The universal elements of financial crashes are:

- Substantial and steady increases in the value of an asset -- tulips, stocks, property.

- Leverage -- borrowing -- that is easy to get.

- Nearly universal belief that a new form of wealth creation has been found that is immune from the limitations of past economics.

- Disgust with and marginalization of any naysayers.

- A precipitous retreat of values and panic dumping of assets.

- Denial, after the fact, in the form of scapegoating individuals or a sector and minimizing personal culpability.

- Astonishment and anger that lenders, as John Kenneth Galbraith put it, "should now in hard times, ask for payment of debts so foolishly granted and incurred."

- Phenomenally short memories with regard to any lessons learned.

BackgroundIn the year 2000, interest rates as arranged by the Fed and its then chairman Alan Greenspan were at an all-time high. This was not an effort to rein in the dot.com bubble, but a reaction to invisible threats of inflation discerned by Maestro Magoo. [Reining in the stock market bubble should have been done by adjusting margin requirements, tightening rules on brokers, and jawboning to discourage blatant speculation. Never done.]

Inflation never showed up for Greenspan, but the economic slowdown did. And down came the interest rates, until eighteen short months later they were at their lowest point in history. Highest to lowest. The fact that the reduction was meted out in monthly quarter point drops makes it only cosmetically less drastic.

A few of us predicted the economic slowdown based on the fact that energy prices were spiking at the same time Greenspan was spiking interest rates. Others -- notably Dean Baker of the Center for Economic and Policy Research predicted the dot.com bust, but not the slowdown. Most, you may recall, had discovered the "New Economy" and "Dow 36,000," a new age of information technology unrestricted by the fundamentals of the past.

The effort of the Fed to restart the economy with low interest rates succeeded after a fashion, but not in the way that was hoped -- by restarting business investment. Instead, millions of Americans took advantage of the low rates to buy homes. With interest rates down, principle can go up while the payment remained the same.

Home values increased, partly based on demand, and partly based on the seemingly inexorable rise in the values. Where was a stock market shy investor going to make his big bucks now? Speculation moved from the stock market into real estate.

What now?Now things have changed. Residential investment is plummeting. See EPI's chart.

The Financial Times reported yesterday:

The US homebuilding sector slowed dramatically last month as new home construction tumbled to a six-year low, according to figures released on Friday which contained troubling signs for the economy.

....

There was a clear indication of further weakness ahead for the construction industry as building permits for residential homes fell to the lowest level in nearly a decade after a drop last month of 6.3 per cent to 1.5m, while the number of permits issued in September was also lower than previously thought.

The fall in permits for new homes suggests the housing market has reached a critical point as builders abandon speculative residential developments to curb oversupply.

What does a housing crash look like?In housing, a crash may have a different dynamic. "Panic dumping" is less feasible. Speculators may dump their property at the first downturn, but homeowners who live in their assets will tend to hold on, perhaps thinking they are whole, since they have to spend on shelter anyway.

But there are inescapable consequences. When prices go down, the equity in homes will go down, with four depressing consequences: (1) There will be no more equity to tap for current spending, which has been a significant source of spending for the past decade, (2) Mortgage payments that are much higher than (lower) home values warrant, making people feel poor, and hence hold back on spending, (3) The retirement piggy bank that people were counting on in the value of their homes recedes before them, creating the need for other types of savings, and (4) A continuing depressing influence on the housing market, as potential buyers delay purchases because in a few months they may pay less.

So as it plays out, the crash could be a long, slow depletion of economic vigor.

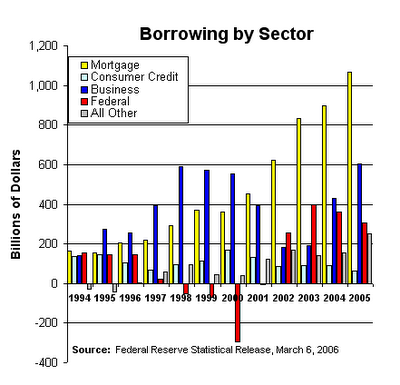

The problem of the debtAs we've shown elsewhere, there is no "growth," only borrowing, a shift of action from the future into the present.

Debt is a burden on our future, but seemingly necessary for our present. Should our overseas partners, the less wealthy countries that are subsidizing our purchases of homes and other goods, decide to reduce their lending, the pressure will become more intense.

Debt is a burden on our future, but seemingly necessary for our present. Should our overseas partners, the less wealthy countries that are subsidizing our purchases of homes and other goods, decide to reduce their lending, the pressure will become more intense.

Interest on the debt is going to begin taking its bite. No jobs are created when interest is paid. It would be one thing if the massive debt had created productive assets, infrastructure, or human capital. That is not the case.

Federal debt has been spent on a destructive war and nonsensical rewards to the rich. Private debt is in the largely passive and nonproductive asset of housing. [Note: The "Federal" bar in this chart shows only the so-called "unified" budget deficit. A segment should be added to each red bar in this chart to reflect the hudreds of billions of dollars per year in borrowing from Social Security and Medicare funds.]

When will it start?Considering the "political business cycle," the fact that the Republicans pushed every spending choice and every positive indicator they could into the pre-election period, a return to reality happens right after the election. Housing weakness has been around for some time, but is now becoming serious.

As long as we can borrow, the day of reckoning can be pushed out. With weakness starting to show, however, our lenders may begin to lose confidence.

With Democrats in control, the chances that the Middle Class will get some attention is good, and this is fundamentally positive for the economy as a whole. Likewise, the serious attention by adults now in Congress to the debt will be significant. But the fundamentals and embedded debt are so heavily negative that it will take concerted and disciplined action to avoid serious loss to our standards of living.

For most of the country, it is likely to begin soon, by next spring. For the Puget Sound, with its trade-based economy that runs counter to the rest of the country, it will be delayed.

Debt is a burden on our future, but seemingly necessary for our present. Should our overseas partners, the less wealthy countries that are subsidizing our purchases of homes and other goods, decide to reduce their lending, the pressure will become more intense.