Aviva Aron-Dine at CBPP correctly points out that tax increases on this class of citizen is in no way contractionary. Can the presidential candidates have hung the economy in the loft by its ... waiting for the campaign to be over?

This is the perfect populist tax -- on the class of folks who have brought us financial sector chaos, who have earned their money outsourcing and downsizing, and have done it all with an eye to short-term gains for themselves. I say this not entirely with the simplistic voice of Middle America in mind.

CONCERNS ABOUT THE STATE OF THE ECONOMY ARE NOT

A GOOD REASON TO WAIVE PAYGO FOR AMT RELIEF

By Aviva Aron-DineSeveral weeks ago, the House of Representatives passed legislation that would provide Alternative Minimum Tax relief for 2007, extend other expiring tax provisions, and offset the cost with various revenue-raising measures. Some have argued that Congress should instead waive its Pay-As-You-Go (PAYGO) rules and deficit finance the cost of the AMT package. Recently, some advocates of this view have offered a new justification for their position. Including offsetting revenue measures, they claim, would dampen AMT relief's positive, stimulus impact on a possibly weakening economy.

Even if this were a valid concern with respect to some types of revenue-raising provisions, it does not apply to the revenue raisers included in the House-passed AMT patch bill. These provisions have three important characteristics.

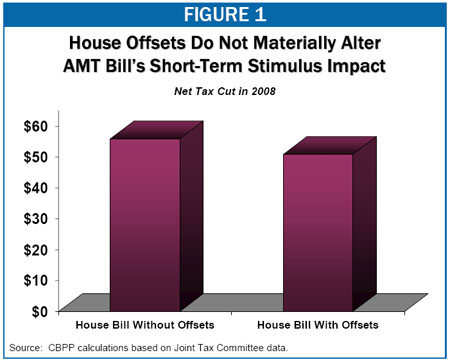

- They would have little impact on tax bills or the economy in the short term. While the AMT patch and other provisions of the House bill would together provide $56 billion in tax cuts in fiscal year 2008, the measures that offset them would raise less than $5 billion in 2008; the bill would recoup the rest of the revenue over the following nine years. This means that any short-run stimulus that would result from the AMT bill would not be materially reduced by the offsets. (See Figure 1.)[1]

At times when Congress has reason to be concerned both about the health of the economy and about the nation’s fiscal health, this approach — providing tax cuts or expenditure increases up front and offsetting their cost over ten years — has much to recommend it. In 2001, this approach was explicitly endorsed by the Chairmen and Ranking Members of both the House and Senate Budget Committees. Laying out principles for economic stimulus, they wrote, “outyear offsets should make up over time for the cost of near-term economic stimulus.”

- The most significant revenue raisers in the House AMT bill raise considerable revenue when the affected industries are faring well but little revenue when they are doing poorly. To the extent that the health of these industries tracks the overall state of the economy, this means that these provisions will raise little revenue — and have little impact on tax levels — if the economy goes into a recession. They will raise revenue later, when the economy recovers.

...

- The House offsets raise revenue primarily from high-income individuals, further dampening their short-term economic impact. Economic stimulus measures have the greatest impact when they put money in the hands of individuals who will spend rather than save it. For this reason, tax-side stimulus is generally more effective when it is targeted to low- and moderate-income, rather than high-income, households. As a 2002 Congressional Budget Office report concluded, “higher-income households save more of their income than do lower-income households… Consequently, tax cuts that are targeted toward lower-income households are likely to generate more stimulus dollar for dollar of revenue loss — that is, be more cost-effective and have more bang for the buck — than those concentrated among higher-income households.”

Conversely, revenue raising measures will have less impact on the economy in the short run when they take money out of the hands of those who are likely to save rather than spend it: that is, when they raise revenue from high-income individuals. The major offsets in the House AMT bill would do exactly that since they would close tax loopholes that primarily affect private equity and hedge fund managers, two very high-income groups.