men and women.

A low volume, high quality source from the demand side perspective.The podcast is produced weekly. A transcript is posted on the day of.

Sunday, October 22, 2006

Saturday, October 21, 2006

Nobody spends like the GOP

Listening to Mike McGavick attempt to apply the "big spender" brand to Maria Cantwell reminds us that the GOP is not about issues, it is about propaganda. Jumping up and down on the "big spender" hot button may impress the few remaining Americans who haven't learned to check the BS gauge, but the rest of us have learned, when Republicans talk, the facts generally run in the opposite direction.

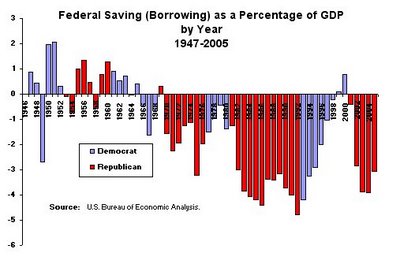

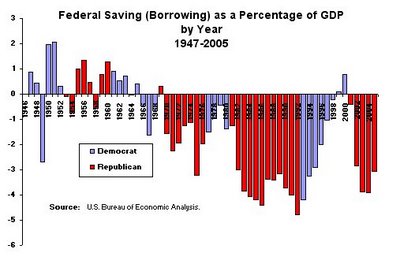

"Big Spender" is a line borrowed from Karl Rove's focus groups. It has little connection to the sorry record of the past six years. The Republicans have controlled both houses of Congress and the Presidency. Spending has gone out of control. Combined with the tax cuts for the rich, you have the most profligate administration in history. All the Democrats can do is watch.

Here's the deficit chart again. The numbers include -- as they should -- borrowing from Social Security and Medicare funds.

Portraying Democrats as big spenders is dishonest and absurd after six years of the GOP's fiscal follies.

"Big Spender" is a line borrowed from Karl Rove's focus groups. It has little connection to the sorry record of the past six years. The Republicans have controlled both houses of Congress and the Presidency. Spending has gone out of control. Combined with the tax cuts for the rich, you have the most profligate administration in history. All the Democrats can do is watch.

Here's the deficit chart again. The numbers include -- as they should -- borrowing from Social Security and Medicare funds.

Portraying Democrats as big spenders is dishonest and absurd after six years of the GOP's fiscal follies.

Friday, October 6, 2006

Next Washington is the Last Washington

The Governor's economic game plan is hard for a committed anti-corporatist to swallow. As our readers may know, the Guv is my favorite elected official.

Chris Gregoire is a leader, not a leaper in front of parades, not a facilitator, but one who determines what needs to be done and generates the energy and support to get it done. She's doing it in education. She's doing it in health care. In economic development, she needs to expand her sources.

As one who ascribes to corporations the authorship of the misery of billions and the frustration of most of the key public policies essential for a successful future, it is difficult for me to swallow the Governor's Next Washington project. (Check out the governor's prosperity page, too.)

This is the draft of Gregoire's economic game plan for the state. Marbled throughout it are all the elements of corporate capitalism which I hate so much.

It is embarrassing that the state and its governor are operating a deluxe welcome wagon for free agent corportions. Better we should take care of our citizens, including our current corporate citizens, through education, health care, transportation and disciplined regulation.

The Next Washington document came out ten days ago. I have not been able to get a critique together because Thomas Friedman's corporate bias has so thoroughly infected it.

The basics are also there, I admit. Number two is "Education is the single most important economic investment we can make."

The fact that there is no trade-off between economic development and enlightened environmental and social policy is explicit. But the absurdities are there, too, distilled in the conclusions (which does not match the manual of market capitalism, as usual) that states must compete for companies.

Corporations are the basic engines of prosperity. States and nations compete on the basis of cost as in cheap labor, on the basis of cost as in big tax giveaways, or on the basis of sophisticated public goods such as in an educated work force and sufficient infrastructure.

Of course, we hope to be in the last category, because we like education and sufficient infrastructure. But what happened to companies competing and states taking care of their citizens? That would be the situation right side up.

The Guv's Competitiveness Council document last spring was chaired by Alan Mullaly, or however you spell it, famous downsizer, outsourcer, tax code raider.

Once of Boeing, Mullaly is now downsizing, laying off and cutting everything except the earnings per share number at Ford. No wonder it concluded that corporations need welfare and the public needs to accept the harsh realities of the market.

It bothers me when the Guv says, as she often does, that when she goes to Beijing, she flies in on a Boeing jet, passes by a Microsoft office tower, and sits in a hotel across the street from a Starbucks, and it makes her proud.

Better she should reflect on the dozens of thousands of individuals in China benefitted by Washington's Universities. Those corporate logos don't represent five percent of the good that has come from Washington.

It is, in fact, by the education of people and by organization of our society through courts and regulatory agencies and by the facilitation of product movement via transportation systems that the state increases our common well-being. Those companies benefit from us and ride on our effort, not the other way around.

The role of corporations (at least if you look directly at how they act on the stage) seems to be to increase the benefit of stockholders and corporate managers wherever they live and whatever the cost to the rest of us.

Corporations adhere to this mission even if it means frustrating educated common sense. Nothing is more absurd, for example, than the current energy plan based on ever more extensive use of a shrinking resource that poisons the environment.

This is not the choice of anyone other than the corporate elite who muscled it in by way of their flunkies in the political process.

(Another parenthetical example is the dominance of public health care policy by corporate profiteers in the face of evidence and more evidence affirming that public health care systems are more efficient and less costly.)

By rediscovering and promoting the fundamental role of government in providing public goods which all can share -- irrespective of access to offices in Olympia -- the Guv will do far more to enhance economic development than she will be being the shill for corporate newcomers to our state.

Read the document. It's in discussion phase. Send your comments to:

Marc Baldwin

Executive Policy Advisor

Marc.Baldwin (at) Gov.WA.Gov.

Chris Gregoire is a leader, not a leaper in front of parades, not a facilitator, but one who determines what needs to be done and generates the energy and support to get it done. She's doing it in education. She's doing it in health care. In economic development, she needs to expand her sources.

As one who ascribes to corporations the authorship of the misery of billions and the frustration of most of the key public policies essential for a successful future, it is difficult for me to swallow the Governor's Next Washington project. (Check out the governor's prosperity page, too.)

This is the draft of Gregoire's economic game plan for the state. Marbled throughout it are all the elements of corporate capitalism which I hate so much.

It is embarrassing that the state and its governor are operating a deluxe welcome wagon for free agent corportions. Better we should take care of our citizens, including our current corporate citizens, through education, health care, transportation and disciplined regulation.

The Next Washington document came out ten days ago. I have not been able to get a critique together because Thomas Friedman's corporate bias has so thoroughly infected it.

The basics are also there, I admit. Number two is "Education is the single most important economic investment we can make."

The fact that there is no trade-off between economic development and enlightened environmental and social policy is explicit. But the absurdities are there, too, distilled in the conclusions (which does not match the manual of market capitalism, as usual) that states must compete for companies.

Corporations are the basic engines of prosperity. States and nations compete on the basis of cost as in cheap labor, on the basis of cost as in big tax giveaways, or on the basis of sophisticated public goods such as in an educated work force and sufficient infrastructure.

Of course, we hope to be in the last category, because we like education and sufficient infrastructure. But what happened to companies competing and states taking care of their citizens? That would be the situation right side up.

The Guv's Competitiveness Council document last spring was chaired by Alan Mullaly, or however you spell it, famous downsizer, outsourcer, tax code raider.

Once of Boeing, Mullaly is now downsizing, laying off and cutting everything except the earnings per share number at Ford. No wonder it concluded that corporations need welfare and the public needs to accept the harsh realities of the market.

It bothers me when the Guv says, as she often does, that when she goes to Beijing, she flies in on a Boeing jet, passes by a Microsoft office tower, and sits in a hotel across the street from a Starbucks, and it makes her proud.

Better she should reflect on the dozens of thousands of individuals in China benefitted by Washington's Universities. Those corporate logos don't represent five percent of the good that has come from Washington.

It is, in fact, by the education of people and by organization of our society through courts and regulatory agencies and by the facilitation of product movement via transportation systems that the state increases our common well-being. Those companies benefit from us and ride on our effort, not the other way around.

The role of corporations (at least if you look directly at how they act on the stage) seems to be to increase the benefit of stockholders and corporate managers wherever they live and whatever the cost to the rest of us.

Corporations adhere to this mission even if it means frustrating educated common sense. Nothing is more absurd, for example, than the current energy plan based on ever more extensive use of a shrinking resource that poisons the environment.

This is not the choice of anyone other than the corporate elite who muscled it in by way of their flunkies in the political process.

(Another parenthetical example is the dominance of public health care policy by corporate profiteers in the face of evidence and more evidence affirming that public health care systems are more efficient and less costly.)

By rediscovering and promoting the fundamental role of government in providing public goods which all can share -- irrespective of access to offices in Olympia -- the Guv will do far more to enhance economic development than she will be being the shill for corporate newcomers to our state.

Read the document. It's in discussion phase. Send your comments to:

Marc Baldwin

Executive Policy Advisor

Marc.Baldwin (at) Gov.WA.Gov.

Wednesday, October 4, 2006

Cynical GOP - 1, Prediction Tuesday - 0

In a move as baffling as it is inane, the Republican Congress failed to extend the deductibility of state sales taxes, costing citizens of Washington hundreds and thousands of dollars per year. Prediction Tuesday guaranteed last spring this would not happen, then promised again a month ago. We were wrong.

Republicans had used their window under the arcane budget rules to extend tax cuts for capital gains and dividends for two years -- from 2008 to 2010. The obvious assumption was that the more popular tax breaks for college expenses and state sales taxes would come later.

Here's how it works. Budget rules allow some deficit expansion without the jeopardy of filibuster. Republicans used this to feed the rich their dividend and capital gains cuts out to 2010. Yes, not this year, not next year -- these were already taken care of -- but years into the future.

Then, instead of just putting up the popular and deserved tax deductions to pass on their merits, the GOP hitched them to still more top end giveaways -- the estate tax elimination -- and the minimum wage tomfoolery.

When that "Trifecta" didn't pass, Prediction Tuesday said the GOP would cave. They would not be so ethically corrupt or politically obtuse to so blatantly raid the federal budget for the rich and ignore the middle class, at least not in an election year.

We were wrong.

Congress recessed without extending the middle class tax breaks.

Wow.

The same Congress could well come back after the elections and make the changes. But that won't count. We were wrong. We admit it.

You might say this is payback for a Blue State. But Florida, Texas, and North Carolina are in the same boat -- sales tax and no state income tax. That's Bush, Bush and Frist.

Wow.

Cynically, ever so cynically, Republicans blame Democrats.

As if.

Doc Hastings comes up a loser for the second day in a row, as well. Sales tax deductibility was his only positive contribution. With it gone, and new attention as House "Ethics" Committee chairman (following the Foley page scandals), Doc is looking more and more vulnerable.

Republicans had used their window under the arcane budget rules to extend tax cuts for capital gains and dividends for two years -- from 2008 to 2010. The obvious assumption was that the more popular tax breaks for college expenses and state sales taxes would come later.

Here's how it works. Budget rules allow some deficit expansion without the jeopardy of filibuster. Republicans used this to feed the rich their dividend and capital gains cuts out to 2010. Yes, not this year, not next year -- these were already taken care of -- but years into the future.

Then, instead of just putting up the popular and deserved tax deductions to pass on their merits, the GOP hitched them to still more top end giveaways -- the estate tax elimination -- and the minimum wage tomfoolery.

When that "Trifecta" didn't pass, Prediction Tuesday said the GOP would cave. They would not be so ethically corrupt or politically obtuse to so blatantly raid the federal budget for the rich and ignore the middle class, at least not in an election year.

We were wrong.

Congress recessed without extending the middle class tax breaks.

Wow.

The same Congress could well come back after the elections and make the changes. But that won't count. We were wrong. We admit it.

You might say this is payback for a Blue State. But Florida, Texas, and North Carolina are in the same boat -- sales tax and no state income tax. That's Bush, Bush and Frist.

Wow.

Cynically, ever so cynically, Republicans blame Democrats.

As if.

Doc Hastings comes up a loser for the second day in a row, as well. Sales tax deductibility was his only positive contribution. With it gone, and new attention as House "Ethics" Committee chairman (following the Foley page scandals), Doc is looking more and more vulnerable.

Subscribe to:

Posts (Atom)