Principal Writedowns and the Fake Stress Test

Mike Konczal

New Deal 2.0

March 9, 2010

Three things happened in a row yesterday: (1) Two positive profiles of Timothy Geithner (New Yorker, and The Atlantic) came out, both working under the assumption that the stress tests of last year worked. (2) Shahien Nasiripour had a comment about principal write-downs walked back on him by Treasury: “Treasury is NOT poised to roll out a major principal write-down program. As the [official] said, we are looking at a number of tweaks to existing programs to help reach more borrowers.”

(Are you reading Shahien’s work? You should, he’s doing great work on financial issues; he was the one who caught the modifcations -> 70% more underwater issue. Here’s a little secret about Huffington Post – you can rss feed specific reporters off their page. So if you find the page itself a little overwhelming, or think you are missing most of the better financial reporting as it gets buried quickly, your rss feed reader will catch it for you.)

(3) And Barney Frank released a letter to the four largest banks, centered around this language:

Many investors in first-lien mortgages have indicated that they are willing to accept the fact of significant losses on those investments in order to move on and use their money for other purposes, rather than having it locked in underwater mortgages with a high and growing likelihood of foreclosure. With the interests of homeowners and investors aligned in this way, it should follow that large numbers of principal-reduction modifications could be made relatively quickly. That is not happening. According to investors, Administration officials, and other experts I have consulted, holders of second-lien mortgages are now a principal obstacle to many modifications. The problem of second-lien mortgages standing in the way of successful principal reduction modifications has reached a critical stage and requires immediate attention from your institutions.

Large numbers of these second liens have no real economic value – the first liens are well underwater, and the prospect for any real return on the seconds is negligible. Yet because accounting rules allow holders of these seconds to carry the loans at artificially high values, many refuse to acknowledge the losses and write down the loans, which would allow willing first lien holders to reduce principal and keep borrowers in their homes.

I want to connect these three things around a simple premise: writing down those second liens, which would allow principal writedowns of underwater mortgages, would expose the stress tests of last year as a lie.Those Stress Tests

Read Barney Frank’s letter again. In order to write down the first principal of a mortgage, the second needs to be destroyed. However the second mortgages are on the books of the largest banks, and they are on their books for a high value even though they are worthless.

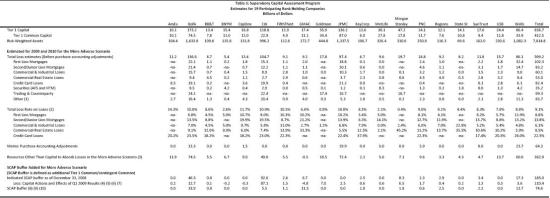

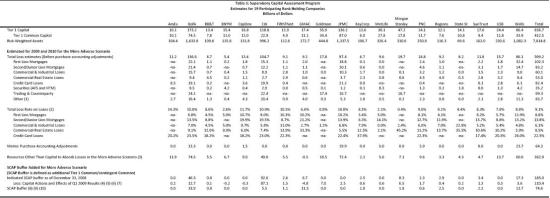

Let’s talk specifics: Last June I made a DIY Stress Test, using values reversed-engineered from the public documents, where you could play around with the values online or download an excel spreadsheet yourself (it’s still one of my favorite blogging items). The backbone of the overview of results, page 9 from the Federal Reserve’s document, looks like this:

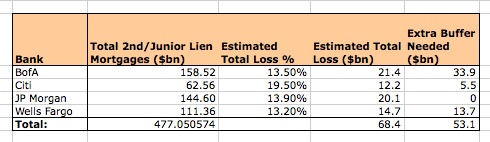

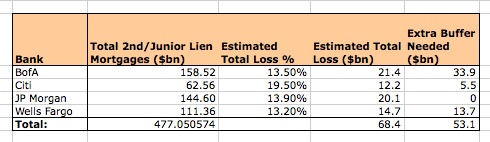

I’m going to isolate the four largest banks Frank questioned about second-liens, along with their loses as they’ve legally sworn to being accurate during the stress test:

Again, this is data as reported to the government by the major banks during the stress test of 2009. So what’s going on here? The four major banks have about $477 billion in junior liens, either in the form of a second mortgage or a home equity line of credit. If you go to the Fed Funds data online, you’d see that there’s about a trillion dollars of 2nd/Juniors out there, so the four major players have about half the market.

The four major players each report that they expect to have a 13-14% loss on these items under an “adverse scenario”, with Citi reporting a 20% loss under an adverse scenario. That means of the $477bn, $68.4 bn is junk that’ll never be collected on. This, combined with all the other expected losses (see the link to the stress test for the rest) meant that the four biggest players needed around $53bn to be raised.

Notice how Frank’s letter, and pretty much anyone you’d speak to who isn’t working for the four largest banks, assume that second liens in the country aren’t worth 86% of their value (for a 14% loss). You see in Frank’s letter “no economic value.” Huh. Well, that’s a problem.

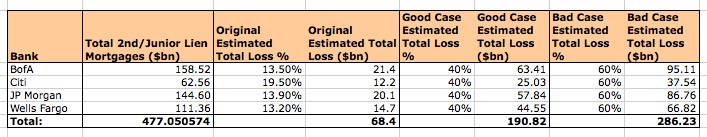

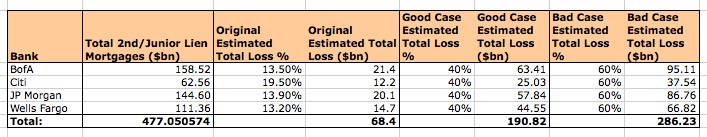

Let’s look at these values again, assuming that the expected total loss would be 40%, and then 60%.

So the original loss from second-liens, as reported by the stress tests, was $68.4 billion for the four largest banks. If you look at those numbers again, and assume a loss of 40% to 60%, numbers that are not absurd by any means, you suddenly are talking a loss of between $190 billion and $285 billion. Which means if the stress tests were done with terrible 2nd lien performance in mind, there would have been an extra $150 billion dollar hole in the balance sheet of the four largest banks. Major action would have been taken against the four largest banks if this was the case.

Tradeoffs

Notice the tradeoff – with this valuation of 2nd liens locked into the stress test, it meant that a huge chunk of homeowners wouldn’t be able to renegotiate their mortgages. So you have a decade of people underwater in their homes, unable to move to pursue new jobs, with the 1st mortgage owner willing to negotiate new terms but being blocked by the second mortgage owner, in order to pretend that the stress tests weren’t completely invalid.

And the endgame? I’ve heard anecdotally from enough credible people that there’s extra pressure on underwater homeowners to pay off the small second lien first. This is in part because the servicers, who will be nudging (or “sweat boxing”) homeowners in desperate situations on how to act, work for the major banks, and in part because the second liens are usually smaller and easier to pay. This is what happens when servicers don’t have a fiduciary responsibility to investors. Between that and playing the gruesome (for regular people) spread on interest rates, the major players should be able to drag themselves to solvency.

Perhaps 40% is too bad, or 60% is too kind. This is where regulators should be stepping in and demanding that the books are updated with new values. Notice how Barney Frank has to ask politely that these 2nd liens are recorded correctly, playing a game of chicken with a quarter of all homeowners in the cross-fires. You had people like myself calling for additional stress tests on the largest banks over the course of the following year, specifically to watch for huge incorrect estimates in any of the categories. I’ve done many stress tests in my day, and the most important part is being able to update them as new information comes down the line. By the end of last summer, when it was clear that the value of the 2nd liens were never coming back, there should have been a mechanism for re-estimating the balance sheets of the banks. You could tell that wasn’t going to happen – they’ve already unrolled the “Mission Accomplished” banner when it comes to these tests.

Mike Konczal is a Fellow at the Roosevelt Institute. He blogs here and at rortybomb.

Read Barney Frank’s letter again. In order to write down the first principal of a mortgage, the second needs to be destroyed. However the second mortgages are on the books of the largest banks, and they are on their books for a high value even though they are worthless.

Let’s talk specifics: Last June I made a DIY Stress Test, using values reversed-engineered from the public documents, where you could play around with the values online or download an excel spreadsheet yourself (it’s still one of my favorite blogging items). The backbone of the overview of results, page 9 from the Federal Reserve’s document, looks like this:

I’m going to isolate the four largest banks Frank questioned about second-liens, along with their loses as they’ve legally sworn to being accurate during the stress test:

Again, this is data as reported to the government by the major banks during the stress test of 2009. So what’s going on here? The four major banks have about $477 billion in junior liens, either in the form of a second mortgage or a home equity line of credit. If you go to the Fed Funds data online, you’d see that there’s about a trillion dollars of 2nd/Juniors out there, so the four major players have about half the market.

The four major players each report that they expect to have a 13-14% loss on these items under an “adverse scenario”, with Citi reporting a 20% loss under an adverse scenario. That means of the $477bn, $68.4 bn is junk that’ll never be collected on. This, combined with all the other expected losses (see the link to the stress test for the rest) meant that the four biggest players needed around $53bn to be raised.

Notice how Frank’s letter, and pretty much anyone you’d speak to who isn’t working for the four largest banks, assume that second liens in the country aren’t worth 86% of their value (for a 14% loss). You see in Frank’s letter “no economic value.” Huh. Well, that’s a problem.

Let’s look at these values again, assuming that the expected total loss would be 40%, and then 60%.

So the original loss from second-liens, as reported by the stress tests, was $68.4 billion for the four largest banks. If you look at those numbers again, and assume a loss of 40% to 60%, numbers that are not absurd by any means, you suddenly are talking a loss of between $190 billion and $285 billion. Which means if the stress tests were done with terrible 2nd lien performance in mind, there would have been an extra $150 billion dollar hole in the balance sheet of the four largest banks. Major action would have been taken against the four largest banks if this was the case.

Tradeoffs

Notice the tradeoff – with this valuation of 2nd liens locked into the stress test, it meant that a huge chunk of homeowners wouldn’t be able to renegotiate their mortgages. So you have a decade of people underwater in their homes, unable to move to pursue new jobs, with the 1st mortgage owner willing to negotiate new terms but being blocked by the second mortgage owner, in order to pretend that the stress tests weren’t completely invalid.

And the endgame? I’ve heard anecdotally from enough credible people that there’s extra pressure on underwater homeowners to pay off the small second lien first. This is in part because the servicers, who will be nudging (or “sweat boxing”) homeowners in desperate situations on how to act, work for the major banks, and in part because the second liens are usually smaller and easier to pay. This is what happens when servicers don’t have a fiduciary responsibility to investors. Between that and playing the gruesome (for regular people) spread on interest rates, the major players should be able to drag themselves to solvency.

Perhaps 40% is too bad, or 60% is too kind. This is where regulators should be stepping in and demanding that the books are updated with new values. Notice how Barney Frank has to ask politely that these 2nd liens are recorded correctly, playing a game of chicken with a quarter of all homeowners in the cross-fires. You had people like myself calling for additional stress tests on the largest banks over the course of the following year, specifically to watch for huge incorrect estimates in any of the categories. I’ve done many stress tests in my day, and the most important part is being able to update them as new information comes down the line. By the end of last summer, when it was clear that the value of the 2nd liens were never coming back, there should have been a mechanism for re-estimating the balance sheets of the banks. You could tell that wasn’t going to happen – they’ve already unrolled the “Mission Accomplished” banner when it comes to these tests.

Mike Konczal is a Fellow at the Roosevelt Institute. He blogs here and at rortybomb.

I never thought that the banks passed the test anyway. Nouriel Roubini, said that they were insolvent before the big crash. Meredith Whitney said similar, and yet they all passed the tests to a greater or lesser degree. The sham that was the stress test was for public consumption. To restore faith in the banks. Little has really changed. I still expect a further recession and a further knock to property values which will be hard to hide.

ReplyDelete