Employment growth is the best simple measure to watch in judging economic well-being. GDP is misleading. It describes the agitation of a market economy and includes borrowing as earning. We covered that last week. Employment is better. Aside from the obvious benefits to job holders and their families, which ought to be a primary consideration, job growth is closely related to investment, balanced budgets, falling poverty levels and other measures.

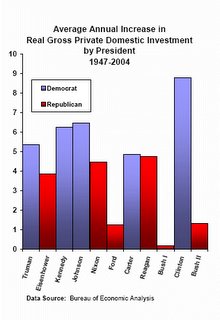

The following charts describe economic performance by president. (I am pressing them into service for the present discussion because they're what I have at hand. ) We can assume that presidents determine economic policy and that Democrats are more bottom up vs. Republicans top down.)

First, notice the correlation between investment and employment. Employment growth and investment are mutually reinforcing and create a productive cycle of growth. Investment creates jobs which creates demand which stimulates production and more investment, which creates jobs which stimulates.... You could begin with jobs create demand which stimulates production and investment.... Or demand stimulates production and investment which creates jobs which stimulates....

This last was the genius of Keynesian fiscal stimulus. It has been bastardized by the current administration to read tax cuts for the rich are good for the economy. In fact, tax cuts for the rich do not create demand because the rich spend out of accumulated wealth, not out of new income, which they just put in the bank. The same money to the poor or middle class -- boom! The sonic barrier. Cuts to social programs are patently inefficient economically.

It is a cycle. One element cannot be isolated and glorified to the exclusion of the other elements. Trickle down economics has attempted to isolate investment through investment tax breaks and preferences to savings. Insofar as these reduce demand from other sources or jobs, the experience is frustration. Witness the abysmal performance of Supply Side measures under Reagan. I do understand that all investment is not created equal. Investment in palatial residences will not yield the same long-term benefits as, say, investment in energy technology.

Next, notice the absence of a relationship between the unemployment rate and employment. The unemployment rate is calculated as the number of unemployed people looking for work as a percentage of the total civilian labor force. The labor force expands when there are good jobs to be had, and it contracts when there are no jobs worth having. People go to school, go on disability, go underground, hang out, become "discouraged workers," etc.

This expands and contracts the denominator, which makes a weak measure that unfortunately has been relied on too much. The Fed, for example, treats the unemployment rate as sensitive indicator of impending inflation, which it is not.

(To be fair, see that these numbers are through 2004. I guess W is finally on the positive side in terms of creating jobs. New annual numbers are out next month.)

Just so we cover it, and assume that employment growth means bad news for profits, notice that profits are steady in all weather -- as a percentage of total income. The implication of this "as a percentage" is that Democrats and stronger growth mean a stronger bottom line in absolute terms as well. The fascination of corporations for Republicans has more to do with CEOs and managers and an insider control mentality than it does for all shareholders' interests.

The business community seems to be captive to the Republicans, even small businesses, though I suspect it is more the organizations that purport to represent these folks that are in the Republican camp (easier to lobby for tax breaks than sound economics?). But look again at the jobs numbers when you hear, "Being a successful businessman, I know how to create jobs." Entrepreneurs are in the business of identifying opportunities for investment, which means potential demand. Investment can be stimulated by technical innovation or pressing public need or other factors. Jobs are created by the cycle of investment and demand as identified above.

Now, see how GDP is stronger under Democrats, but kind of respectable under Republicans. This is because -- thump -- a lot of that GDP under the GOP is generated by borrowing. I posted the federal borrowing chart last week, as well as a measure unique to me called "Net GDP," which was GDP minus federal borrowing, what GDP would have done without the borrowing. If you look that one up, you will see its similarity to the two charts at the top. Federal borrowing as a short-term stimulus effort is okay. It cannot become a way of life, as it has under Republican administrations.

Finally, in a chart that is not going to come through very well on the blog, but I find in my tedious way extremely fascinating is the unemployment rate year over year. I know I just panned the unemployment rate as flaccid and weak on fundamentals. But look, under Democrats the unemployment rate goes down, like stair steps, consistently, no matter what other evens are going on, no matter how many new job-seekers come into the market. (Exceptions, 1948, when Truman had to deal with 9 million men and women returning from service in the War, and in 1980, when Volcker panicked and restricted the money supply and Carter choked under the Iran crisis.) No matter how big the denominator gets, the numerator outpaces it. Very cool.

No comments:

Post a Comment