Here's a hint,

from The Big Picture and Barry Ritholtz

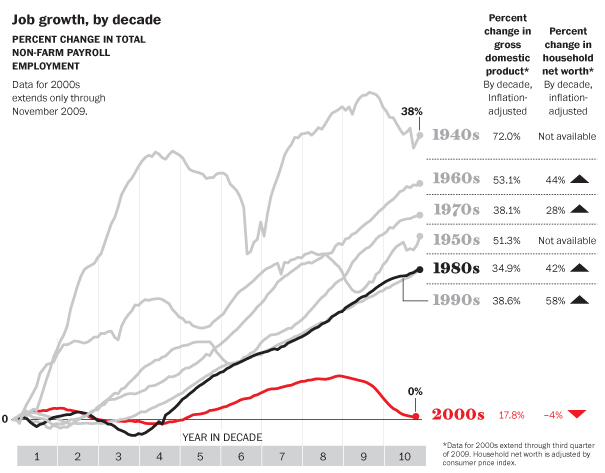

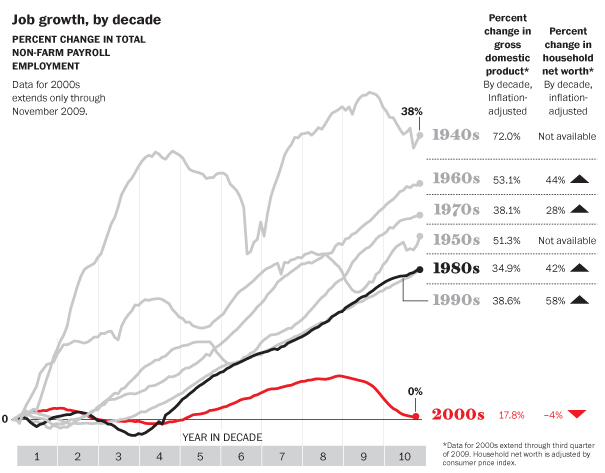

To hell with Japan, we have already had our lost decade — or at least so says the Washington Post. And, it was more than just the stock market that lost ground over the past 10 years:

click for larger graphic

>

Source:

The lost decade for the economy

NEIL IRWIN, CRISTINA RIVERO AND TODD LINDEMAN

Washington Post, January 1, 2010

http://www.washingtonpost.com/wp-dyn/content/graphic/2010/01/01/GR2010010101478.html

• Job growth was essentially zero;Here is how the 2000’s compared with a few other decades:

• Economic output (GDP) was weak.

• Household net worth (inflation adjusted) fell as stock prices stagnated;

• Home prices declined in the second half of the decade

• Consumer debt skyrocketed.

click for larger graphic

>

Source:

The lost decade for the economy

NEIL IRWIN, CRISTINA RIVERO AND TODD LINDEMAN

Washington Post, January 1, 2010

http://www.washingtonpost.com/wp-dyn/content/graphic/2010/01/01/GR2010010101478.html

and then we get to

Goldman's Ten Questions For 2010

and an introduction by Tyler Durden from zero hedge

One of the great paradoxes of life is that the smarter one is, the better one realizes just how little one knows. The same thing is true with forecasts: one can hypothesize and conjecture, but if one is unlucky, one is screwed: no matter how thought out, error-proof or logical the narrative - it is the unpredictable events that ultimately shape events, not the "priced in" obvious factors. The Heisenberg Uncertainty Principle applies in a perverse fashion not only to the wave-particle duality in the quantum realm, but to the very underpinning of economics: by predicting the future we implicitly change it. The futility of forecasts is well known to all those, who with the exception of a several few, whose very existence is an economy of scale "strange attractor" (think Warren Buffett and Goldman Sachs), have tried to repeat a winning performance, be it based on fundamentals, technicals, or kangaroo entrails.

It is also sufficiently useless to the point where we will spare you a Zero Hedge set of observations of what to expect: if you have been reading this blog, you know what we believe is relevant as we enter 2010. How it will all pan out, however, is a totally different story. It is therefore not too ironic, and somewhat fitting, that Goldman Sachs' chief economists do not leave 2009 with a dogmatic set of forecasts, which, just like every other year would have the success rate of a coin toss, but with 10 key questions addressed exactly one year into the future. Here are Goldman's 10 Questions for December 31, 2010.

It is also sufficiently useless to the point where we will spare you a Zero Hedge set of observations of what to expect: if you have been reading this blog, you know what we believe is relevant as we enter 2010. How it will all pan out, however, is a totally different story. It is therefore not too ironic, and somewhat fitting, that Goldman Sachs' chief economists do not leave 2009 with a dogmatic set of forecasts, which, just like every other year would have the success rate of a coin toss, but with 10 key questions addressed exactly one year into the future. Here are Goldman's 10 Questions for December 31, 2010.

To which we interject a great big Demand Side, BULL. This expression of confusion may reflect the obsession with the stock market or financial markets in general, but recent events have proven only that wild-eyed optimists and bubble chasers were wrong. Yes, nothing is known with certainty. No, that does not mean it is a random draw. The great group think of markets is not an example of changing the future, but of forming the future. One should listen to Soros, not Heisenberg. In predicting the future, one ought to be describing the present. Of course the data points can change, but the outline of demand, investment, and the other fundamentals does not change.

But let's get to the Goldman Sachs predictions. Likely authored by Jan Hatzius

Our forecast for 2010 features sluggish GDP growth, employment gains that are too slow to prevent a further modest increase in the unemployment rate, low (and probably falling) core inflation, and a Federal Reserve that “exits” from some unconventional monetary policies but keeps the funds rate at its current near-zero level.

Unquote

This is the more of the same data forecast. Not much information in terms of dynamics.

In terms of the Fed's exit. How they are going to sell out the trillion dollars in MBS's and not take a bath is the real question. More likely, they will do what Goldman tells them to do, and that means no funds rate increase.

1. Have house prices bottomed?

Probably not yet, but we are quite uncertain. Although US homes are no longer significantly overvalued, we believe that much of the increase in prices over the past six months has been due to three temporary factors: a) the homebuyer tax credit, which has been extended into 2010 but is likely to be less powerful in boosting demand than it was when first introduced in 2009; b) the Fed’s purchases of mortgage-backed securities, which have pushed down mortgage rates but are slated to end in early 2010; and c) the temporary mortgage modifications through the Obama administration’s Home Affordable Mortgage Program (HAMP), only a relatively small portion of which seem to be turning into permanent modifications. These factors suggest that home prices are at risk of declining anew, and our working assumption is a renewed 5%-10% cumulative drop in the national Case-Shiller index through 2010.

Indeed, there are some early signs that home prices are starting to fall again. In particular, the Loan Performance home price index fell more than ½% in both September and October. The S&P/Case-Shiller index, which is based on three-month moving averages, remained positive in these months but the gains were smaller—averaging just over ¼% versus more than ¾% in the preceding three months—suggesting that spot observations are turning negative.

No, house prices have not bottomed. Here Goldman is describing the scene on the ground, not anything in the future. Forecasting should be so easy. Look out the window. It's raining. "I predict rain."

2. Will banks become more willing to lend?

Probably yes, but at a pace that is only consistent with subdued spending growth. In thinking about banks’ willingness to lend, it is important to distinguish between levels and rates of change. Conceptually, it is the change in lending standards that should affect the change in consumption, capital spending, or GDP.

The concern in the current recovery is that the very sharp tightening of lending standards during the recession is giving way only very gradually to an easing during the recovery. As of the fourth quarter of 2009, standards for both consumer and business loans are still being tightened modestly.

The combination of sharp tightening followed by gradual normalization puts the current cycle in a category of its own. ... yada yada yada

Big banks will not increase lending, since there is no recovery and no prospect of increased demand and thus prospect of profit. Smaller banks will get the big squeeze from the commercial real estate meltdown of 2010. It would really be good if the Fed raised interest rates as a way of squeezing bank margins and making them active in the credit markets again.

3. Will small business activity pick up?

It should, but so far we are not seeing it. We have been quite concerned about the implications of the weakness in the small business sector. Since small firms aren’t as well captured in the economic statistics as larger firms, their weak performance may mean that standard economic indicators currently overestimate growth in economic activity.

and there is more

Small businesses are the engine of growth, it is repeated ad nauseum. So, help small business and things will get better. Demand is the engine of growth. Help household spending by writing down debt, not financial sector balance sheets so they can hoard capital. Begin big new public goods investment and stabilize the states and localities. Otherwise. Why would small business want to invest? "How's business" does not mean how much of a subsidy are you getting. It means how many customers.

4. Will hiring revive?

Yes, but we expect the rate of job creation to reach only about 100,000 per month by the second quarter, not enough to push the unemployment rate down in a meaningful way.

Some analysts argue that US businesses cut jobs more aggressively during the recession than was warranted by the decline in output out of fear that the downturn would be even more severe. If this were true, it might suggest that employment would rebound more sharply than suggested by the cumulative growth of real GDP from the business cycle trough.

But the evidence for the “excess layoffs” hypothesis is weak. ... and so on

It is difficult to tell whether Goldman is being intentionally coy or what. Surely they as major financiers realize business as overleveraged had to cut as fast as possible to keep up debt payments and to put the rosiest gloss on a bad apple. Huge job cuts mean huge demand cuts. The result is not a bounce, it is a hole.

5. Does the saving rate have further to rise?

Yes, we think so. The current saving rate of just over 4% remains below the 6%-10% range that we estimate is needed to stabilize the ratio of household net worth to disposable income in a “normal” environment for capital gains on existing assets. This is admittedly a very long-term perspective. But in addition, the current level of household net worth also seems to imply an increase in the saving rate on simple short-term “wealth effect” grounds. Hence, we project a gradual increase to around 6% by the end of 2011.

The main reason why we see only a very slow increase is the weakness in household income growth. Household debt is already contracting sharply, so an increase in saving would need to reflect a pickup in gross saving—i.e. purchases of financial and physical assets—from its current, depressed level. This will be difficult for households to accomplish if income growth remains anemic.

Goldman's "sharp contraction in household debt" means levels are back a couple of quarters. The huge mountain of debt has not been significantly reduced. The "savings rate" -- as we've said before -- is the difference between income and spending. Not a build-up of financial assets, a pay-down of debt.

In standard economic analysis it is realized that an increase in income creates an increase in the savings rate. This used to be the rationale for favoring the rich. They save more. They are more virtuous. A savings rate increasing from falling incomes is bad for demand and reflects only insecurity and debt burdens, not health. It also reflect the illusion that homeowners had that their homes were a secure form of wealth. They thought they were being prudent. Turns out, they were just gullible marks for the financial sector.

Oops, we ran out of time. The rest is up on Friday

No comments:

Post a Comment